Introduction

Navigating the realm of options trading can be an exhilarating yet daunting task. Understanding the intricacies, including the associated costs, is crucial for making informed decisions that align with your financial goals. In this comprehensive guide, we will delve into the complexities of Ally options trading costs, empowering you with the knowledge to optimize your trading strategies.

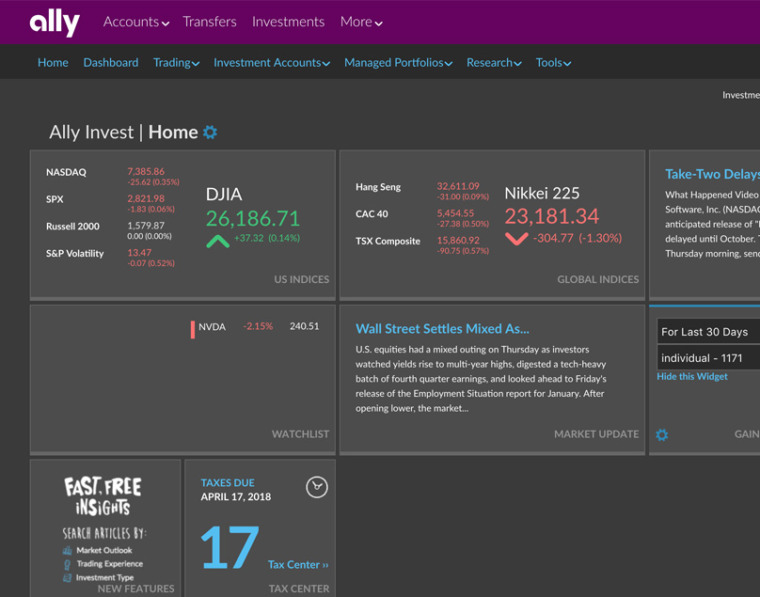

Image: www.listenmoneymatters.com

Options trading offers investors the opportunity to leverage various strategies, from hedging against risk to speculating on market movements. However, it’s essential to be aware of the costs involved, as they can significantly impact your profitability. In this blog post, we will break down the different types of Ally options trading costs, providing you with a clear understanding of what to expect when entering the options market.

Types of Ally Options Trading Costs

When trading options with Ally, there are several cost categories to consider:

1. Commission Fees:

Ally charges commission fees for executing options trades. These fees vary based on the type of option (equity, index, or ETF) and the number of contracts traded. Generally, the commission structure is tiered, with lower fees for larger trade sizes.

2. Exercise and Assignment Fees:

If you exercise or assign an option contract, Ally will charge an exercise or assignment fee. These fees are typically nominal, but they can add up if you exercise or assign multiple contracts.

Image: www.economagic.com

3. Spread Fees:

When trading spreads (combinations of options contracts), Ally may charge spread fees. These fees vary depending on the complexity of the spread and the number of contracts involved.

4. Margin Interest:

If you trade options on margin, you will be charged margin interest on the borrowed funds. The interest rate is determined by Ally and can fluctuate based on market conditions.

5. Regulatory Fees:

In addition to Ally’s own fees, there may also be regulatory fees associated with options trading. These fees are typically minimal and levied by various regulatory bodies, such as the Securities and Exchange Commission (SEC).

Factors Influencing Ally Options Trading Costs

Several factors can influence the costs associated with Ally options trading:

1. Market Volatility:

When market volatility is high, options premiums tend to be higher, resulting in increased commission fees.

2. Option Type:

Equity options generally have higher commission fees compared to index or ETF options.

3. Contract Size:

Larger contract sizes incur higher commission fees than smaller contract sizes.

4. Number of Contracts:

Trading multiple contracts in a single trade can lead to lower per-contract commission fees due to tiered pricing structures.

5. Trading Frequency:

Active traders may qualify for reduced commission fees through negotiated arrangements with Ally.

Minimizing Ally Options Trading Costs

To optimize your profitability in options trading, consider the following tips for minimizing Ally options trading costs:

1. Choose a Low-Cost Broker:

Ally’s options trading fees are competitive, but comparing fees with other brokers can help you find the most cost-effective option.

2. Trade Larger Contract Sizes:

Tiered pricing structures favor larger contract sizes, allowing you to save on per-contract commission fees.

3. Limit Spread Trading:

Spread fees can add up quickly, especially for complex spreads. Consider limiting spread trading to minimize these costs.

4. Avoid Margin Trading:

Margin trading involves borrowing funds, which incurs interest charges. Avoid margin trading if possible to reduce overall trading costs.

5. Negotiate with Ally:

Active traders may be able to negotiate reduced commission fees with Ally based on their trading volume and profitability.

Ally Options Trading Costs

Conclusion

Understanding Ally options trading costs is a crucial aspect of successful options trading. By familiarizing yourself with the different cost categories and the factors that influence them, you can make informed decisions that maximize profitability and minimize expenses. Remember to consider your trading style and risk tolerance when evaluating options trading costs to create a trading strategy tailored to your specific needs.