In the intricate realm of financial markets, where risk and reward intertwine, option trading spreads emerge as a potent tool for investors seeking to navigate the turbulent waters of market fluctuations. This multifaceted strategy hinges on leveraging the interplay between different options, enabling traders to tailor their risk-reward profile and potentially enhance their returns.

Image: luckboxmagazine.com

Option trading spreads involve the simultaneous purchase and sale of two or more options with different strike prices or expiration dates. By combining these options, traders aim to exploit the nuanced relationship between their premiums and strike prices. This intricate dance of option dynamics can lead to substantial gains or serve as a protective layer against market volatility.

Navigating the Basics of Option Trading Spreads

To unravel the intricacies of option trading spreads, let’s delve into some fundamental concepts:

- Strike Price: Each option contract is tied to a specific strike price, which represents the price at which the underlying asset can be bought (in the case of a call option) or sold (for a put option).

- Expiration Date: Every option contract has a designated expiration date, after which it ceases to exist and any value it holds evaporates.

- Premium: The price paid to acquire an option contract is known as its premium. This premium reflects the intrinsic value of the option and incorporates other factors such as time to expiration, interest rates, and market sentiment.

Unveiling the Potential of Spread Strategies

The arsenal of option trading spreads is vast, each strategy tailored to distinct investment goals and risk tolerance. Here are some widely employed spread strategies:

