Investment Arm is Scaled-Back Following Heavy Losses

Introduction

Image: seekingalpha.com

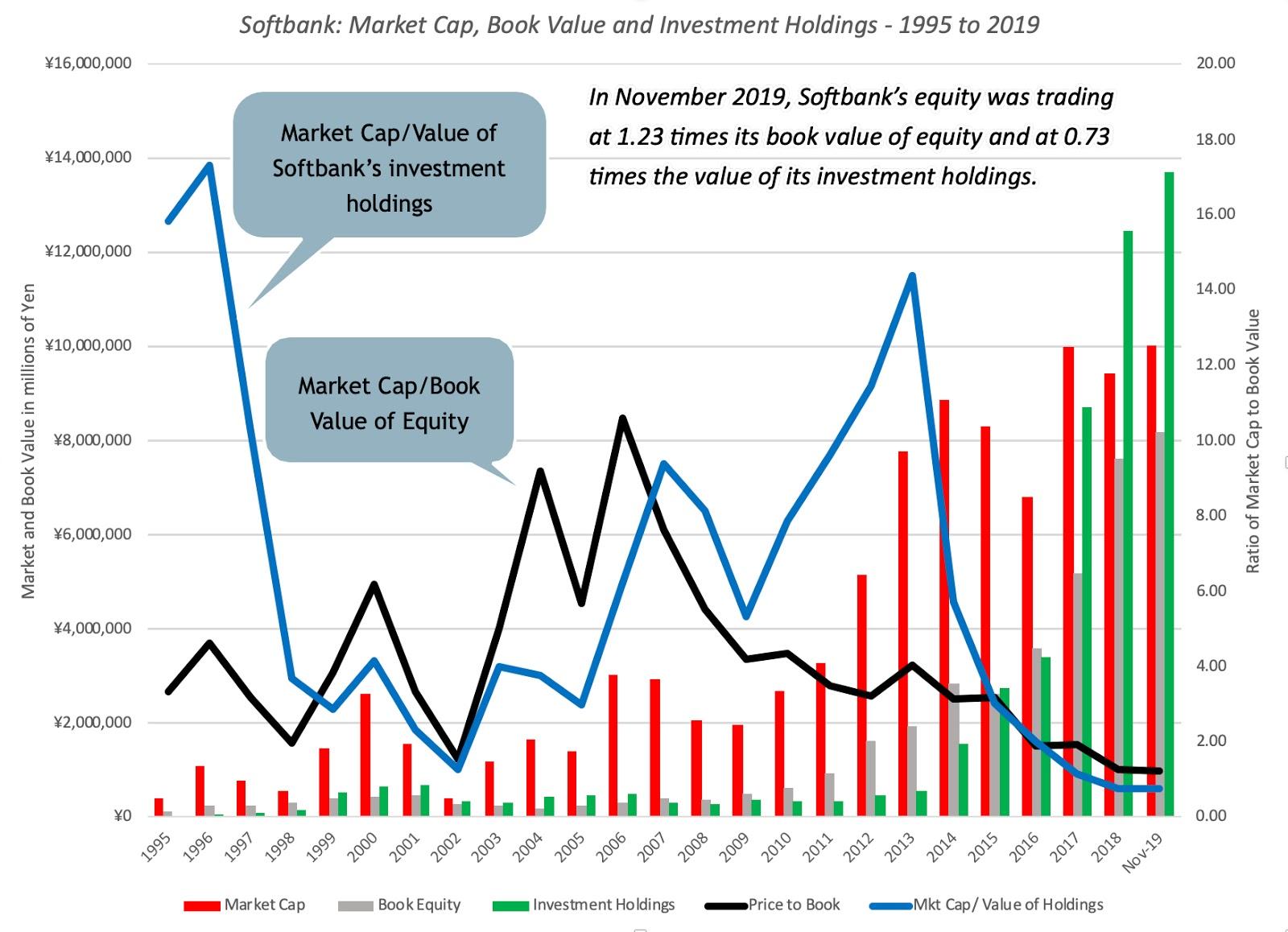

Japanese tech conglomerate SoftBank has announced the winding down of its once-ambitious options trading arm following a massive backlash from shareholders. The decision was prompted by soaring losses incurred by SoftBank Group International, a subsidiary established in 2021 to execute complex options strategies. Amid waning investor confidence, SoftBank has retreated from high-risk trading and is reallocating resources to its core businesses.

Options Trading Misadventures

SoftBank’s foray into options trading was initially praised as a strategic move to generate additional revenue and diversify its portfolio. However, the strategy quickly unraveled, resulting in significant losses for the company. In the fiscal year ending March 2023, SoftBank Group International reported a staggering $6.2 billion loss, largely attributable to its options trading activities. The losses were primarily driven by failed bets on technology stocks during the 2022 market downturn.

Shareholder Concerns and Management Rethink

As losses mounted, shareholders voiced their discontent, demanding that SoftBank reconsider its options trading strategy. Criticism centered around the excessive risk exposure and misallocation of resources. Shareholders argued that SoftBank should prioritize its core businesses, such as telecommunications, e-commerce, and renewable energy, which have historically been more profitable and less volatile.

Strategic Backpedal

In response to shareholder pressure, SoftBank’s management team has announced a significant scaling back of the options trading arm. The company will progressively unwind its positions and focus on more conservative investment strategies. SoftBank CEO Masayoshi Son acknowledged the concerns raised by shareholders and stated that the company will “prioritize profitability and shareholder value creation.”

Redeployment of Resources

The resources previously allocated to options trading will be redirected towards SoftBank’s core businesses. The company plans to invest in 5G network expansion, artificial intelligence research, and the development of its e-commerce and renewable energy platforms. SoftBank is also considering strategic acquisitions and partnerships to strengthen its position in key markets.

Recalibrating for Long-Term Growth

By abandoning its options trading venture, SoftBank is acknowledging the need to refocus on its core competencies and adopt a more sustainable approach to investment. The company’s decision underscores the importance of listening to shareholder concerns and adjusting strategies accordingly. SoftBank’s recalibration is expected to reduce volatility and pave the way for long-term growth.

Lessons Learned

SoftBank’s decision to wind down its options trading arm serves as a cautionary tale for investors considering high-risk strategies. It demonstrates that even well-established companies can suffer significant losses when venturing outside their core areas of expertise. Investors are advised to carefully assess risk appetite and diversification strategies before investing in complex financial instruments.

Conclusion

SoftBank’s retreat from options trading marks a significant shift in the company’s investment strategy. By reallocating resources to its core businesses and adopting a more conservative approach, SoftBank aims to restore investor confidence and drive long-term growth. The company’s decision highlights the importance of strategic alignment and the need to balance risks and rewards in investment decision-making.

Image: vip.graphics

Softbank To Wind Down Options Trading After Investor Backlash

Image: ifunny.co