Imagine standing on the edge of a precipice, anticipating a thrilling adventure. In the vast expanse of options trading, a long call beckons, promising the potential for exponential returns. But what is a long call, and how can you leverage its might to your advantage? Join us on an enlightening journey as we delve into the captivating world of long calls, unraveling their enigmatic nature and empowering you with practical knowledge.

Image: www.youtube.com

A Long Call Unveiled: Definition and Essence

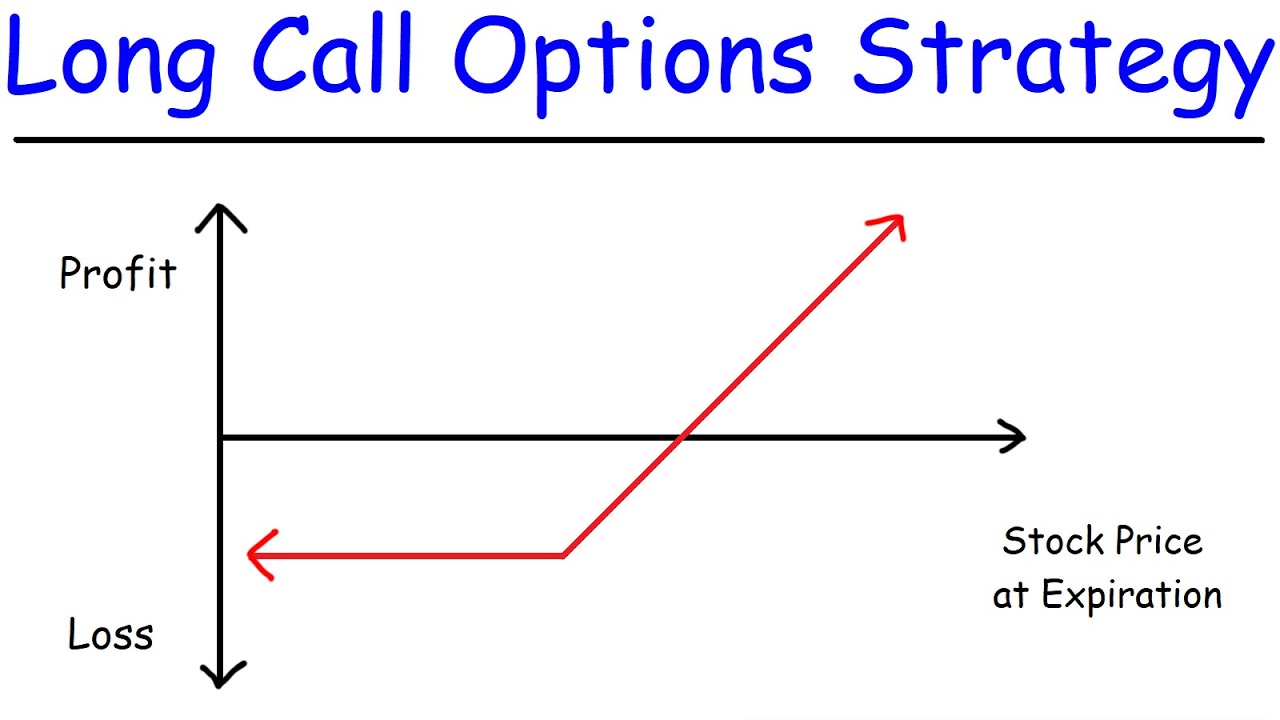

A long call is a fundamental options strategy that grants you the privilege of purchasing an underlying asset, such as a stock, at a predetermined price on or before a specific date. By holding a long call option, you gain the right, but not the obligation, to acquire the asset at the strike price—the mutually agreed-upon purchase price embedded within the contract. This strategy is often employed by investors who anticipate a future increase in the value of the underlying asset.

Consider this scenario: You firmly believe that the stock of your favorite tech titan is poised for a meteoric rise. Rather than buying the stock outright, which requires a substantial investment upfront, you opt for a more strategic approach—you purchase a long call option. Imagine securing the right to purchase this sought-after stock at a set price in the future, while only paying a fraction of the stock’s current market value. This is the magic of a long call.

Navigating the Long Call Landscape

Understanding the components of a long call option is crucial for effective execution. Primarily, the strike price, the premium, and the expiration date shape the potential outcomes of your trade. The strike price signifies the price at which you have the right to purchase the underlying asset. Higher strike prices lead to lower premiums, while lower strike prices demand higher premiums.

The premium represents the cost of the contract, encompassing both the time value and the intrinsic value. As the expiration date approaches, the time value diminishes, potentially reducing the premium’s worth. The expiration date marks the day when your option contract expires, and your rights to exercise it vanish. Therefore, selecting a suitable expiration date is essential to align with your investment horizon.

Unleashing the Power of Long Calls

Long calls serve a versatile role in the diverse world of options trading, catering to various investor objectives. Primarily employed in bullish market sentiments, they offer the potential to magnify profits when an underlying asset’s value surges. By leveraging a long call, you can participate in the upside potential of the asset while limiting your risk to the initial premium paid for the contract.

Moreover, long calls provide flexibility, allowing you to tailor your strategy based on your risk tolerance and market outlook. By strategically selecting the strike price and expiration date, you can craft an options strategy that aligns with your investment goals and time frame. Additionally, long calls offer the potential for hedging against potential losses, a defensive maneuver commonly employed by seasoned investors.

Image: www.youtube.com

Expert Insights and Actionable Advice

Renowned options trader Mark Sebastian emphasizes the significance of thorough research and understanding the nuances of long calls. He advises traders to evaluate the underlying asset’s historical price movements, analyze market trends, and stay abreast of industry-specific news to make informed decisions.

Industry veteran Tom Sosnoff echoes the importance of managing risk effectively. He suggests using stop-loss orders to limit potential losses and closely monitoring the performance of your long call options. By actively managing your trades, you can mitigate risks and enhance your overall trading outcomes.

What Is A Long Call In Options Trading

Conclusion: Embracing the Potential of Long Calls

In the realm of options trading, long calls stand tall as a powerful instrument for tapping into the potential of rising asset values. Their flexibility, potential for profit, and risk-limiting characteristics make them a valuable addition to any investor’s toolkit. By embracing the insights shared in this article, you can harness the power of long calls strategically and elevate your options trading journey. Remember, knowledge is the key that unlocks the doors to financial success. Continue exploring, learning, and leveraging your newfound understanding to navigate the markets with confidence.