Introduction

Option trading, a sophisticated realm of financial markets, holds immense potential for seasoned investors. Yet, it often conjures a veil of uncertainty and myriad unanswered questions. This article embarks on a comprehensive journey to unravel the enigmatic nature of option trading, answering your most pressing queries with unparalleled clarity and depth.

Image: www.pinterest.com

Deciphering Option Trading: A Foundation

Options, as financial instruments, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This unique characteristic empowers traders with flexibility and the ability to speculate on future asset prices.

Demystifying Key Concepts

-

Option Premium: The price paid to acquire an option contract. It represents the value of the rights granted by the option.

-

In the Money: When an option’s strike price is more favorable than the current market price of the underlying asset (for call options) or less favorable (for put options).

-

Out of the Money: When an option’s strike price is less favorable than the current market price of the underlying asset (for call options) or more favorable (for put options).

-

Intrinsic Value: The difference between the current market price of the underlying asset and the strike price for an option that is in the money.

-

Time Value: The portion of the option premium that represents the time remaining until the expiration date.

Unveiling the Mechanics of Option Trading

-

Option Chain: A display of all available option contracts for a specific underlying asset, including their strike prices, expiration dates, and premiums.

-

Buying Options: Acquiring the right to buy or sell the underlying asset at a specific price. A buyer pays the option premium to the option seller.

-

Selling Options: Granting the right to another party to buy or sell the underlying asset at a specific price. A seller receives the option premium from the option buyer.

-

Exercise: When an option holder decides to exercise their right to buy or sell the underlying asset at the strike price before the expiration date.

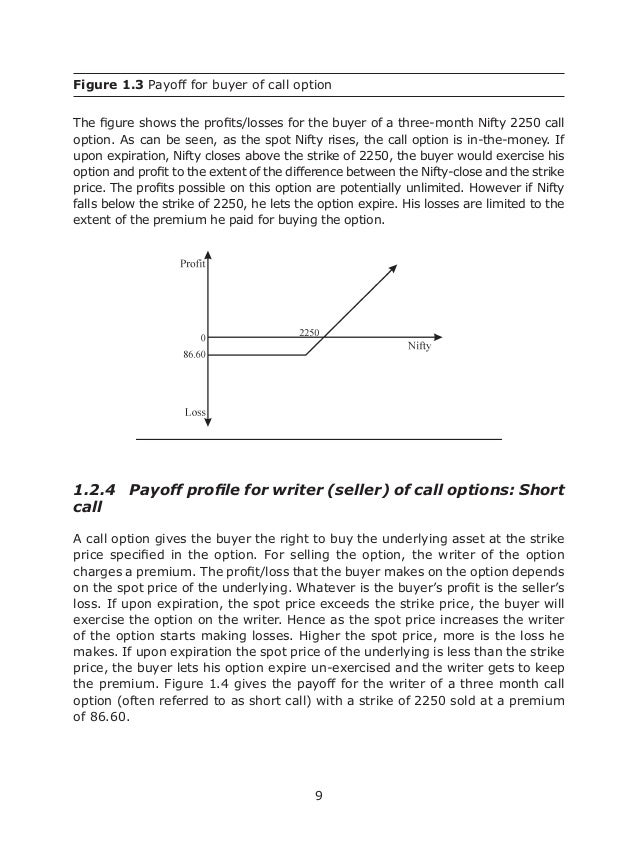

Image: www.slideshare.net

Decoding the Factors Affecting Option Prices

-

Underlying Asset Price: A fundamental factor that directly influences option prices.

-

Time to Expiration: The remaining time until the option’s expiration date, which affects the time value of the option.

-

Volatility: The expected fluctuation in the underlying asset’s price, which impacts the option premium.

-

Interest Rates: Interest rates can affect the time value of options, as they influence the cost of carrying an option position.

Unveiling Option Strategies: A Tactical Guide

-

Covered Call: Selling a call option against an underlying asset that you already own.

-

Protective Put: Buying a put option to protect against potential losses in the underlying asset.

-

Bull Call Spread: Buying a call option with a lower strike price and selling a call option with a higher strike price.

-

Bear Put Spread: Selling a put option with a lower strike price and buying a put option with a higher strike price.

Harnessing the Wisdom of Experts

-

“Options are not for the faint of heart or those looking to get rich quick. They are complex instruments that require a thorough understanding of the risks involved.” – Warren Buffett, renowned investor

-

“Options can be a powerful tool for managing risk and potentially generating income, but they should only be used by experienced traders who fully comprehend the mechanics and risks involved.” – Mark Mobius, renowned emerging markets investor

Option Trading Questions

Conclusion

Option trading, a captivating yet intricate realm, unlocks a world of opportunities for discerning investors. By demystifying key concepts, exploring the mechanics, and uncovering actionable strategies, this guide serves as an invaluable roadmap for those seeking to navigate the labyrinth of option markets. Remember to approach option trading with a balanced perspective, meticulously evaluating both its potential rewards and risks. Embrace the wisdom of experts and seek guidance when necessary, embarking on this journey with informed confidence.