Introduction

In an era of economic uncertainty, the allure of regular income is stronger than ever. Options trading presents an attractive opportunity to supplement your income or build a passive income stream. By understanding the fundamentals and deploying effective strategies, you can tap into the potential of options markets for consistent returns.

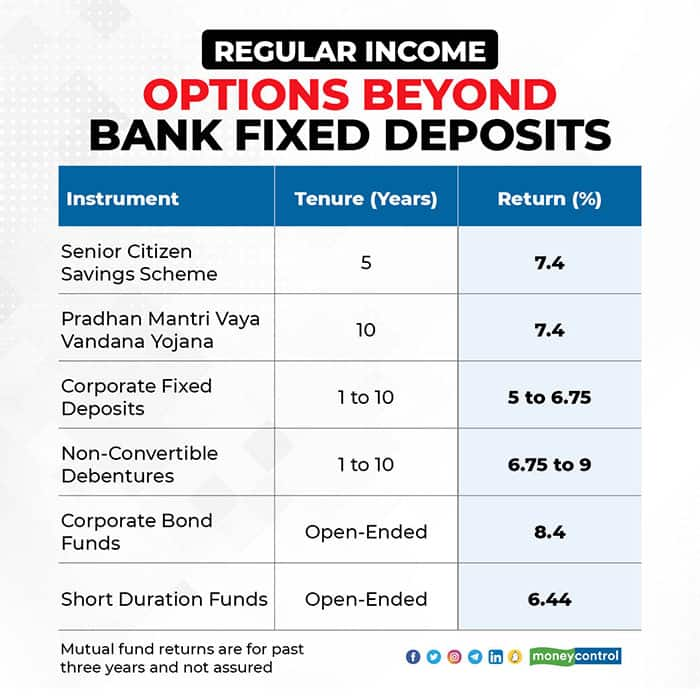

Image: www.moneycontrol.com

Delving into Options Trading

Options provide flexible instruments that allow traders to speculate on the future movement of an underlying asset without committing to actual ownership. They offer a diverse range of strategies, from high-risk, high-reward plays to conservative approaches that focus on generating regular income. This versatility makes options accessible to traders of all experience levels and risk appetites.

Building an Income-Generating Strategy

The key to generating regular income from options trading lies in identifying suitable income-oriented strategies. One popular approach is selling covered calls. Here, the trader sells a call option against an underlying stock or ETF they already own. By receiving a premium for granting the buyer the right to purchase the asset at a specified price, the trader generates immediate income. While in most cases, the seller hopes they will be able to keep the underlying stock or security, if the stock price rises above the strike price of the call option sold, the buyer of that option has the right to exercise the option forcing the seller to sell the underlying shares to them at the strike price.

Another effective strategy is the sale of cash-secured puts. This involves selling a put option, granting the buyer the right to sell the trader an underlying asset at a predetermined price. The seller receives a premium for this option and is obligated to purchase the asset if the buyer exercises their right. This strategy generates income until the option expires unexercised or until the trader is forced to buy the asset.

Minimizing Risk and Maximizing Returns

Managing risk is critical in options trading. Careful attention should be paid to factors such as choosing appropriate strike prices, understanding option Greeks, and implementing stop-loss mechanisms. Proper risk management can help traders preserve their capital and ensure sustainable income generation.

Image: kumeyuroj.web.fc2.com

The Psychology of Options Trading

Emotions can be a formidable enemy in trading, clouding judgment and leading to poor decisions. Maintaining a calm demeanor, being patient, and avoiding impulsive reactions are essential for successful options trading. Traders must understand the potential risks and rewards before entering any trades and remain disciplined in their approach.

Regular Income From Options Trading

Conclusion

Generating regular income through options trading requires a combination of knowledge, strategy, and discipline. By understanding the fundamentals, implementing effective strategies, managing risk vigilantly, and controlling emotions, you can harness the power of options markets to create a reliable income stream. Remember, options trading is not a get-rich-quick scheme, but with dedication and a disciplined approach, it can become a valuable tool for financial freedom.