In the realm of finance, I’ve witnessed firsthand the thrill and intrigue of stock option trading. As a financial professional, I’ve navigated the intricate world of options, deciphering their complex mechanics to harness their potential. In this article, I’ll unravel the mechanics of stock option trading, providing you with a comprehensive guide to this exhilarating and rewarding aspect of the financial markets.

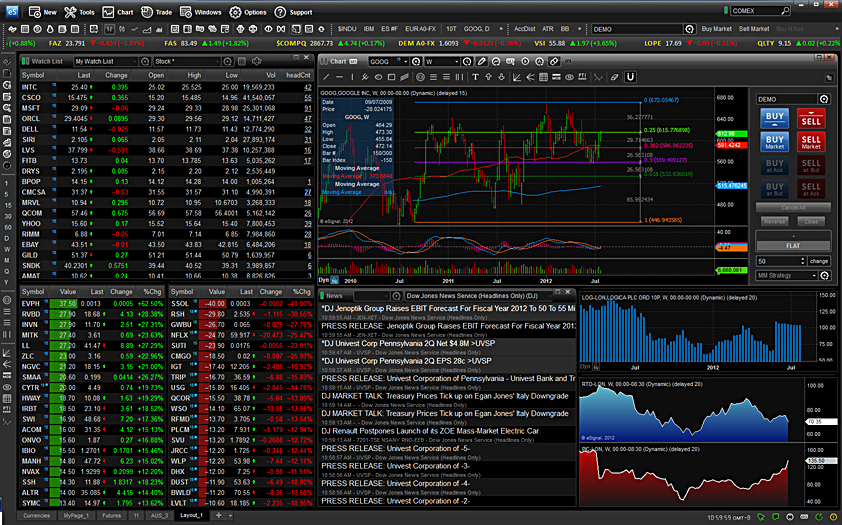

Image: www.fool.com

Options, as financial instruments, confer the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) by a specified date (expiration date). They serve as contracts between two parties, with the buyer acquiring the right from the seller to exercise the option at their discretion.

Understanding Different Options

Call Options

Call options convey the right to buy an asset at the strike price. They’re often employed when traders anticipate an upward price movement in the underlying asset, enabling them to acquire the asset at a potentially favorable price.

Put Options

Put options, on the other hand, offer the right to sell an asset at the strike price. They’re typically utilized when traders expect a decline in the underlying asset’s value, allowing them to dispose of the asset at a predetermined price before it depreciates further.

Image: www.samco.in

Key Features of Options

Options trading operates on several fundamental principles:

- Premium: The premium is the price paid by the option buyer to the seller granting the option contract. It represents the value of the right to exercise the option.

- Expiration Date: Options have a limited lifespan, expiring on a predetermined date. Exercising the option becomes void after that date.

- Strike Price: The strike price is the agreed-upon price at which the underlying asset can be bought (call option) or sold (put option) upon exercising the option.

Determining Option Value

Various factors influence the value of an option contract:

- Underlying Asset Price: The value of the option contract is directly linked to the price of the underlying asset. Call option values rise with an increase in the asset’s price, while put option values increase as the asset’s price falls.

- Time to Expiration: The time remaining until the option’s expiration date impacts its value. As the expiration date approaches, the option’s value decays due to reduced time value.

- Volatility: Market volatility plays a crucial role in option pricing. Increased volatility typically leads to higher option premiums as investors anticipate more price fluctuations.

Strategies and Tactics

Options trading involves adopting various strategies based on market conditions and trader objectives. Some popular strategies include:

- Covered Call: A covered call involves selling a call option while simultaneously owning the underlying asset. The strategy aims to generate premium income while maintaining potential exposure to upside price movements.

- Protective Put: A protective put is designed to hedge against potential losses in the underlying asset. It involves buying a put option to establish a downside price protection.

FAQs on Stock Option Trading

Can options be used for hedging?

Yes, options can be utilized as effective hedging instruments to mitigate potential losses in underlying asset investments.

What is the maximum profit potential of an option?

For call options, the maximum profit potential is the difference between the underlying asset price and the strike price minus the premium paid. For put options, the maximum profit potential is the difference between the strike price and the underlying asset price minus the premium paid.

Can options expire worthless?

Yes, options can expire worthless if the underlying asset price does not reach a level that allows the option to be profitably exercised.

Mechanics Of Stock Option Trading

Image: niyudideh.web.fc2.com

Conclusion

Stock option trading presents a captivating opportunity to leverage market movements and enhance the potential returns on financial investments. By understanding the mechanics of options, investors can unlock this powerful tool to navigate the complexities of global financial markets. Embracing this knowledge and incorporating it into trading strategies can empower investors to make informed decisions and achieve financial success.

Are you intrigued by the mechanics of stock option trading and eager to delve deeper into its fascinating intricacies? Share your thoughts, questions, and experiences in the comments section below. Your insights contribute to a vibrant financial community where knowledge and wisdom are shared for the benefit of all.