In the fast-paced, ever-evolving realm of financial markets, knowledge is power. Options trading, a sophisticated investment strategy, is no exception to this rule. Understanding the historical data that shapes options prices is akin to possessing a treasure map, guiding investors towards informed decisions and potentially unlocking substantial gains.

Image: optionstradingiq.com

Historical data in options trading provides a window into past market behaviors, enabling traders to discern patterns, identify trends, and make educated predictions about future market movements. By delving into this wealth of information, we uncover the secrets that have long eluded many investors, empowering them to navigate the complexities of options trading with greater confidence and precision.

Unveiling the Essence of Options Trading Historical Data

At its core, options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These contracts, known as options, derive their value from the potential price fluctuations of the underlying asset.

Historical data plays a pivotal role in understanding the pricing dynamics of options. By analyzing past prices, traders can assess the impact of factors such as market sentiment, economic conditions, and geopolitical events on options values. This knowledge equips them to make informed judgments about the future direction of option prices and devise strategies that maximize profit potential.

Harnessing the Power of Key Historical Indicators

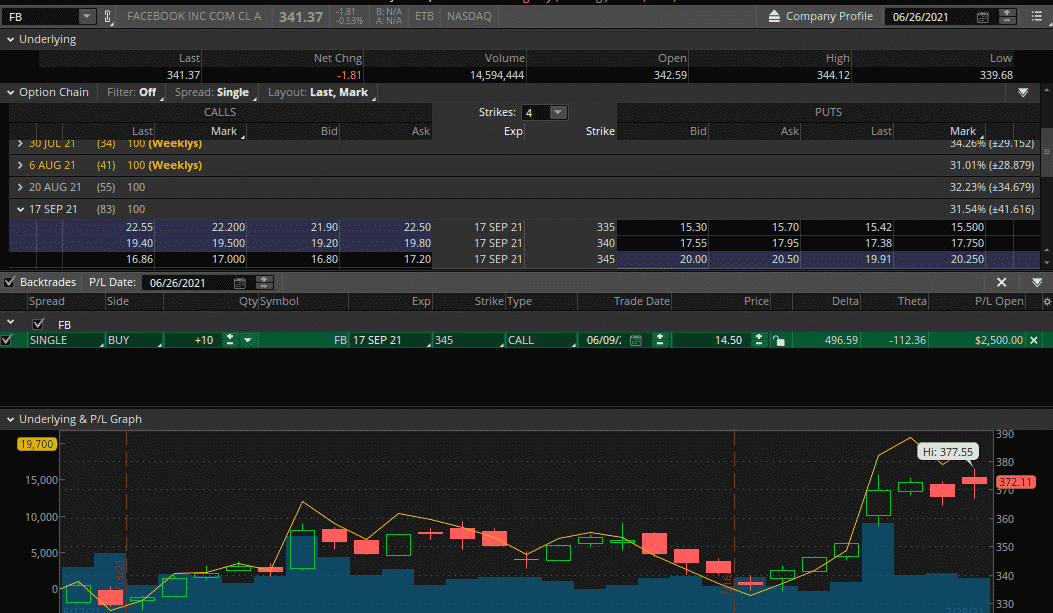

The vast tapestry of options trading historical data encompasses a multitude of key indicators that serve as guiding stars for discerning traders. These indicators include:

- Implied Volatility (IV): A measure of the market’s expectations for future price volatility of the underlying asset. High IV indicates greater uncertainty and potential for large price swings, while low IV suggests stability and predictability.

- Open Interest: The total number of outstanding options contracts for a specific strike price and expiration date. High open interest signifies increased market activity and interest in a particular option.

- Volume: The number of options contracts traded over a specific period. Higher volume suggests increased liquidity and potential for rapid price movements.

- Greeks: A set of metrics that measure the sensitivity of an option’s price to changes in various factors, such as the underlying asset price, time to expiration, and interest rates.

By meticulously studying these indicators, traders gain valuable insights into the dynamics of options markets, enabling them to identify opportunities, manage risk, and optimize their trading strategies.

Realizing the Transformative Potential of Options Trading Historical Data

The transformative potential of options trading historical data is undeniable. By harnessing this wealth of information, investors can:

- Identify Market Trends and Patterns: Historical data allows traders to uncover recurring patterns in the market, enabling them to anticipate future price movements and capitalize on emerging trends.

- Gauge Market Sentiment: By analyzing historical open interest and volume data, traders can gauge market sentiment and identify areas of potential overvaluation or undervaluation in options prices.

- Manage Risk and Protect Capital: Historical volatility data provides valuable insights into the potential risks associated with options trading, empowering investors to develop effective risk management strategies and preserve capital.

- Optimize Trading Strategies: Armed with historical data, investors can refine their trading strategies, adjusting parameters and selecting options that align with their risk tolerance and profit objectives.

Image: www.bitcoininsider.org

Options Trading Historical Data

Conclusion: Embracing the Path of Empowerment

Embracing the power of options trading historical data is an investment in financial literacy and empowerment. By unraveling the secrets of past market behaviors, investors gain the knowledge and confidence to navigate the complexities of options trading with greater precision and foresight.

Remember, the journey of a thousand miles begins with a single step. Take the first step today by immersing yourself in the world of options trading historical data. Equip yourself with the tools and knowledge necessary to unlock the path to informed decision-making and unlock the full potential of this transformative investment strategy.