Introduction

Options trading offers traders an avenue to potentially magnify returns while limiting risk. One common and powerful strategy employed by many traders is the long call option. This type of option entails acquiring the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) before a specific expiration date. By utilizing this strategy, traders aim to capitalize on the anticipated rise in the underlying asset’s value.

The allure of long call options lies in their flexibility and potential profitability. However, it’s crucial for traders to possess a thorough understanding of the intricacies of this strategy before delving into the market. This comprehensive guide will delve into the concept of long call options, providing you with the knowledge necessary to make informed trading decisions and potentially enhance your trading outcomes.

Image: cannytrading.com

Understanding Long Call Options:

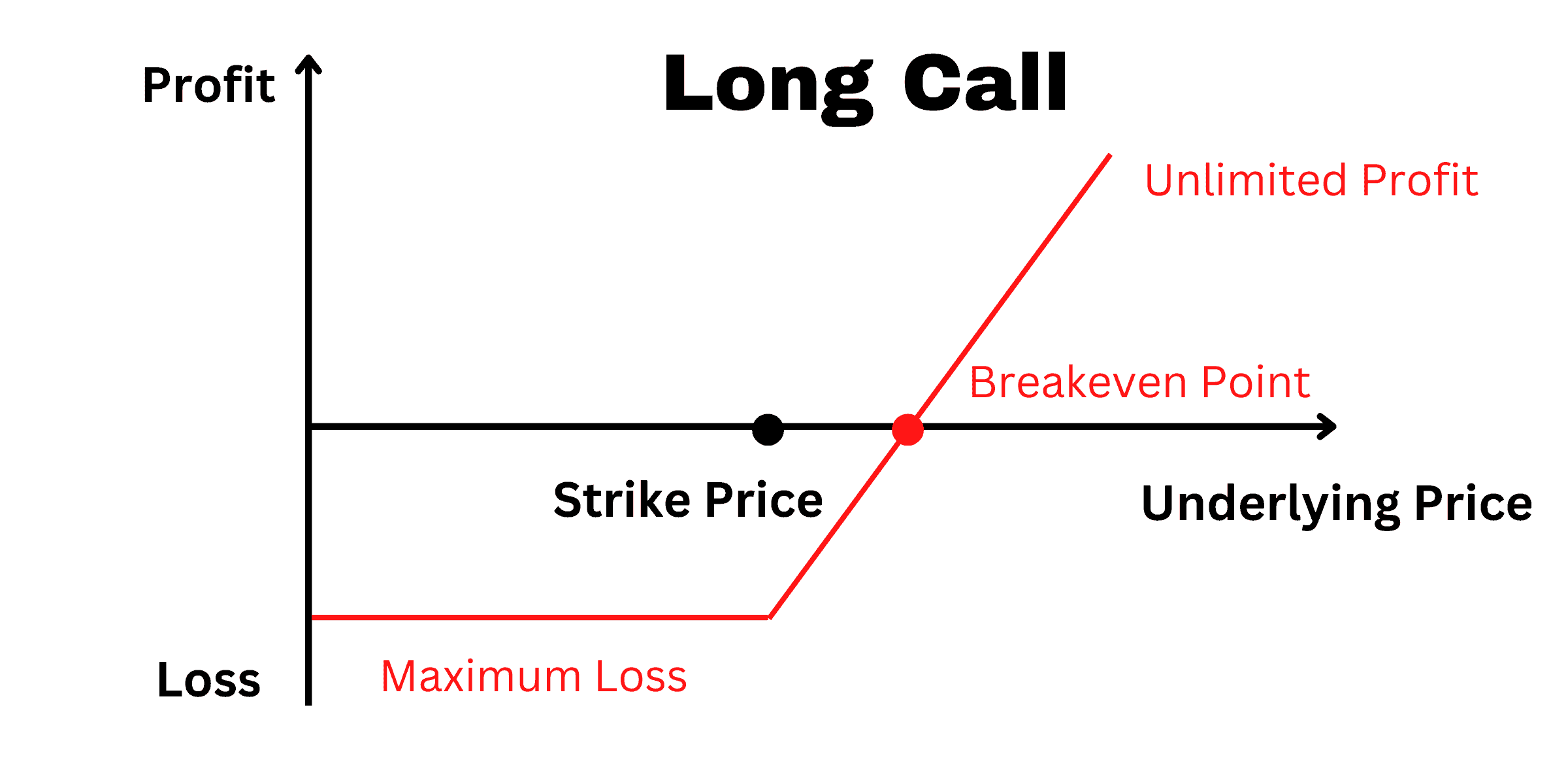

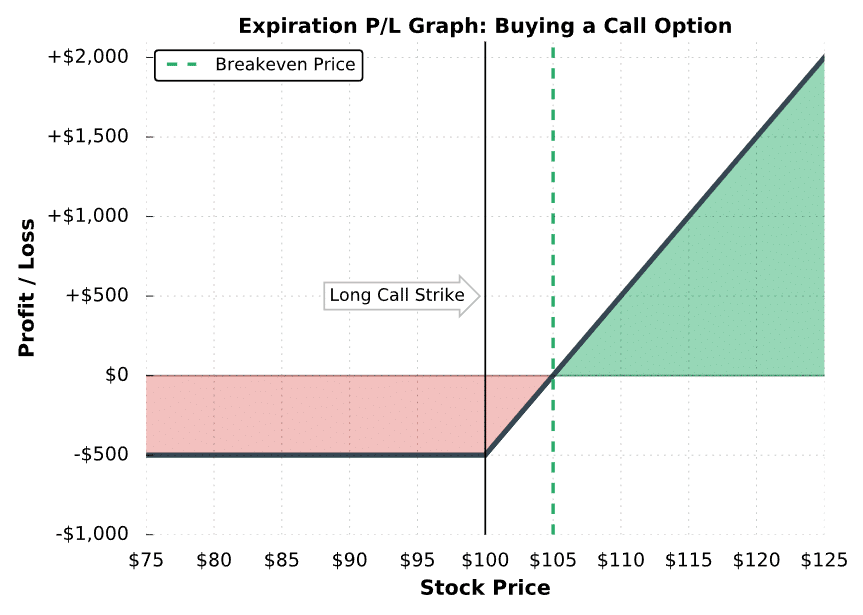

To comprehend long call options effectively, one must grasp their fundamental concepts. A long call option grants the buyer the privilege to purchase a defined quantity (typically 100 shares) of an underlying asset at a predetermined price within a specified timeframe. In exchange for this right, the buyer pays a premium to the option seller.

The key to profiting from long call options lies in correctly predicting the price movement of the underlying asset. If the underlying’s value surges beyond the strike price before expiration, the long call option holder stands to reap substantial gains. The potential return is theoretically unlimited, making this strategy appealing to traders seeking amplified returns. However, it’s important to note that this strategy also carries the potential for significant losses.

Reasons for Utilizing Long Call Options:

Traders opt for long call options due to several compelling reasons:

-

Leverage: Long call options provide traders with a significant degree of leverage. With a relatively small premium outlay, traders can potentially control a much larger position in the underlying asset. This leverage magnifies the potential for outsized returns, making it an attractive proposition for traders seeking to maximize gains.

-

Limited Risk: Unlike other trading strategies, long call options offer limited risk to the buyer. The maximum loss is capped at the initial premium paid for the option. This characteristic helps mitigate downside risk, providing traders with a safety net.

-

Versatility: Long call options present traders with a versatile tool that can be employed in various market conditions. Whether the market is trending upward, consolidating, or experiencing volatility, long call options offer the potential for profit generation.

Benefits of Long Call Options:

