In the ever-evolving financial world, the advent of options has opened up a gateway to advanced investment strategies. Among them, covered calls stand tall as a versatile technique that leverages existing stock holdings to generate potential income and manage risk. Delve into the intricacies of covered calls in this comprehensive guide, meticulously crafted to empower you with knowledge and inspire you to navigate this exciting realm of option trading.

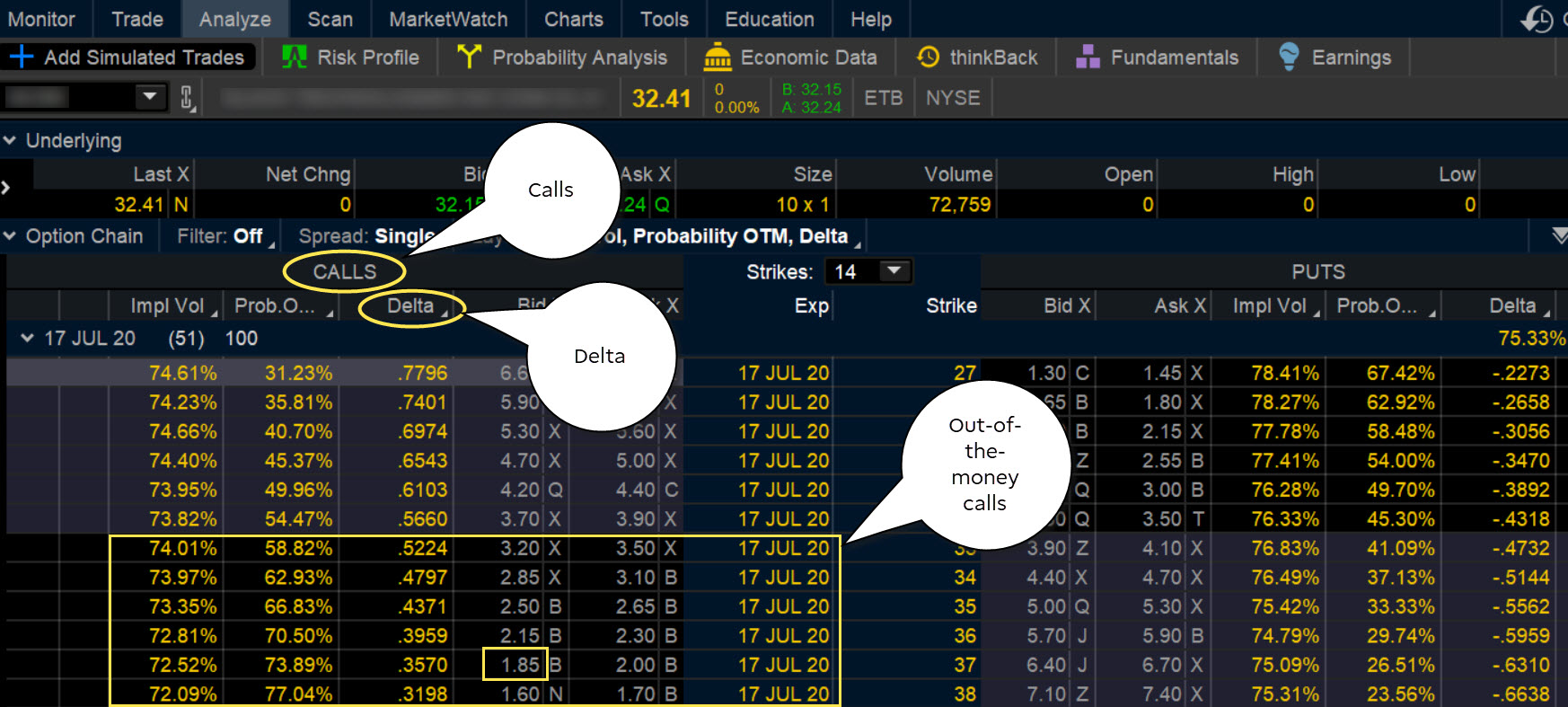

Image: tickertape.tdameritrade.com

Covered Calls: A Strategic Balance of Income and Risk Management

Imagine a scenario where you possess a stock that you believe has the potential to appreciate in the future. However, the market is somewhat unpredictable, and you wish to safeguard your investment while still capitalizing on the stock’s potential growth. Enter covered calls, an ingenious strategy that strikes a balance between income generation and risk management. Covered calls allow you to sell (or “write”) call options against your existing stock holdings, enabling you to collect an upfront premium in exchange for granting someone else the right—but not the obligation—to buy your shares at a predetermined strike price by a specific date.