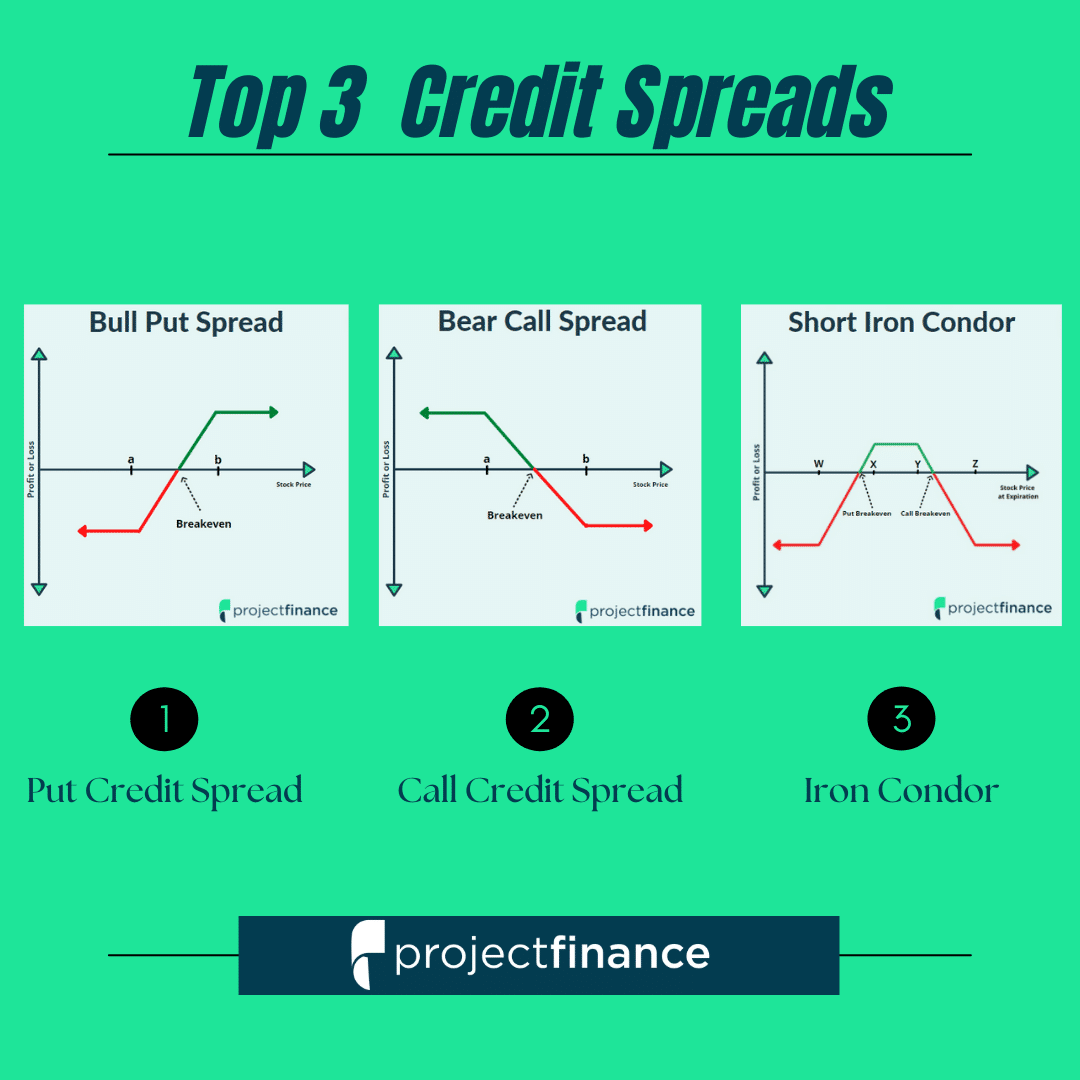

- Bullish Spread: A bullish spread consists of buying a lower-strike call option while concurrently selling a higher-strike call option with the same expiration date. This strategy expresses a bullish sentiment, effectively wagering that the underlying asset will rise in value.

- Bearish Spread: Conversely, a bearish spread involves purchasing a higher-strike put option while selling a lower-strike put option with the same expiration date. This spread capitalizes on an anticipated decline in the underlying asset’s price.

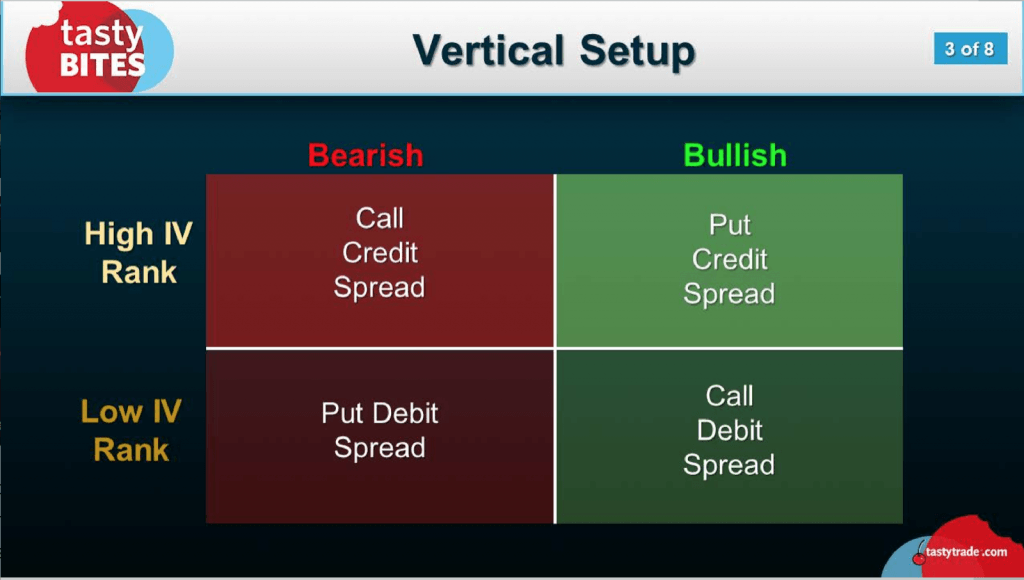

- Vertical Spread: A vertical spread entails buying one option at a lower strike price and simultaneously selling one option at a higher strike price, with both options carrying the same expiration date. Vertical spreads typically limit profit potential but also reduce risk compared to naked options trading.

- Calendar Spread: This strategy involves purchasing an option with a longer expiration date while selling an option with a shorter expiration date, both at the same strike price. Calendar spreads exploit the time value decay of options to generate returns.

Unveiling the Secrets of Successful Spread Trading

While option trading spreads can be enriching, they’re not devoid of risks. To maximize your odds of success, embrace these guiding principles:

- Understand Your Risk Tolerance: Assess your tolerance for financial losses before venturing into option spreads. This introspection will help you align your trading strategy with your risk appetite.

- Meticulously Research Your Trades: Delve into thorough research before executing any spread trade. Analyze the underlying asset, examine market trends, and consult with financial professionals to make informed decisions.

- Exercise Prudence in Position Sizing: Determine an appropriate position size that aligns with your financial resources and risk tolerance. Avoid overextending yourself financially to mitigate potential losses.

- Monitor Your Positions Regularly: Keep a watchful eye on your spread positions, especially during periods of market volatility. Adjust your strategy as needed to manage risk and maximize returns.

Image: fabalabse.com

Option Trading Spreads

Image: www.pinterest.com

Conclusion

Option trading spreads present a potent tool for strategic investors seeking to enhance their returns while navigating market uncertainty. This multifaceted approach demands a thorough understanding of option dynamics and a measured risk tolerance. By embracing prudent trading practices and leveraging sound research, you can harness the transformative potential of option trading spreads to craft a robust investment strategy. Remember, financial success isn’t a sprint but a marathon, requiring patience, discipline, and a deep understanding of the markets.