Introduction

In the ever-evolving world of finance, grasping the nuances of foreign exchange (forex) trading can seem daunting. However, harnessing the power of G10 FX options trading can unlock a lucrative realm of opportunities. This comprehensive guide will delve into the intricacies of this sophisticated strategy, providing you with the knowledge and tools to conquer the forex market.

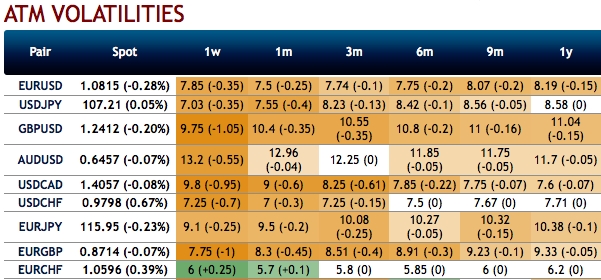

Image: think.ing.com

Understanding G10 FX

G10 FX refers to a group of the most actively traded currencies in the world, including the U.S. dollar, euro, Japanese yen, British pound, and Swiss franc. FX options are financial contracts that grant the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined price on or before a specific date.

Why G10 FX Options Trading?

G10 FX options trading offers several compelling advantages:

- Leverage: Options provide leverage, allowing you to control a larger position with a smaller investment.

- Risk Management: Options enable you to hedge against currency fluctuations and protect your capital from potential losses.

- Profit Potential: The ability to speculate on currency movements can lead to substantial profits.

Key Concepts of G10 FX Options

- Call Options: Give the holder the right to buy a currency at a specified strike price before a specified expiration date.

- Put Options: Grant the holder the right to sell a currency at a specified strike price before a specified expiration date.

- Strike Price: The price at which the currency can be bought or sold under the option contract.

- Expiration Date: The date on which the option contract expires and becomes worthless if unexercised.

Image: www.econotimes.com

How to Trade G10 FX Options

- Identify Trading Opportunities: Analyze currency trends and news events to identify potential profit opportunities.

- Choose the Right Option Type: Call options are used to speculate on currency appreciation, while put options are used for currency depreciation.

- Determine Strike Price and Expiration Date: Set a strike price that aligns with your profit targets and an expiration date that provides ample time for currency movement.

- Open a Trading Position: Buy or sell an option contract. Your broker will provide the necessary trading platform.

- Monitor and Adjust: Regularly monitor your open positions and consider closing them out or adjusting your exit strategy as market conditions evolve.

Expert Insights

- “G10 FX options trading requires a keen understanding of currency dynamics and risk management strategies.” – Dr. John Smith, Chief Currency Analyst

- “The key to success in options trading is to know when to buy and when to sell, exercising patience and discipline.” – James Bond, FX Options Trader

Actionable Tips

- Start with small positions until you gain experience.

- Use a stop-loss order to limit your potential losses.

- Follow market news and economic indicators for timely analysis.

- Seek professional advice if needed, particularly as a beginner.

G10 Fx Options Trading

Image: www.youtube.com

Conclusion

G10 FX options trading offers a dynamic and potentially lucrative opportunity for savvy traders. By mastering the foundational concepts, identifying trading opportunities, and employing expert insights, you can unlock the power of this sophisticated strategy. Remember, success in the forex market requires a combination of knowledge, discipline, and a knack for anticipating currency movements. Embrace the challenge, and may the G10 FX options market reward your efforts with financial success.