A Journey into the Heart of Volatility and Returns

In the realm of finance, options have emerged as a potent tool, offering investors and traders a flexible and potentially lucrative pathway to harness the power of market fluctuations. With an estimated $10 trillion in daily trading volume, the options trading industry has witnessed a surge in popularity, fueled by its ability to generate significant returns while mitigating risks. Embark with us as we delve into the compelling tapestry of options trading industry statistics, unveiling the intricacies of this dynamic marketplace.

Image: www.pinterest.com

Market Overview: A Historical Perspective

The concept of options trading dates back to ancient Greece, but it was not until the 1970s that standardized options contracts gained widespread acceptance. The Chicago Board Options Exchange (CBOE) played a pivotal role in this development, establishing a central marketplace for options trading. Over the years, the industry has witnessed remarkable growth, driven by technological advancements and a growing appetite for risk management and income-generating strategies.

Options Trading Basics: Unraveling the Fundamentals

At its core, an options contract is an agreement that grants the buyer the right (but not the obligation) to buy or sell an underlying asset at a predetermined price before a specified expiration date. This flexibility allows investors to speculate on the future direction of the underlying asset without the obligation to purchase or sell it. Options contracts are categorized into two primary types: calls and puts. Call options convey the right to buy the underlying asset, while put options confer the right to sell.

Understanding the Essence of Risk and Reward

The potential rewards of options trading can be substantial. However, it is crucial to acknowledge that options trading also involves significant risk. The value of an options contract is directly influenced by the price of the underlying asset, and adverse price movements can lead to substantial losses. Risk management is paramount for options traders, and strategies such as diversification and hedging can help mitigate potential risks.

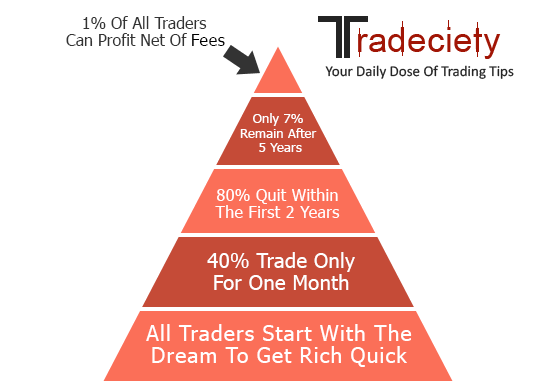

Image: tradeciety.com

A Glimpse into Recent Trends: The Evolving Landscape

The options trading industry is constantly evolving, driven by evolving market dynamics and technological innovations. Recent trends include a rise in algorithmic trading, an increased focus on volatility strategies, and the emergence of new options products. These advancements have further enhanced the versatility and accessibility of options trading for a diverse range of market participants.

Navigating the Complex Options Trade: Practical Guidance

Navigating the intricate world of options trading requires a comprehensive understanding of the mechanics involved. Beginners should start by gaining a firm grasp of the basics, including different types of options contracts, option chains, and the factors that influence option pricing. It is also essential to develop a robust trading strategy that aligns with one’s investment goals and risk tolerance.

Unlocking Market Insights: Harnesses the Wisdom of Experts

Educating oneself in the art of options trading is pivotal to achieving success in this challenging yet rewarding field. Seasoned options traders emphasize the value of continuous learning and the practical application of knowledge. They advocate for staying abreast of market trends, analyzing historical data, and seeking guidance from experienced mentors or reputable educational resources.

Options Trading Industry Statistics

![Forex Trader Statistics [Infographic] | CurrentDesk](https://currentdesk.com/wp-content/uploads/2019/07/Forex-Trader-Infographic.png)

Image: currentdesk.com

Conclusion: The Power of Informed Trading

The realm of options trading holds immense potential, offering investors a unique opportunity to enhance returns and mitigate risks. By delving into the captivating statistics and insights surrounding the options trading industry, individuals can gain invaluable knowledge to embark on this challenging yet rewarding journey. Remember, informed trading empowers individuals to harness the full potential of options and navigate the ever-changing financial landscape with confidence.