Introduction

Image: www.zekerfiscaal.nl

In the realm of investing, option trading has emerged as a powerful tool for astute investors seeking to navigate market volatility, hedge against risk, and enhance potential returns. Key to successful option trading is the ability to harness data, a treasure trove of information that can guide informed decisions and unlock market insights.

What is Option Trading Data?

Option trading data encompasses a vast array of information pertaining to the buying and selling of options contracts. It includes real-time market indicators, volatility data, historical option premiums, and trading volumes, among other metrics. By scrutinizing this data, traders can gain valuable insights into market trends, identify potential opportunities, and make calculated decisions.

Types of Option Trading Data

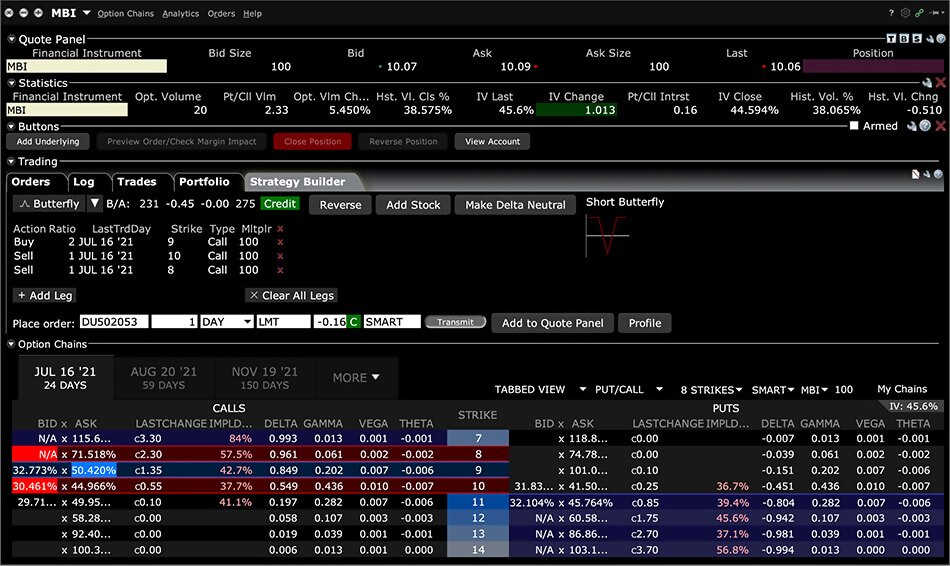

1. Real-Time Market Indicators

This data provides a snapshot of current market conditions, including the bid/ask spread, implied volatility, and Greeks (sensitivity measures of option prices). These indicators help traders gauge market sentiment and adjust their strategies accordingly.

2. Volatility Data

Volatility, a measure of market uncertainty, is a crucial component of option pricing. Data on historical volatility and implied volatility (an estimate of future volatility) enables traders to quantify risk and determine appropriate option strategies.

3. Historical Option Premiums

This data reveals how option prices have fluctuated over time, providing valuable information about market cycles and historical trends. Traders can identify potential support and resistance levels and anticipate future price movements.

4. Trading Volumes

The volume of traded options in a particular contract gives insights into market interest and market sentiment towards that specific asset or sector. High volumes may indicate a significant trend or heightened volatility.

Applications of Option Trading Data

1. Identifying Market Opportunities:

By analyzing option data, traders can identify potential opportunities for lucrative trades. High implied volatility, for instance, may signal an upcoming surge in price volatility, presenting opportunities for profitable option strategies.

2. Risk Management:

Volatility data and Greeks help traders assess the potential risks associated with option transactions, enabling them to hedge against adverse price movements and mitigate losses.

3. Timing the Market:

Historical option data can reveal cyclical patterns and seasonal trends, assisting traders in identifying favorable entry and exit points.

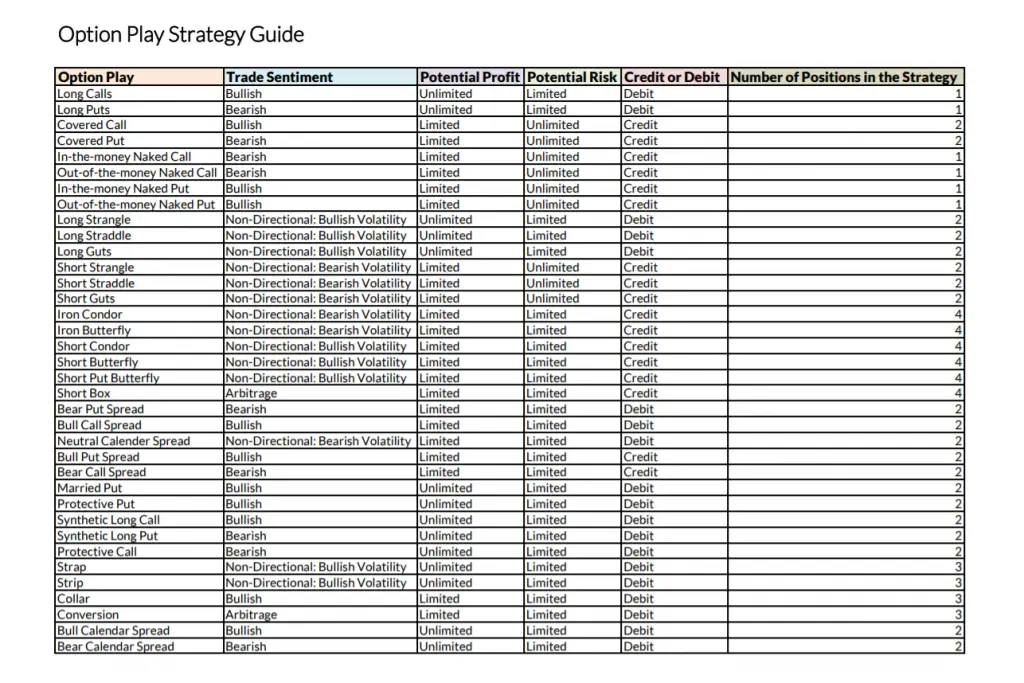

4. Evaluating Option Strategies:

Data on past option premiums and trading volumes allows traders to backtest and evaluate different option strategies, optimizing their performance and maximizing returns.

Conclusion

Option trading data empowers investors with a wealth of actionable insights, enabling them to navigate market uncertainties with greater confidence and precision. By leveraging this data, traders can unlock the full potential of option trading, enhancing their returns and mitigating their risks. To delve deeper into this fascinating realm, explore additional resources and consult with experienced financial professionals. Embark on this knowledge-building journey today to seize the opportunities that option trading has to offer.

Image: www.interactivebrokers.com

Option Trading Data

Image: www.youtube.com