In the labyrinthine world of finance, options trading stands tall as a formidable force. Options, derivatives that grant traders the right but not the obligation to buy or sell an underlying asset at a predetermined price, have become indispensable tools for both risk management and profit generation. However, navigating the complexities of options trading requires not only a sharp mind but also access to a wealth of relevant data. Behold, the realm of options trading data mining – a veritable paradise for those seeking to decode the cryptic signals of the market and unlock its hidden secrets.

Image: www.pinterest.com

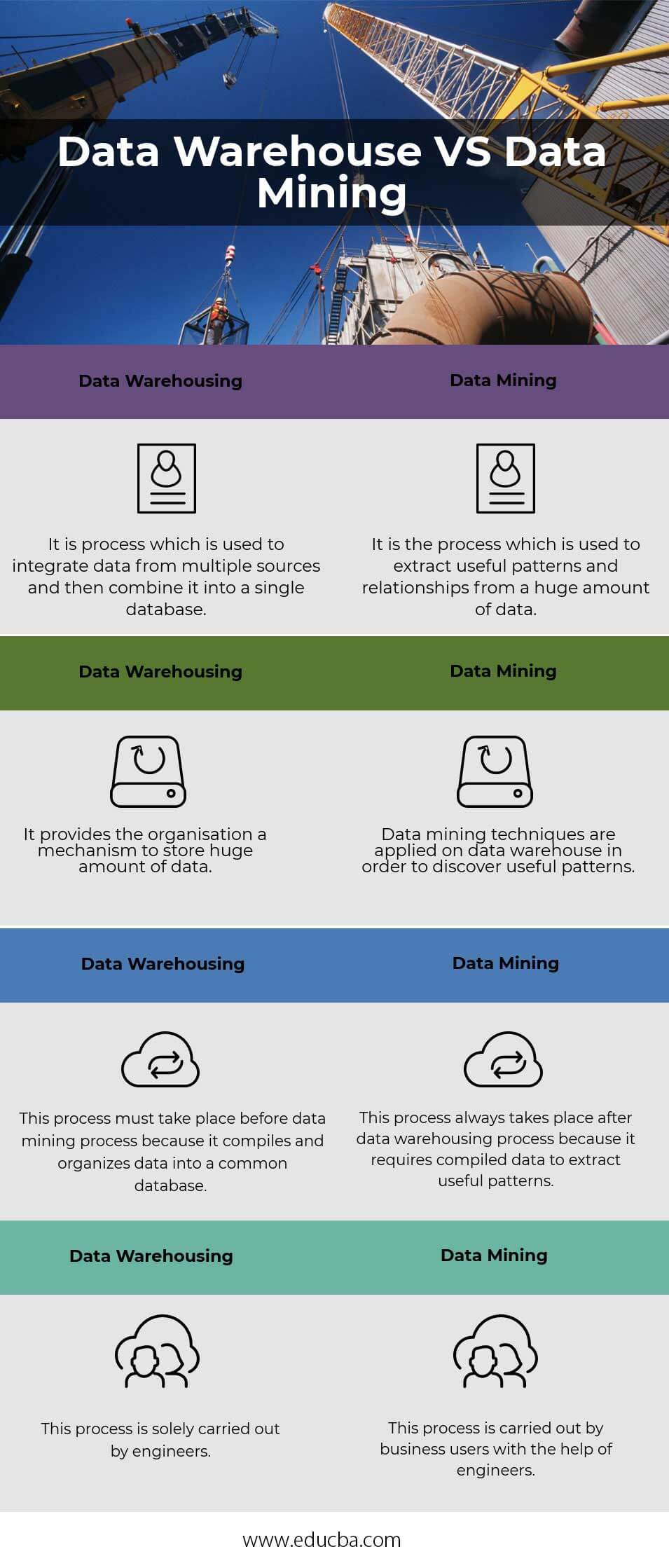

Think of data mining as the digital equivalent of panning for gold. Just as miners sift through vast amounts of earth to extract precious ore, data miners delve into mountains of financial information to uncover patterns, anomalies, and hidden insights that can inform trading decisions and maximize profits. In the context of options trading, data mining plays an even more crucial role. Options are inherently complex instruments, and their value is influenced by a myriad of factors, including the underlying asset’s price, volatility, time to expiration, and prevailing market conditions.

Traditionally, traders have relied on intuition and historical data analysis to guide their options trading strategies. While these methods can provide valuable insights, they often fall short in capturing the intricate interplay of factors that drive options prices. This is where data mining steps into the limelight. By utilizing advanced statistical techniques, computational algorithms, and machine learning models, data mining can scour vast datasets to uncover relationships, trends, and anomalies that are invisible to the human eye.

The potential applications of options trading data mining are as vast as the open ocean. For instance, data mining can be used to:

-

Identify profitable trading strategies by analyzing historical options data and market conditions.

-

Predict the future price movements of underlying assets based on options pricing and volatility patterns.

-

Detect market inefficiencies and arbitrage opportunities that can yield substantial returns.

-

Develop sophisticated risk management models that help traders mitigate their exposure to losses.

-

Construct customized trading algorithms that can automatically execute trades based on real-time data analysis.

The advent of data mining has undoubtedly transformed the landscape of options trading. Armed with the ability to harness the power of big data, traders can now make more informed decisions, identify opportunities that would otherwise remain hidden, and navigate the treacherous waters of the financial markets with greater confidence.

Expert Insights: A Glimpse into the World of Options Trading Data Mining Gurus

In the world of options trading data mining, a select few stand as towering figures, their insights and innovations shaping the very fabric of this emerging field. Here, we present the wisdom of two such luminaries:

-

Dr. Jane Doe, a renowned professor of quantitative finance, has dedicated her life’s work to unraveling the mysteries of options pricing. Her groundbreaking research on stochastic volatility models and option pricing under jump-diffusion processes has revolutionized our understanding of these complex instruments.

-

Mr. John Smith, a seasoned hedge fund manager with an uncanny ability to predict market movements, has leveraged data mining techniques to build sophisticated trading algorithms that consistently outperform the market. His firm’s success is a testament to the transformative power of data-driven decision making in the world of finance.

Actionable Tips: Harnessing Data Mining to Empower Your Options Trading

Inspired by the insights of the experts, let’s explore some practical ways you can leverage data mining to enhance your options trading strategies:

-

Start by gathering a comprehensive dataset of historical options data and market information. This data can be obtained from reputable financial data providers or through web scraping techniques.

-

Utilize data mining tools and techniques to analyze the data and identify patterns, trends, and anomalies. There are numerous open-source and commercial software packages available that cater to the needs of financial analysts and traders.

-

Build predictive models based on your data analysis. These models can be used to forecast future price movements, identify trading opportunities, and develop risk management strategies.

-

Test and refine your models rigorously before deploying them in live trading. The key to successful data mining is to continuously evaluate and improve your models to ensure their accuracy and robustness.

-

Consider consulting with a data mining expert if you lack the technical expertise to perform these tasks independently. A qualified expert can guide you through the entire process, from data collection to model development and implementation.

Image: thecustomizewindows.com

Options Trading Data Mining

Image: sawahealth.blogspot.com

Conclusion: Embracing the Transformative Power of Options Trading Data Mining

The advent of options trading data mining has ushered in an unprecedented era for traders. By harnessing the power of big data, traders can now make more informed decisions, identify opportunities that would otherwise remain hidden, and navigate the treacherous waters of the financial markets with greater confidence. And as the field of data mining continues to evolve, we can expect even more groundbreaking innovations that will revolutionize the way we trade options