In the fast-paced world of trading, having access to reliable and timely data is crucial for making informed decisions. Trading platforms offer a wide array of data options to cater to the diverse needs of traders, from real-time market information to historical data. Navigating these options can be daunting, but understanding them is essential for maximizing your trading potential.

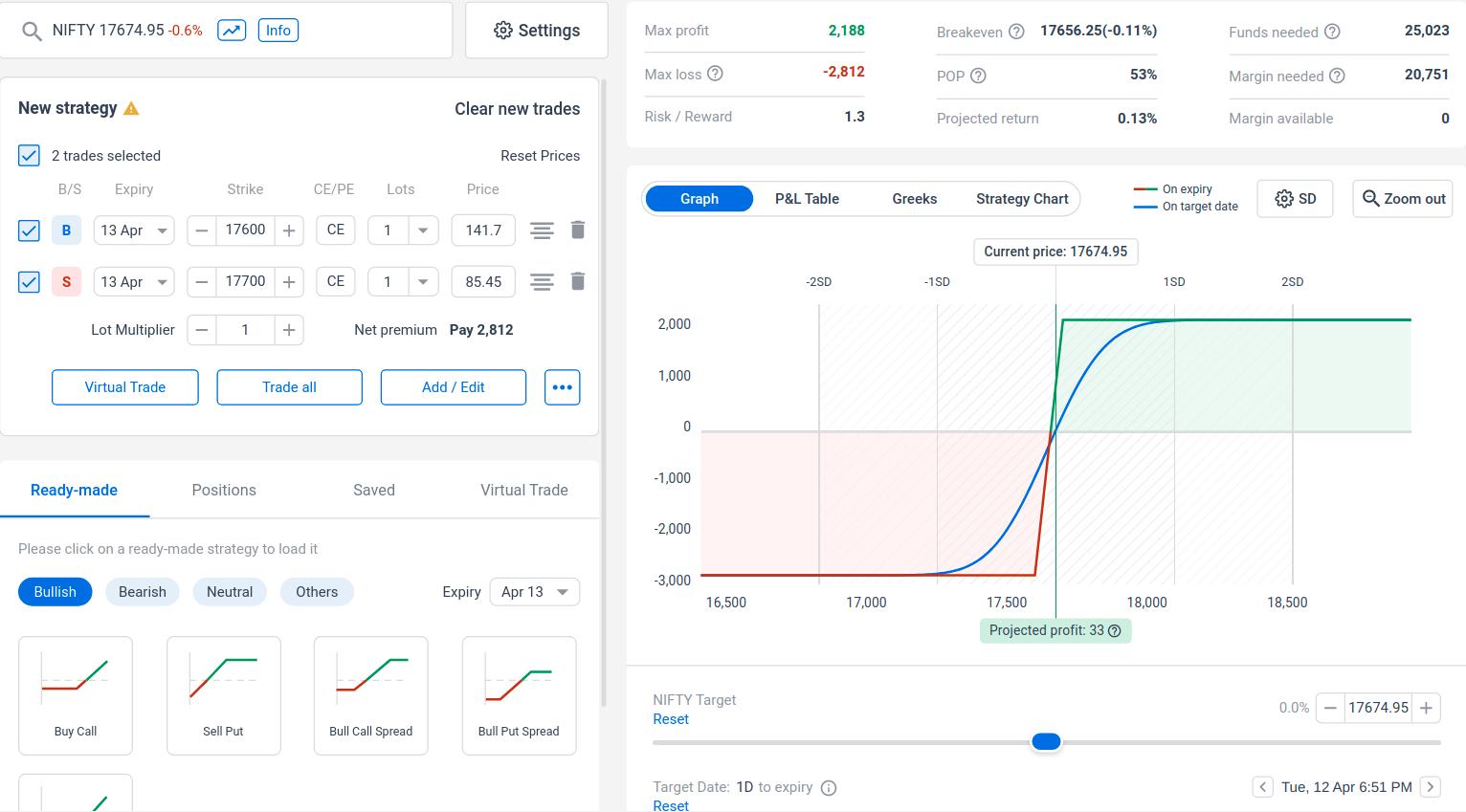

Image: derivbinary.com

Data on trading platforms can be categorized into two main types: real-time data and historical data. Real-time data provides up-to-the-minute market movements, including price quotes, order book updates, and news headlines. This data is essential for making quick trading decisions, as it allows traders to react to market events in real-time.

Historical Data

Historical data offers a different perspective by providing a record of past market behavior. This data includes historical price charts, volume data, and economic indicators. Historical data analysis can help traders identify trading patterns, retracement levels, and support and resistance points. By understanding how the market has behaved in the past, traders can make more informed decisions about future price movements.

Benefits of Historical Data

- Identify Trends and Patterns: Historical data allows traders to identify recurring patterns and trends in the market.

- Determine Support and Resistance Levels: Traders can analyze historical price levels to locate key areas of support and resistance where prices tend to bounce off.

- Test Trading Strategies: Historical data can be used to backtest and refine trading strategies to optimize their performance before implementing them in live trading.

- Gain Market Insights: By analyzing historical data, traders can develop a deeper understanding of market behavior and identify opportunities with increased confidence.

Tips and Expert Advice for Choosing Data Options

Choosing the right trading platform data options can greatly impact your trading performance. Here are some tips to help you make the best decision:

- Identify Your Trading Style: Consider your trading style and the data that is most relevant to your approach. For example, day traders require real-time data, while swing traders may benefit more from historical data.

- Evaluate Data Accuracy: Ensure the trading platform you choose provides accurate and reliable data from reputable sources.

- Consider Data Latency: Real-time data should have minimal latency to ensure you’re receiving the latest market information instantly.

- Explore Historical Data Options: Check the availability and depth of historical data offered, considering the time periods and instruments that align with your trading strategies.

- Test and Compare: Trial different trading platforms and their data options to determine which one best meets your specific needs and preferences.

Remember, trading platform data options are a powerful tool that can enhance your trading decision-making. By understanding the different types of data available and choosing the options that align with your trading strategy, you can increase your chances of success in the competitive world of trading.

Image: stewdiostix.blogspot.com

Trading Platform Data Options

Image: kongashare.com

Frequently Asked Questions

Q: What is the difference between real-time and historical data?

A: Real-time data provides up-to-the-minute market information, while historical data records past market behavior.

Q: What are some benefits of using historical data?

A: Historical data allows traders to identify trends and patterns, determine support and resistance levels, test trading strategies, and gain market insights.

Q: How do I choose the right trading platform data options?

A: Consider your trading style, evaluate data accuracy, check latency, explore historical data options, and test and compare different platforms.

If you’re ready to delve into the world of trading platform data options, remember that knowledge is power. By understanding the different types of data available and making informed choices, you can unlock the potential to optimize your trading performance and achieve your financial goals.