Introduction

In the ever-evolving world of finance, option trading has emerged as a sophisticated yet lucrative strategy. Enter SoftBank Group, a Japanese multinational telecom and internet conglomerate, whose option trading endeavors have garnered significant attention. Today, we delve into the intriguing realm of SoftBank option trading, uncovering its nuances, latest trends, and expert insights.

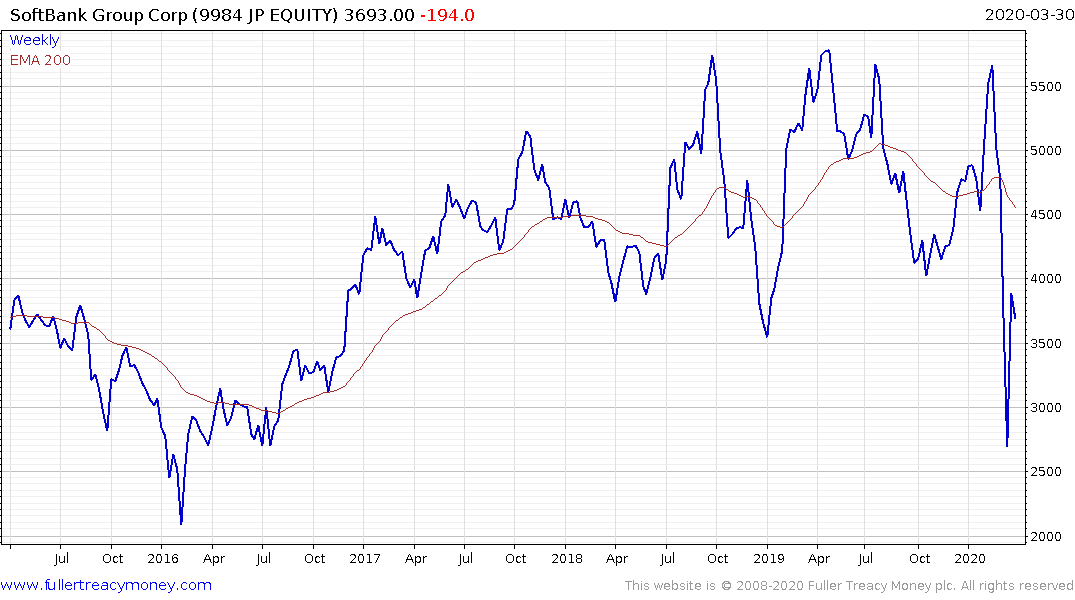

Image: talkmarkets.com

Understanding SoftBank Option Trading

Option trading involves the buying or selling of options contracts, which grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. SoftBank, known for its substantial investments in technology companies, often utilizes option trading to manage investment exposure, speculate on market movements, or generate additional income.

Types of SoftBank Options

SoftBank’s option trading portfolio includes various types of options, each tailored to specific strategies. Some prevalent option types include:

- Call Options: Grant the right to buy an underlying asset, offering potential upside profits in rising markets.

- Put Options: Bestow the right to sell an underlying asset, enabling downside protection or income generation in falling markets.

- Covered Calls: Allow traders to sell covered calls against existing stock positions, potentially enhancing returns or mitigating risk.

- Naked Puts: Grant the right to sell an underlying asset without owning it, carrying greater risk but potential higher rewards.

Latest Trends in SoftBank Option Trading

The landscape of SoftBank option trading is constantly evolving, influenced by global economic conditions, market volatility, and emerging trading strategies. Some key trends include:

- Increased Use of Algorithms: The advent of sophisticated trading algorithms has automated the execution of option trades, improving speed, accuracy, and risk management.

- Growth of Options Markets: The options market has witnessed exponential growth, providing traders with a wider universe of options contracts and underlying assets.

- Focus on Risk Management: SoftBank emphasizes comprehensive risk management techniques to mitigate potential losses, utilizing strategies such as hedging and diversification.

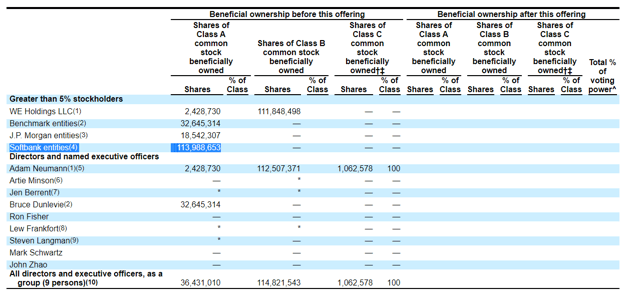

Image: www.fullertreacymoney.com

Tips and Expert Advice

Navigating the complex world of SoftBank option trading requires strategic planning and prudent execution. Here are some invaluable tips and expert advice:

- Thorough Research: Conduct in-depth research on underlying assets, market trends, and option pricing models to make informed decisions.

- Option Pricing and Risk Management: Utilize option pricing models and develop robust risk management strategies to maximize potential rewards while controlling downside risk.

- Leverage Technology: Explore technological tools and platforms that can automate trading operations, enhance analysis capabilities, and optimize portfolio performance.

FAQ on SoftBank Option Trading

- Q: Is SoftBank option trading open to individual investors?

A: Yes, individual investors can participate in SoftBank option trading through licensed brokers and financial institutions. - Q: How do I determine the right strike price and expiration date for my options?

A: Consider factors such as underlying asset price, market volatility, and your investment horizon when selecting the appropriate strike price and expiration date. - Q: What are the risks involved in SoftBank option trading?

A: Option trading carries inherent risks, including the potential for significant losses. Manage risk by understanding option pricing models, employing risk management strategies, and exercising due diligence.

Softbank Option Trading

Image: seekingalpha.com

Conclusion

SoftBank option trading has emerged as a powerful strategy for investment and portfolio management. By embracing a proactive approach, leveraging expert insights, and adhering to prudent risk management practices, traders can harness the full potential of this dynamic market. Whether you are an experienced investor or just starting your journey in option trading, the insights shared in this article will serve as a valuable guide.

Tell us, dear reader, have we sparked your curiosity in the captivating world of SoftBank option trading? If the intrigues of this financial arena appeal to you, we encourage you to delve deeper into the topic and explore the opportunities that await.