In the realm of options trading, the NDAQ 100 index (NDX) emerges as a highly sought-after option due to its affiliation with some of the world’s largest and most influential technology companies. With prominent corporations such as Apple, Microsoft, Amazon, and Google as its constituents, NDX options grant traders an avenue to tap into the burgeoning technology sector.

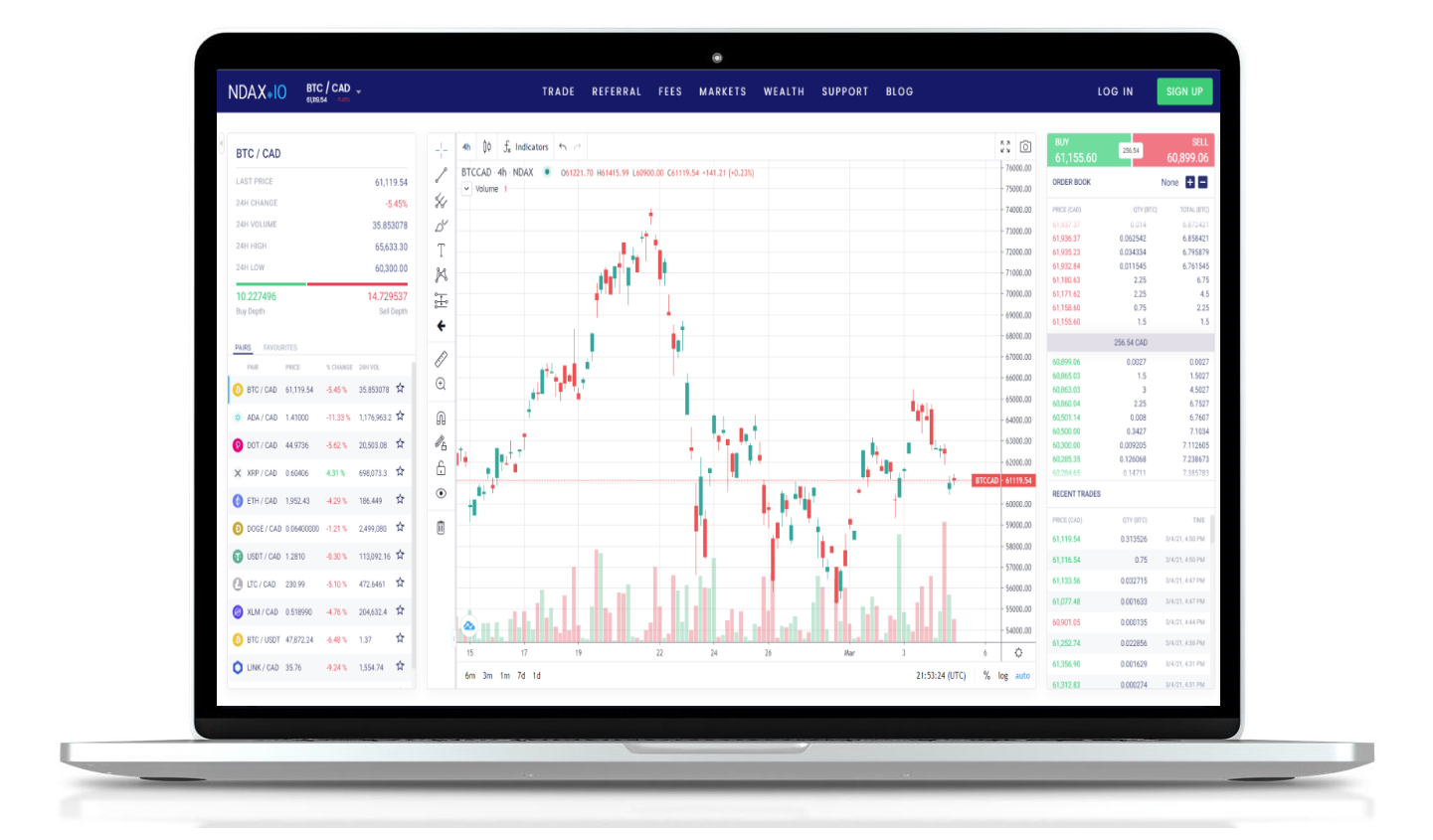

Image: crypto-currencies.ca

Whether you’re an experienced options trader or just starting to explore the possibilities, understanding the mechanics and nuances of NDX options is paramount to capitalizing on market opportunities. This comprehensive guide will delve into the fundamentals of NDX options, providing insights into their benefits, strategies, and risk management techniques.

Decoding NDX Options: A Gateway to Tech Giants

NDX options are derivative contracts that provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) an underlying NDAQ 100 stock at a predetermined price on or before a specific date. By leveraging NDX options, traders can amplify their exposure to the technology sector and harness its growth potential while mitigating potential risks.

Call Options: Betting on NDAQ’s Surge

Call options confer upon the holder the right to purchase the underlying NDAQ 100 stock at a specific “strike price” on or before the “expiration date.” If the market value of NDAQ surpasses the strike price by the expiration date, the call option holder realizes a profit potential.

Put Options: Hedging Against Downturns

Put options, on the other hand, grant the holder the right to sell the underlying NDAQ 100 stock at a pre-specified strike price on or before the expiration date. If the market value of NDAQ falls below the strike price by the expiration date, the put option holder stands to profit.

Image: xtremetrading.net

Trading Ndx Options

Options Strategies for NDAQ: Shaping Profitability

Harnessing the power of NDAQ options involves navigating an array of trading strategies, each tailored to distinct market conditions and risk appetites. Here are a few popular strategies to consider:

- Covered Call: Selling a call option against an existing NDAQ stock position to generate income while limiting potential appreciation.

- Protective Put: Purchasing a put option to protect a long NDAQ stock position against potential downturns.

- Bull Call Spread: A bullish strategy involving buying a call option with a lower strike price and selling a call option with a higher strike price.

- Bear Put Spread: A bearish strategy involving buying a put option with a higher strike price and selling a put option with a lower strike price.