In the realm of financial markets, options trading offers a tantalizing blend of risk and reward, enabling traders to leverage strategies that are both complex and potentially lucrative. Among the diverse array of options contracts, VIX options, which track the volatility of the CBOE Volatility Index (VIX), have emerged as a popular tool for investors looking to capitalize on market uncertainty. This comprehensive guide will delve into the intricate world of VIX options trading, empowering traders with the knowledge and insights necessary to navigate its complexities.

Image: www.cnbc.com

Demystifying VIX Options: A Gateway to Market Volatility

The VIX, often referred to as the “fear gauge” of the stock market, measures market volatility by tracking the implied volatility of the S&P 500 index options over the next 30 days. VIX options provide traders with a unique opportunity to bet on the future volatility of the VIX itself, offering immense leverage to astute investors. By harnessing options strategies, traders can skillfully exploit market turbulence and derive substantial profits while managing risk.

Harnessing the Power of VIX Options: A Trader’s Toolkit

To fully comprehend the mechanics of VIX options trading, a thorough understanding of key concepts is paramount. Call options grant the holder the right, but not the obligation, to purchase the underlying asset at a predetermined price within a specified time frame. On the other hand, put options confer the right to sell. By astutely combining these fundamental elements, traders can construct sophisticated strategies tailored to their individual risk tolerance and market outlook.

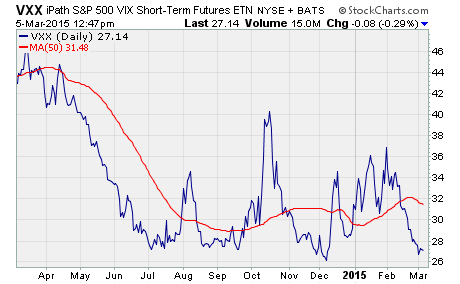

Navigating the Nuances of VXX Trading: A Compass for Success

-

Choose Your Expiration Date Wisely: The expiration date of VIX options is crucial. Traders who anticipate short-term market moves should opt for shorter-term options, while those looking to ride the waves of long-term volatility can choose longer-term contracts.

-

Determine the Right Strike Price: The strike price establishes the price at which the trader can exercise their option. Traders must carefully evaluate the VIX’s historical volatility and market sentiment to select the optimal strike price.

-

Option Premium: Understanding the Cost: Option premium represents the price an investor pays to acquire an option contract. Higher volatility typically drives up the premium, so traders should factor in this cost when devising their strategy.

-

Risks Associated with VXX Options: VIX options trading is not without its risks. Market volatility can fluctuate dramatically, potentially leading to significant losses. Traders must always employ proper risk management techniques to safeguard their capital.

Image: optionstradingresearch.com

Vxx Options Trading

Image: tradingetfs.com

The Art of VIX Options Trading: Strategies for Every Market Condition

-

Bullish Strategies: When traders anticipate an increase in VIX and market volatility, they may consider bullish strategies such as buying call options or selling put options.

-

Bearish Strategies: If traders foresee a decline in VIX and market stability, bearish strategies like buying put options or selling call options may be more appropriate.

-

Neutral Strategies: Neutral strategies, such as straddles or strangles, are designed to profit from significant volatility, regardless of the direction. These strategies involve purchasing options at different strike prices.

Conclusion: Harnessing VXX Options for Enhanced Portfolio Management

VIX options trading presents a compelling opportunity for investors to navigate market volatility and unlock substantial returns. However, it is crucial to remember that this arena of trading comes with inherent risks. By meticulously studying the intricacies of VIX options and applying the principles outlined in this guide, traders can become proficient in this exhilarating and potentially rewarding domain of financial markets.