By engaging in a covered call, you effectively “cover” your stock position, reducing your exposure to potential downside risk should the stock price decline. Simultaneously, you gain the opportunity to earn additional income through the premium received from selling the call option. However, it’s crucial to remember that if the stock’s price rises above the strike price, you may be obligated to sell your shares at that predetermined price, potentially limiting your potential profits. Nonetheless, covered calls provide a strategic means to enhance your portfolio’s return potential while managing risk.

Navigating the Mechanisms of Covered Calls

Comprehending the mechanics of covered calls is paramount to harnessing their full potential. Let’s delve into the key components involved:

-

Underlying Stock: The stock you currently own and against which you will sell the call option.

-

Call Option: A contract that conveys the buyer the right—but not the obligation—to purchase a specific number of shares of your underlying stock at a predetermined strike price before a certain expiration date.

-

Strike Price: The price at which the buyer of the call option can acquire your shares if they choose to exercise the option.

-

Expiration Date: The date by which the call option must be exercised or it expires worthless.

-

Premium: The upfront payment you receive for selling the call option, representing the premium paid by the buyer for the right to potentially purchase your shares.

Unveiling the Advantages of Covered Calls

-

Income Generation: Covered calls provide an opportunity to generate additional income through the premium received from selling the call option, potentially enhancing your overall portfolio returns.

-

Risk Management: By covering your stock position with a call option, you effectively limit your downside risk in the event of a stock price decline.

-

Flexibility: Covered calls offer flexibility in tailoring your investment strategy. You can adjust the strike price and expiration date of the call option to suit your risk tolerance and profit objectives.

Image: www.pinterest.com

Expert Insights and Practical Tips for Success

-

Select the Right Underlying Stock: Choose stocks with a solid track record, good liquidity, and growth potential for optimal returns.

-

Determine an Appropriate Strike Price: Set a strike price that balances profit potential with downside protection, considering the stock’s current price and volatility.

-

Monitor Market Conditions: Stay attuned to market news and economic events that could impact the underlying stock’s price and adjust your strategy accordingly.

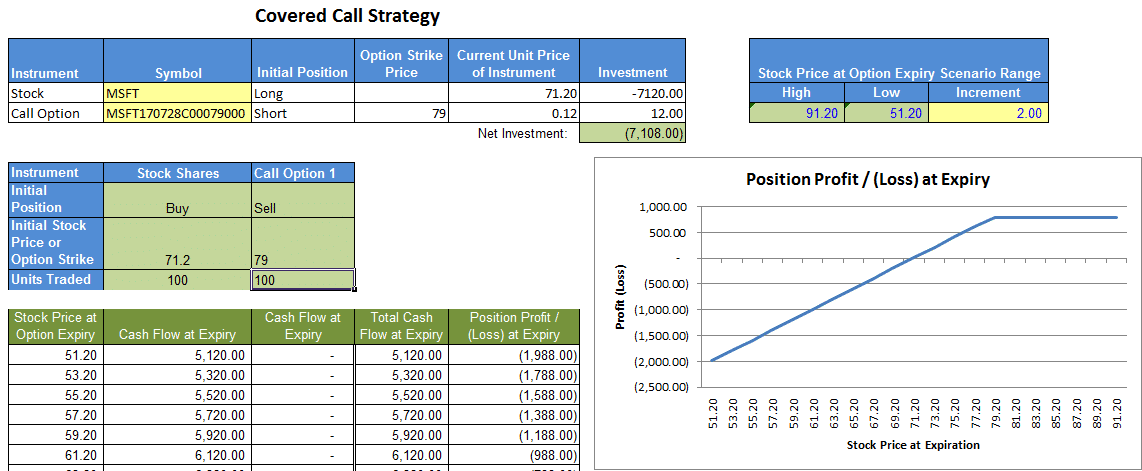

Option Trading Covered Calls

Image: marketxls.com

Conclusion: Embracing the Power of Covered Calls

Covered calls are a valuable tool in the arsenal of savvy investors, enabling them to generate income, manage risk, and potentially enhance their overall portfolio returns. Embracing this strategy empowers you to navigate the complexities of the stock market, unlocking new avenues for financial success. Whether you’re a seasoned pro or just starting your investment journey, covered calls offer a compelling path to explore, adding a layer of sophistication to your investment endeavors.