Are you looking for a way to trade the volatility of the stock market? If so, then you need to learn about options trading on the VIX. The VIX, or Volatility Index, is a measure of the implied volatility of the S&P 500 index. It is often called the “fear gauge” because it tends to rise when investors are fearful and fall when they are complacent.

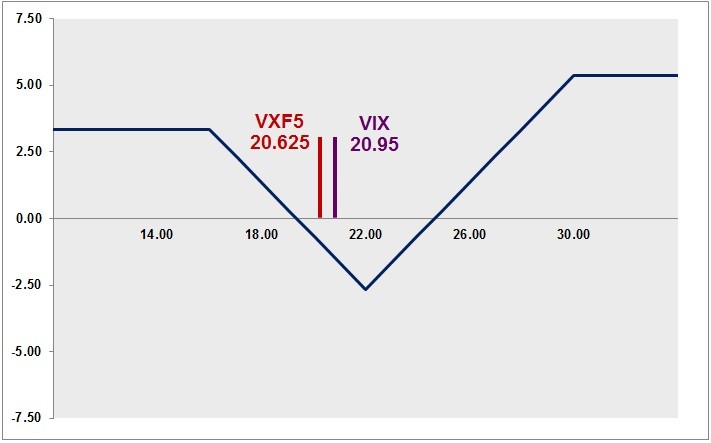

Image: investpost.org

Options trading on the VIX can be a great way to profit from market volatility. However, it is important to understand the risks involved before you start trading. In this article, we will provide you with a comprehensive overview of options trading on the VIX, including how it works, the different types of VIX options, and the strategies you can use to trade them.

What is Options Trading on the VIX?

Options trading on the VIX is a way to speculate on the future volatility of the stock market. When you buy a VIX option, you are buying the right, but not the obligation, to buy or sell the VIX at a certain price on a certain date. You can use VIX options to hedge against risk or to bet on the direction of the market.

There are two main types of VIX options: calls and puts. A call option gives you the right to buy the VIX at a certain price on a certain date. A put option gives you the right to sell the VIX at a certain price on a certain date.

How to Trade VIX Options

To trade VIX options, you will need to open an account with a broker that offers options trading. Once you have opened an account, you will need to decide which type of VIX option you want to trade. If you think that the VIX is going to rise, you can buy a call option. If you think that the VIX is going to fall, you can buy a put option.

Once you have decided which type of VIX option you want to trade, you will need to choose a strike price and an expiration date. The strike price is the price at which you can buy or sell the VIX. The expiration date is the date on which the option expires.

Tips for Trading VIX Options

Here are few tips for trading VIX options:

- Start by learning the basics. Before you start trading VIX options, you need to understand how they work. There are many resources available online that can help you learn about VIX options.

- Trade with a small amount of money. When you are first starting out, it is important to trade with a small amount of money. This will help you to learn the ropes without risking too much capital.

- Use a stop-loss order. A stop-loss order is an order that will automatically sell your VIX option if it falls below a certain price. This will help you to protect your profits.

- Don’t be afraid to take profits. When you are trading VIX options, it is important to take profits when you are up. This will help you to lock in your gains.

- Be patient. Trading VIX options can be a rewarding but it takes time to learn how to do it successfully.

Image: optionstradingiq.com

Options Trading Vix

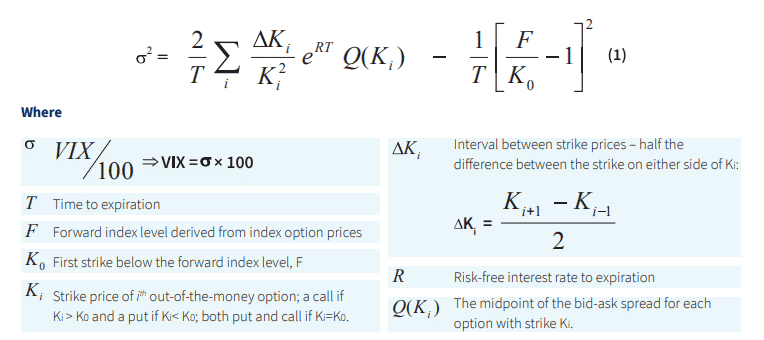

Image: www.volatilitytradingstrategies.com

Conclusion

Options trading on the VIX can be a great way to profit from market volatility. However, it is important to understand the risks involved before you start trading. If you are not sure how to trade VIX options, you should consult with a financial advisor.