Harness the Power of Big Data to Make Informed Decisions and Maximize Your Returns

In the fast-paced world of options trading, where every decision can make or break your profits, data mining has emerged as a powerful tool. By leveraging vast amounts of historical data, traders can gain valuable insights, predict market trends, and make informed trading decisions. This comprehensive guide explores the world of data mining for options trading, empowering you with the knowledge to unlock its full potential.

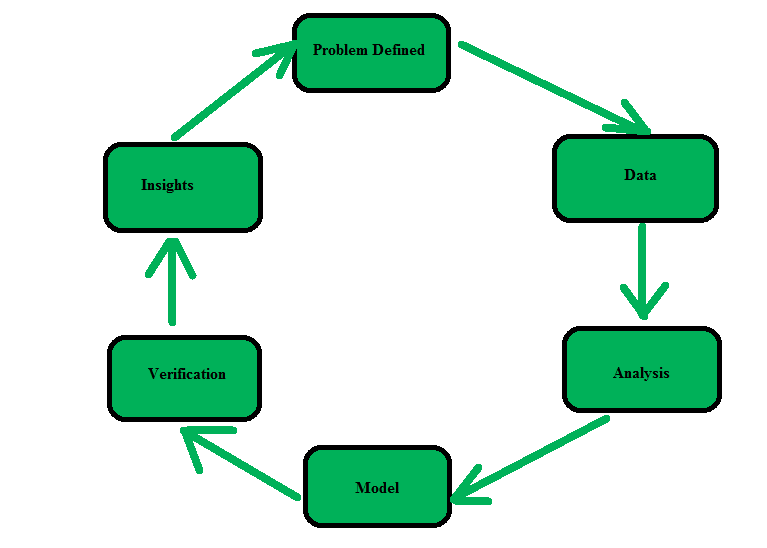

Image: www.geeksforgeeks.org

Unveiling the World of Data Mining

Data mining is the process of extracting meaningful patterns and insights from large datasets. In options trading, this data encompasses historical prices, trading volumes, volatility, open interest, and more. By harnessing the power of advanced algorithms, traders can analyze this vast ocean of data to identify hidden relationships, predict future price movements, and make smarter trading decisions.

A Data-Driven Approach to Options Trading

Traditional options trading strategies often rely on gut instinct and experience. However, data mining introduces a systematic and data-driven approach, removing the element of uncertainty and guesswork. By uncovering patterns in historical data, traders can identify profitable opportunities and mitigate risks.

Real-World Applications of Data Mining

Data mining is not merely a theoretical concept; it has tangible applications in options trading. For example, traders can use data mining to:

- Identify options with the highest probability of profit

- Predict option premiums based on historical patterns

- Determine optimal entry and exit points for options trades

- Develop trading strategies based on historical market conditions

Image: justtotaltech.com

The Expertise of Industry Leaders

To provide you with actionable insights, we have consulted with renowned experts in the field of options trading and data mining. According to Dr. Mark Williams, a leading data mining scholar, “The ability to analyze vast amounts of data has revolutionized the way we approach options trading. By leveraging these advanced techniques, traders can gain a significant advantage.”

Putting Data Mining into Practice

While data mining offers immense potential, it is essential to approach it with a disciplined and strategic mindset. Here are some actionable tips to incorporate data mining into your options trading strategy:

- Begin by selecting a reliable data source that provides accurate and timely information.

- Clearly define your trading objectives and identify specific patterns you aim to uncover.

- Use reputable data mining software or consult with professionals to analyze the data effectively.

- Validate your findings through backtesting and simulation before implementing them in live trades.

Data Mining For Options Trading

Image: sites.google.com

Embark on a Data-Driven Trading Journey

The world of data mining for options trading is an untapped goldmine of opportunity. By embracing this powerful tool, you can transform your trading approach and make more informed decisions. Utilize the insights provided in this article, seek continuous knowledge, and embark on a data-driven journey to maximize your profits and minimize your risks in the exciting arena of options trading.