The advantages of incorporating long call options into a trading strategy are compelling:

-

Profitable in Upward Markets: Long call options excel in rising markets, allowing traders to capture substantial profits if the underlying asset’s price appreciates beyond the strike price. This strategy benefits from strong bullish momentum and can lead to significant returns.

-

Limited Downside Risk: As previously mentioned, long call options offer limited downside risk. The buyer’s maximum loss is confined to the premium paid, providing a built-in safety mechanism that safeguards against catastrophic losses.

-

Gearing for Small Price Movements: Long call options provide traders with the ability to profit even from modest price movements. Unlike buying the underlying asset outright, which requires a substantial price increase to generate meaningful returns, long call options can amplify gains with relatively small price fluctuations above the strike price.

Image: www.schwab.com

Limitations and Risks of Long Call Options:

While long call options offer many benefits, it’s essential to acknowledge their inherent limitations and risks:

-

Time Decay: Long call options are subject to time decay as the expiration date approaches. This means the value of the option gradually diminishes over time, even if the underlying asset’s price remains unchanged. Time decay can significantly impact profitability, especially for options with short expirations.

-

Market Volatility: Long call options are particularly sensitive to market volatility. Increased volatility can lead to rapid fluctuations in option prices, which can be both beneficial and detrimental to traders. While volatility can amplify gains, it can also magnify losses.

-

Missed Opportunities: Long call options require the underlying asset’s price to rise above the strike price by a specific amount before expiration to generate profits. If the price fails to achieve this target, the option may expire worthless, resulting in a loss of the entire premium paid.

Option Trading Long Calls

Image: www.projectfinance.com

Conclusion

In the realm of options trading, long call options present a powerful strategy with the potential for significant returns. By leveraging these contracts, traders can capitalize on anticipated price increases in underlying assets while limiting their downside risk. However, it’s essential to approach this strategy with knowledge, understanding, and prudent risk management. By carefully considering the factors discussed and employing sound trading practices, traders can harness the profit-making potential of long call options while mitigating associated risks. Always remember to conduct thorough research, consult with financial advisors when appropriate, and exercise responsible trading decisions to maximize your chances of success.