Introduction

The world of finance is constantly evolving, and with it, so does the range of investment strategies available to traders. Option trading is one such strategy that has gained immense popularity in recent years, thanks to its potential to generate substantial returns. However, option trading can also be complex and risky, making it essential for traders to have a thorough understanding of the underlying concepts and strategies. This article dives into the world of option trading strategies, with a particular focus on the use of CUDA (Compute Unified Device Architecture) for enhanced trading performance.

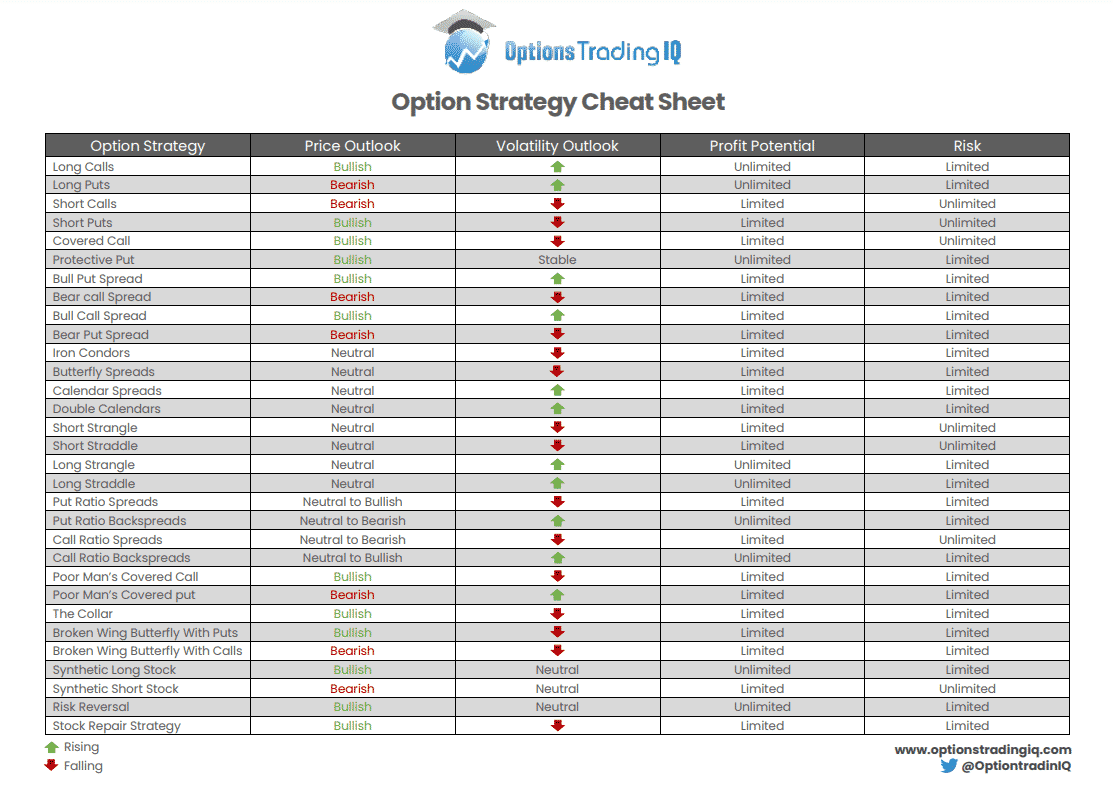

Image: optionstradingiq.com

Understanding Option Trading Strategies

Option trading involves buying or selling contracts that give the buyer or seller the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a συγκεκριμένη ημερομηνία. There are numerous option trading strategies, each with its own advantages and risks. Some of the most common strategies include:

- Call options: Give the buyer the right to buy the underlying asset at a specified price on or before a συγκεκριμένη ημερομηνία.

- Put options: Give the buyer the right to sell the underlying asset at a specified price on or before a συγκεκριμένη ημερομηνία.

- Straddles: Involve buying both a call and a put option with the same strike price and expiration date, giving the trader the right to either buy or sell the underlying asset at that price.

- Strangles: Similar to straddles, but the strike prices are different, creating a wider range for the trader to profit.

