Unlocking the World of Options with a Trusted Broker

Navigating the complex world of options trading can be a daunting task, but with a reliable broker like Ally, the journey becomes more accessible and rewarding. In this comprehensive guide, we delve into the intricacies of options trading with Ally, empowering you with the knowledge and strategies to succeed in this challenging arena.

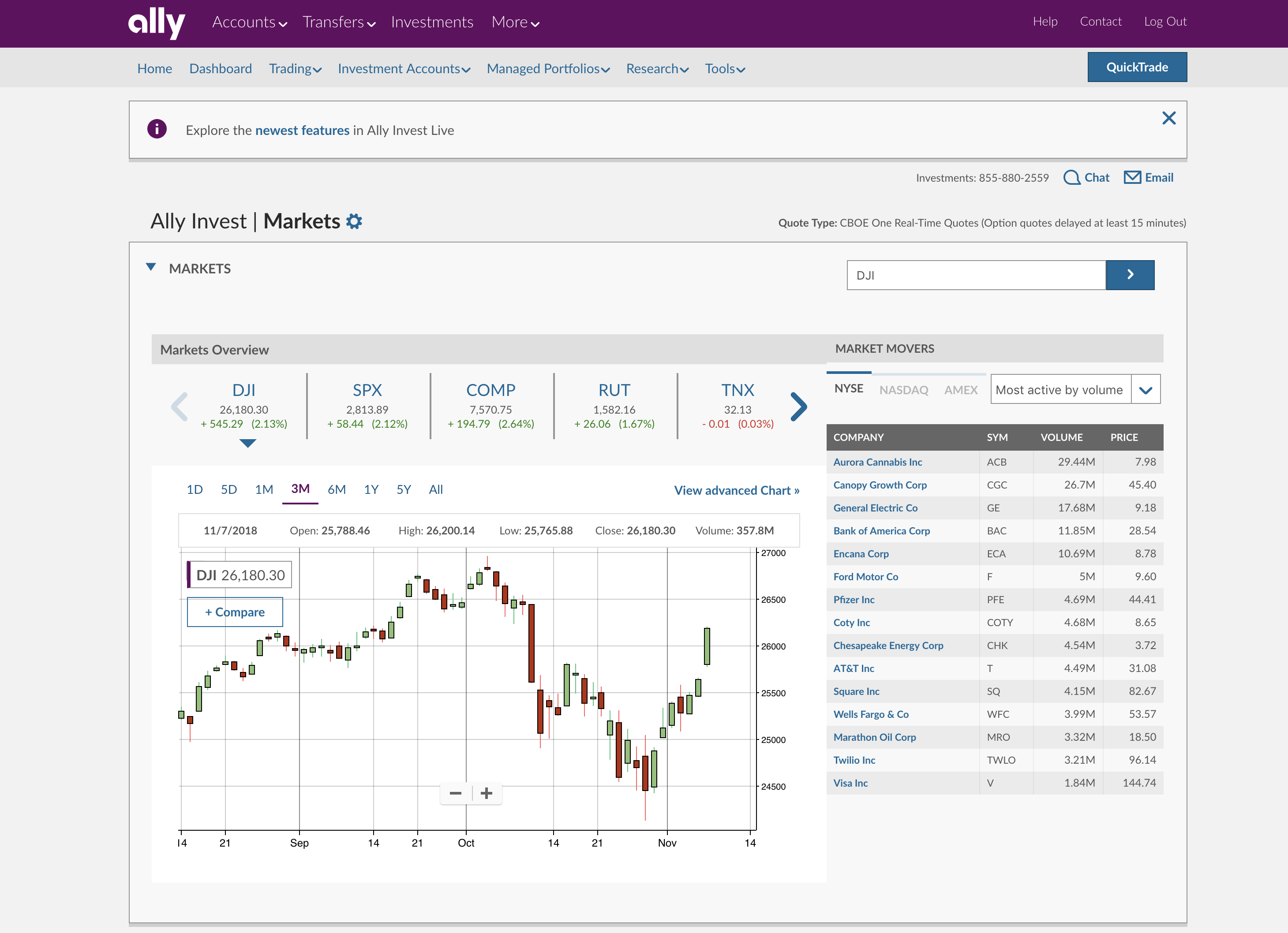

Image: www.creditdonkey.com

What is Options Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset, such as a stock or index, at a predetermined price (known as the strike price) on or before a specific date (known as the expiration date).

Why Trade Options with Ally?

Ally, a reputable and established financial institution, offers a comprehensive range of options trading services and resources, including:

- Versatile Trading Platform: Ally’s powerful trading platform provides advanced features and real-time data, enabling traders to execute trades seamlessly and monitor market movements.

