Trading VIX options has become increasingly popular on Reddit, as investors seek ways to capitalize on market volatility. r/options is a subreddit dedicated to discussing options trading, and it’s a great place to learn from experienced traders and share knowledge.

Image: www.themeetinghouse.net

What is the VIX?

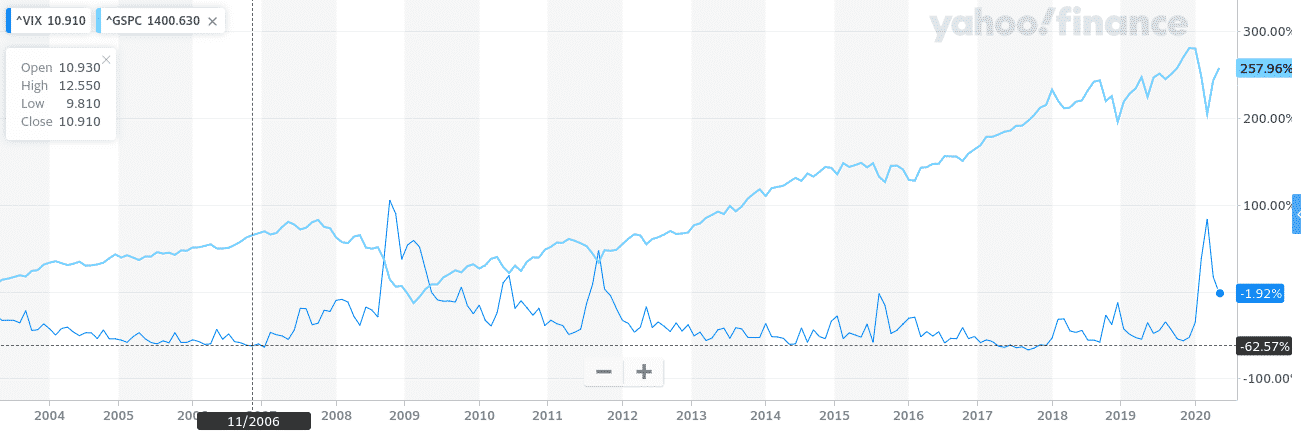

The VIX, or CBOE Volatility Index, is a measure of market volatility based on the prices of S&P 500 index options. It’s often referred to as the “fear gauge” because it tends to rise when investors are fearful and sell off stocks, and fall when investors are more optimistic and buy stocks.

Trading VIX Options

Trading VIX options allows investors to speculate on the volatility of the stock market. When the VIX is high, it means that investors expect the market to be more volatile in the future, and when it’s low, it means that they expect the market to be less volatile.

There are a number of different ways to trade VIX options, each with its own risk and reward profile. Some of the most common strategies include:

- **Call options:** Give the investor the right to buy the VIX at a specified price on or before a specified date. They’re profitable if the VIX rises.

- **Put options:** Give the investor the right to sell the VIX at a specified price on or before a specified date. They’re profitable if the VIX falls.

- **Volatility spreads:** This strategy involves buying and selling options with different strikes and expiration dates. It can be used to profit from changes in VIX volatility, whether it rises or falls.

Tips for Trading VIX Options

Here are a few tips for trading VIX options:

- Do your research:** Before you start trading VIX options, it’s important to understand how they work and the risks involved. Read books, articles, and blogs about VIX trading and talk to other investors.

- Start with a small position:** When you’re first starting out, it’s best to trade with a small position so that you can learn how the market works without risking too much money.

- Use stop-loss orders:** A stop-loss order is an order to sell your option if it falls below a certain price. This can help you to limit your losses.

- Manage your risk:** VIX options can be very volatile, so it’s important to manage your risk carefully. Don’t trade with more money than you can afford to lose, and don’t get caught up in the excitement of the market.

Image: zenothestoic.com

FAQs About Trading VIX Options

Q:** What happens if the VIX goes up?**

A:** If the VIX goes up, it means that market volatility is expected to increase, which can make VIX options more valuable.

Q:** What happens if the VIX goes down?**

A:** If the VIX goes down, it means that market volatility is expected to decrease, which can make VIX options less valuable.

Q:** Is it possible to lose money trading VIX options?**

A:** Yes, it is possible to lose money trading VIX options. These options can be very volatile, and their value can fluctuate rapidly.

Trading Vix Options Reddit

Image: optionstradingiq.com

Conclusion

Trading VIX options can be a profitable way to speculate on market volatility, but it’s important to understand the risks involved before you start trading.

If you’re interested in learning more about VIX options, I encourage you to read some of the resources linked above and talk to other investors.