Imagine this: you’ve carefully invested in a stock, convinced it’s poised for a meteoric rise. But as the market turns volatile, your stock plummets, leaving you with a gaping hole in your portfolio. This is the nightmare scenario every investor dreads. However, there’s a powerful tool in the financial world that can act as a safety net against such market downturns: put options.

Image: www.onlinefinancialmarkets.com

Put options, while often shrouded in mystery, are a fascinating and potentially lucrative strategy for both seasoned traders and those new to the world of options trading. They represent a right, but not an obligation, to sell a specific asset (like a stock) at a predetermined price within a specified time frame. This means you can essentially lock in a minimum price for your investment, mitigating the risk of significant losses during market dips.

Diving Deep into the World of Put Options

Let’s start with a little history. Put options, like their companion, call options, have been around since the 17th century. They were initially used by merchants in Amsterdam to manage the price risk of goods like tulip bulbs, a testament to the enduring appeal of risk management strategies throughout history. Today, put options are traded on a vast array of assets, including stocks, indices, commodities, and even currencies, providing a flexible tool for managing risk across diverse market sectors.

Understanding the Basics

At their core, put options are contracts that grant the buyer (the holder) the right to sell a specific asset at a predetermined price (the strike price) before the contract expires. The seller (the writer) is obligated to purchase the asset at that strike price if the option holder chooses to exercise their right. Now, you might be wondering, “Why would anyone want to buy the right to sell an asset?” The answer lies in the potential to profit from a decline in the asset’s price.

Imagine you own 100 shares of a company you believe will experience a short-term dip. You’re concerned about the potential loss, but you don’t want to sell your shares outright. Purchasing a put option gives you the right to sell those shares at a predetermined price, even if the market price drops below that level. If the stock price does decline, you can exercise your option, selling your shares at the higher strike price and offsetting your losses.

Real-World Applications: Putting Put Options to Work

The applications of put options are wide-ranging, catering to a variety of investment goals. Here are some common scenarios where these options can be invaluable:

-

Hedging Against Downside Risk: One of the most common uses of put options is to protect a portfolio against market downturns. Imagine you own shares of Company X and are bullish about its long-term prospects. However, you’re worried about a potential short-term market crash. Purchasing a put option on Company X provides a safety net, allowing you to sell your shares at a pre-determined price if the stock price plummets.

-

Generating Income: While typically used for risk management, put options can also be employed for income generation. By selling put options, you receive a premium upfront, hoping the stock price stays above the strike price and the option expires worthless. This strategy works well when you believe the underlying asset’s price will remain relatively stable or even increase.

-

Speculating on Market Volatility: If you believe a particular stock or index is likely to experience significant price swings, put options can provide a powerful tool for speculating on that volatility. By purchasing put options, you are essentially betting on the asset’s price to decline. This strategy might not be suitable for everyone, given its speculative nature, but it can potentially offer substantial returns for those with a keen understanding of market volatility.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

Expert Insights and Actionable Tips

While put options can provide significant benefits, it’s crucial to approach them with a well-informed strategy. Here are some insights from experienced traders to help you navigate the intricacies of put option trading:

-

Understand the Underlying Asset: Before buying or selling put options, thoroughly research the underlying asset. A deep understanding of the company’s financials, industry trends, and competitive landscape can significantly impact your trading decisions.

-

Choose the Right Strike Price and Expiration Date: The strike price and expiry date are crucial determinants of your potential profit or loss. Researching market trends and volatility can help you select the appropriate combination of these factors.

-

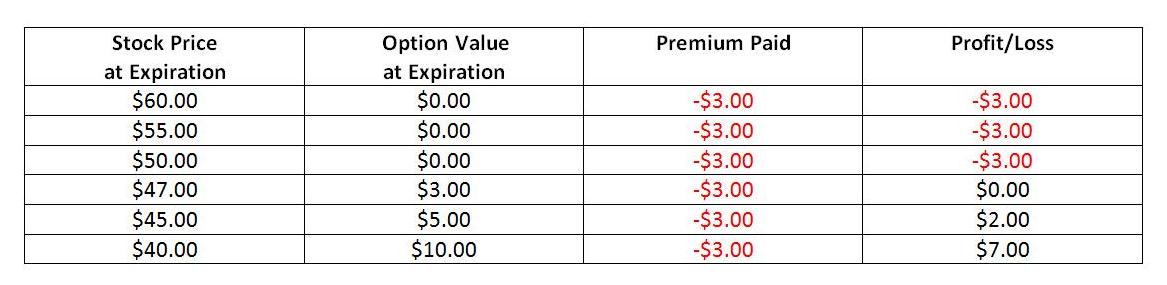

Mind the Premium: When buying a put option, you pay a premium upfront. This premium is the cost of purchasing the right to sell the underlying asset at a specific price. Consider the premium’s impact on your overall profit potential.

-

Manage Risk: Put options are leveraged investments, meaning a small price movement in the underlying asset can lead to significant gains or losses. Manage your risk by establishing clear stop-loss orders and diversifying your portfolio.

Put Option Trading

A New Era of Risk Management: Embracing the Power of Put Options

Put options present a unique opportunity for investors to navigate the complexities of the market with confidence. They offer a powerful tool to protect against downside risk, generate income, and even speculate on market volatility. Armed with a clear understanding of their fundamentals and a well-thought-out strategy, investors can leverage put options to enhance their portfolio’s resilience and potentially unlock significant returns.

As the financial world evolves, put options are likely to play an even more vital role in shaping investment strategies. By embracing these versatile instruments, investors can navigate market uncertainties with increased clarity and potentially unlock a new era of risk management.

Ready to explore the world of put options? Share your thoughts and experiences in the comments below or visit reputable resources like Investopedia and Option Strategies for further insights.