Harnessing AI and Machine Learning for Enhanced Decision-Making

Harnessing the power of artificial intelligence (AI) and machine learning (ML), options market trading algorithms have emerged as a game-changer in the financial world. These sophisticated tools automate trading decisions, analyze market data, and predict price movements with remarkable accuracy, empowering traders with unparalleled insights. By leveraging a combination of advanced statistical models, data mining techniques, and predictive analytics, these algorithms navigate the complexities of the options market, optimizing portfolio performance and maximizing returns.

Image: dev.to

Unveiling the Algorithm’s Inner Workings

The core of an options market trading algorithm is its ability to process vast amounts of data, identify patterns, and make intelligent trading decisions. These algorithms are typically designed with specific parameters tailored to the trader’s risk tolerance, investing goals, and trading style. Equipped with historical market data, real-time market updates, and fundamental analysis, the algorithm continuously monitors market conditions and evaluates potential trading opportunities. Through predictive modeling, it projects potential price movements and calculates the probability of success for each trade, reducing the element of guesswork and enabling informed decision-making.

Gaining an Edge in the Competitive Market

In the fiercely competitive options market, traders rely on every available advantage to outmaneuver their counterparts. Options market trading algorithms offer a significant edge by providing real-time market insights and predictive analytics. These tools empower traders to identify potential trading opportunities, determine optimal entry and exit points, and manage risk effectively. The speed and efficiency of these algorithms allow traders to capitalize on fleeting market movements and capture profitable trades, providing a substantial edge in an environment where every millisecond counts.

Exploring the Latest Trends in Algorithm Development

The world of algorithms is constantly evolving, with ongoing advancements in AI and ML techniques driving the next generation of trading tools. One notable trend is the adoption of deep learning, a subfield of ML that utilizes artificial neural networks to uncover complex patterns and relationships in data. Deep learning algorithms can process vast amounts of data, identifying subtle correlations and anomalies that may have escaped traditional statistical models. This enhancement promises even greater accuracy in predicting price movements and optimizing trading strategies.

Image: www.ccamonash.com.au

Harnessing the Power of AI and ML: Tips and Expert Advice

Embracing options market trading algorithms can significantly enhance your trading prowess. However, it’s crucial to approach their utilization strategically to maximize their benefits. Consider the following tips from expert traders:

- Choose a Reputable Algorithm Provider: Opt for providers with a proven track record of success and transparent methodologies.

- Test the Algorithm Thoroughly: Before committing capital, conduct rigorous testing on historical data to evaluate the algorithm’s performance under different market conditions.

- Monitor and Adjust: Monitor the algorithm’s performance continuously and make adjustments as needed to adapt to changing market dynamics.

- Stay Informed about Market Trends: Keep abreast of the latest market news, updates, and expert insights to supplement the algorithm’s predictions.

- Use Algorithms as a Tool: Remember that algorithms are assistants, not replacements for human traders. Exercise caution, rely on your own analysis, and never invest more than you can afford to lose.

Frequently Asked Questions about Options Market Trading Algorithms

- Q: Are algorithms suitable for all traders?

A: Options market trading algorithms can be a valuable tool for both experienced and novice traders, provided they are used prudently. - Q: How much does an algorithm cost?

A: The cost of an options market trading algorithm varies depending on the provider, features, and level of support offered. - Q: Can algorithms guarantee profits?

A: While algorithms enhance trading efficiency and provide valuable insights, they cannot guarantee profits. Market conditions and other factors can still affect trading outcomes.

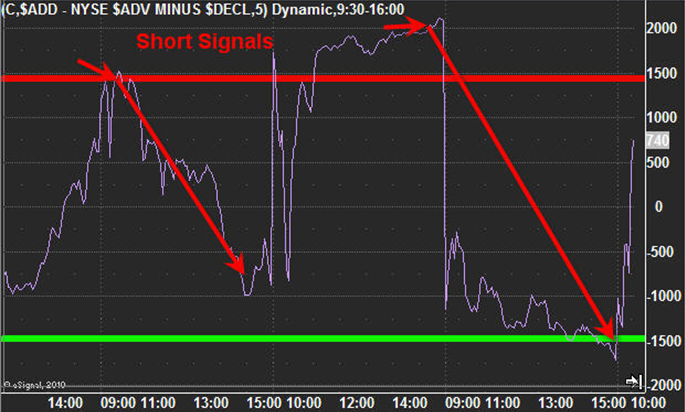

Options Market Trading Algorithm

Image: www.thegoldandoilguy.com

Conclusion: Empowering Traders with Algorithmic Advantage

In today’s dynamic options market, options market trading algorithms have become indispensable tools for discerning traders. By harnessing the power of AI and ML, these algorithms provide valuable insights, predict market movements, and automate trading decisions. While they do not eliminate risk, they empower traders with a significant advantage, enabling them to make informed decisions, capitalize on trading opportunities, and potentially enhance their portfolio’s performance.

Are you intrigued by the world of options market trading algorithms and eager to explore their potential in your trading journey? If so, embrace them cautiously, diligently test their capabilities, and continuously monitor their performance. With strategic utilization and a sound understanding of their limitations, these algorithms can become valuable allies in your quest for success in the complex and ever-evolving options market.