Introduction

In the ever-evolving financial landscape, navigating market volatility can be daunting. Yet, for savvy traders, volatility presents lucrative opportunities. One such platform that caters specifically to volatility trading is the North American Derivatives Exchange (Nadex). This comprehensive guide will delve into the intricacies of trading volatility through Nadex’s unique options offerings.

Image: www.best-trading-platforms.com

Understanding Nadex

Nadex, established in 2004, has emerged as a pioneer in offering binary options and spread options, empowering traders to speculate on the future direction of a market. Unlike traditional options, Nadex contracts have predefined expiration times and fixed payouts, making them ideal for short-term trading and volatility strategies.

Binary Options: A Simplified Approach

Binary options, the cornerstone of Nadex’s offerings, grant traders the option to predict whether an underlying asset (e.g., stock, index, currency) will increase or decrease in value before a specified expiration time. The payoff structure is straightforward: if the prediction aligns with the market outcome, the trader receives a fixed payout; otherwise, the investment is lost.

Spread Options: Enhanced Volatility Trading

Spread options, the advanced counterpart to binary options, allow traders to capitalize on volatility fluctuations by establishing a price range within which the underlying asset must remain at expiration. If the narrow range is successfully navigated, traders earn a proportional payout based on the degree of price movement within the defined spread.

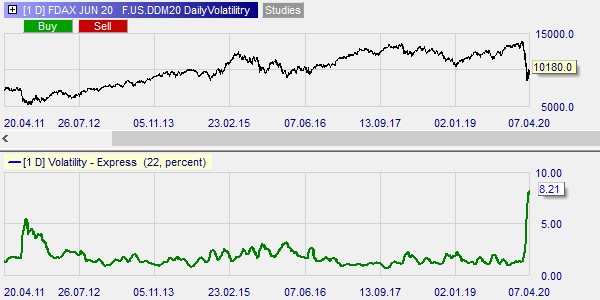

Image: www.nadex.com

Trading Strategies for Volatile Markets

-

Breakout Trading: Exploiting periods of increased volatility, traders identify potential price breakouts by monitoring support and resistance levels. Option purchases are placed with the expectation that the breakout will continue.

-

Range Trading: Conversely, range trading seeks to profit from consolidation periods by predicting fluctuations within a defined price range. Spread options with narrow strikes can capture small price movements.

-

Volatility Arbitrage: Savvy traders can leverage the correlation between implied volatility and historical volatility to identify mispriced options contracts. By establishing positions in both markets, traders can capitalize on imbalances and capture arbitrage profits.

Expert Tips and Advice

-

Monitor Economic Indicators: Stay informed about economic releases and key data that can influence market volatility. This allows traders to anticipate potential price swings.

-

Manage Risk with Synthetic Positions: By creating synthetic positions through a combination of binary and spread options, traders can hedge risk and enhance profitability.

-

Practice Discipline and Consistency: Successful volatility trading requires discipline in executing strategies, managing emotions, and maintaining consistency in position sizing and risk management.

FAQs

Q: Can Nadex be used to trade stocks?

A: Yes, Nadex offers binary and spread options on major stocks.

Q: What is the minimum deposit required to open a Nadex account?

A: The minimum deposit is $250.

Q: How long do Nadex contracts last?

A: Nadex contracts have defined expiration times ranging from 3 minutes to 3 months.

Trading Volatility With Options Nadex

Image: www.pinterest.com

Conclusion

Trading volatility through Nadex’s options offerings presents ample opportunities for those willing to embrace risk and understand market dynamics. By leveraging the insights and advice provided in this guide, traders can equip themselves with the knowledge and strategies necessary to navigate the volatile markets and harness its potential for profit. Are you ready to join the ranks of successful Nadex traders?