- Educational Content: Ally offers a wealth of educational resources, including articles, videos, and webinars, designed to enhance your understanding of options trading concepts and strategies.

- Dedicated Support: Ally’s knowledgeable support team is available to assist you with any questions or concerns, ensuring a smooth and hassle-free trading experience.

Understanding Options Terminology

Before embarking on options trading, it’s essential to familiarize yourself with crucial terminology:

- Call Option: Gives the buyer the right to purchase the underlying asset at the strike price.

- Put Option: Gives the buyer the right to sell the underlying asset at the strike price.

- Premium: The price paid to acquire the option contract.

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date on which the option expires.

Image: www.stockbrokers.com

Types of Options Strategies

Options traders can employ various strategies to potentially profit from market fluctuations:

- Long Call: The buyer expects the underlying asset’s price to rise and has the right but not the obligation to purchase it at the strike price.

- Long Put: The buyer expects the underlying asset’s price to fall and has the right but not the obligation to sell it at the strike price.

- Covered Call: The seller of the call option owns the underlying asset and expects its price to remain stable or increase.

- Protective Put: The buyer of the put option owns the underlying asset and seeks to protect it from a decline in price.

Risk Management in Options Trading

Understanding and managing risk is paramount in options trading:

- Define Risk Tolerance: Determine your tolerance for potential loss before engaging in options trading.

- Limit Maximum Loss: Choose options strategies that align with your financial capabilities and risk appetite.

- Use Stop-Loss Orders: Place stop-loss orders to automatically sell your options contracts if the price moves against you, limiting potential losses.

Market Analysis for Options Trading

Successful options trading requires sound market analysis:

- Technical Analysis: Study price charts and patterns to identify trading opportunities.

- Fundamental Analysis: Examine factors like earnings reports, economic data, and industry trends to assess the underlying asset’s value.

- Monitor News and Events: Stay informed about market-moving news and events that may impact option prices.

Options Trading With Ally

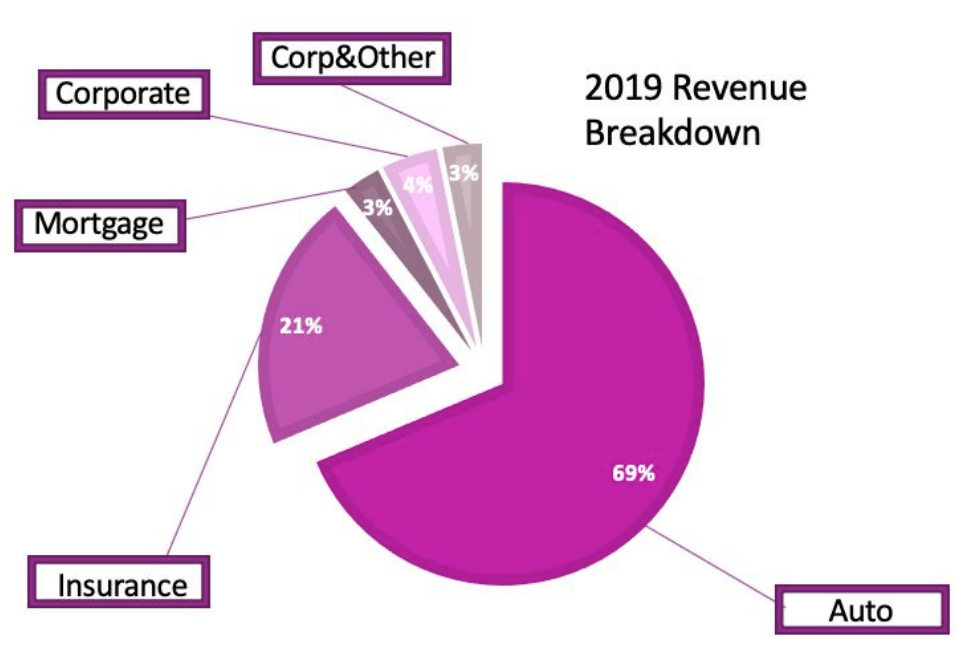

Image: seekingalpha.com

Conclusion

Options trading with Ally opens up a world of financial opportunities. By understanding the concepts, strategies, risk management techniques, and employing effective market analysis, you can navigate this dynamic arena with confidence. Remember, the key to success lies in education, practice, and a commitment to continuous learning. Ally provides the tools and support to help you achieve your options trading goals. Embark on this exciting journey today and unlock the potential of the financial markets.