Prologue

Stepping into the enigmatic realm of option trading is akin to navigating a treacherous labyrinth, where every decision can lead to financial triumphs or catastrophic pitfalls. Amidst this tumultuous landscape, armed with historical data, astute traders gain an invaluable advantage, illuminating their path towards informed choices and calculated risks.

Image: www.pinterest.com

Historical data, like a beacon in the financial storm, offers traders precious insights into the dynamic behavior of markets. This treasure trove of past observations unravels the intricate tapestry of asset price fluctuations, market volatility, and trading patterns. As traders delve into these annals, they uncover the hidden correlations, subtle trends, and cyclical rhythms that shape market movement.

Unveiling Historical Data’s Multifaceted Applications

Backtesting Trading Strategies

Traders can harness historical data as a virtual testing ground for their trading strategies, a crucial step in refining their approach. By meticulously simulating trades against historical market conditions, they identify potential strengths and weaknesses, optimizing their strategies for maximum efficiency and minimizing risk.

Assessing Market Volatility

Historical data becomes an indispensable tool for assessing market volatility, the ever-shifting pulse of market movement. By studying historical volatility patterns, traders gain a deeper understanding of the market’s risk profile, enabling them to calibrate their positioning and risk management strategies accordingly.

Image: pankajchaudhary.in

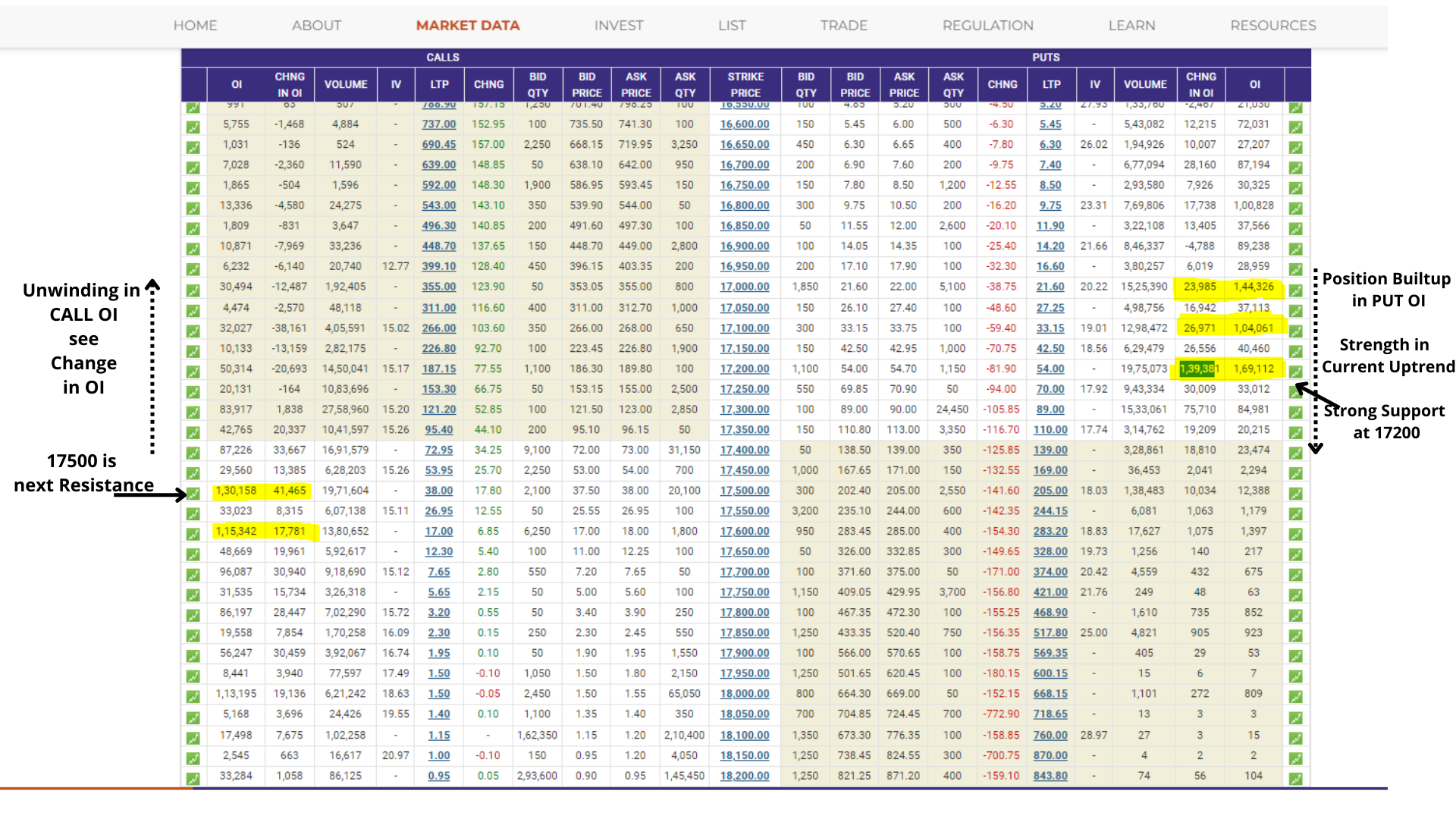

Identifying Historical Support and Resistance Levels

Historical price data illuminates key support and resistance levels, crucial reference points that depict areas of price stability or potential reversals. These levels, gleaned from historical observations, guide traders in identifying potential reversal zones or entry and exit points, maximizing profit potential while managing risk.

Forecasting Future Market Conditions

While gazing into the crystal ball of future market behavior is a formidable task, historical data provides invaluable clues about potential market trends. By analyzing historical data, traders can identify repeating patterns and seasonal influences that may shed light on future market direction, giving them an edge in making informed trading decisions.

Navigating the Challenges of Historical Data

Imperfect Data

Historical data, while valuable, is not impervious to imperfections. Traders must be cognizant of potential data gaps, inaccuracies, or outliers that may arise from varying sources or data collection methods.

Constantly Evolving Markets

Markets are dynamic entities, constantly adapting and evolving in response to a myriad of internal and external factors. Historical data, while providing valuable insights, may not fully capture the nuances and complexities of ever-changing market dynamics.

Option Trading Historical Data

Conclusion

In the intricate world of option trading, historical data emerges as a guiding star, illuminating the path towards informed decision-making and calculated risk-taking. By scrutinizing historical patterns, traders uncover valuable insights into market behavior, enabling them to refine their strategies, assess volatility, and potentially forecast future market trends. While historical data is a powerful tool, it should not be the sole arbiter of trading decisions, as markets constantly evolve. By employing historical data judiciously, alongside a comprehensive understanding of market dynamics and sound risk management principles, traders can navigate the treacherous waters of option trading with increased confidence and profitability.