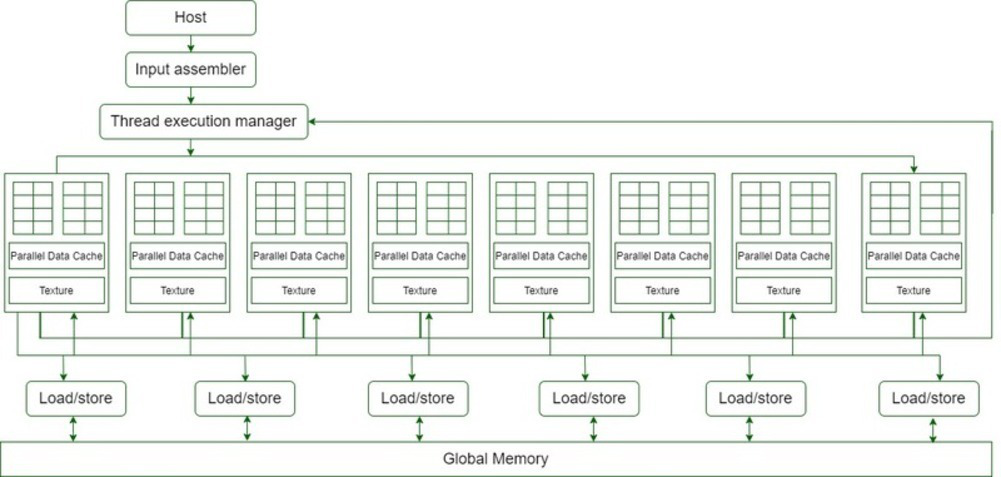

CUDA for Enhanced Trading Performance

CUDA is a parallel computing platform developed by NVIDIA that harnesses the power of graphics processing units (GPUs) to accelerate computation-intensive tasks. In the context of option trading, CUDA can provide significant benefits, including:

- Faster execution: CUDA allows traders to perform complex calculations, such as option pricing and risk analysis, much faster than with traditional CPU-based systems. This faster execution can be critical in time-sensitive trading situations.

- Enhanced accuracy: CUDA’s parallel processing capabilities enable traders to utilize more sophisticated pricing models, resulting in more accurate estimates of option prices and risks.

- Improved risk management: CUDA-powered risk analysis tools allow traders to assess and manage risk more effectively, helping them make informed trading decisions.

Popular Option Trading Strategies with CUDA

Traders can leverage CUDA’s capabilities to enhance the performance of various option trading strategies. Some popular strategies that benefit from CUDA acceleration include:

- Monte Carlo simulations: These simulations use random sampling to estimate the possible outcomes of complex trading strategies, allowing traders to better understand the potential risks and rewards.

- Volatility trading: CUDA enables traders to perform real-time analysis of volatility data, helping them identify trading opportunities based on changes in market volatility.

- High-frequency trading: CUDA’s fast execution capabilities make it ideal for high-frequency trading strategies, where traders execute multiple trades within a short period.

Image: stacklima.com

Expert Insights

“CUDA has transformed option trading by providing traders with the ability to perform complex calculations and analysis in near real-time,” says Dr. Mark Jenkins, a quantitative finance expert. “This has empowered traders to make more informed decisions and capitalize on market opportunities that were previously inaccessible.”

“The use of CUDA for option pricing and risk analysis has significantly improved the accuracy of my trading strategies,” adds experienced trader Sarah Williams. “I have been able to reduce my losses and increase my profits, thanks to the enhanced insights provided by CUDA-powered tools.”

Option Trading Strategies Cuda

Image: rmoneyindia.com

Conclusion

Option trading strategies can provide investors with a powerful tool for generating returns, but it is crucial to approach these strategies with a clear understanding of the underlying concepts and risks. CUDA, with its parallel computing capabilities, offers a valuable tool for traders to enhance the performance of their option trading strategies, enabling them to execute trades faster, improve accuracy, and manage risk more effectively. By leveraging the power of CUDA, traders can unlock new opportunities and achieve greater success in the ever-evolving world of option trading.