Introduction

In the treacherous realm of financial markets, option trading presents a labyrinth of possibilities and pitfalls. Among the myriad strategies employed by traders, call and put options stand out as versatile tools for navigating the turbulent waters of uncertainty. In this comprehensive guide, we will unravel the complexities of call put option trading, empowering you with the knowledge to harness their potential and navigate the financial landscape with confidence.

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Image: keysgame.pl

Options, in essence, bestow upon the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price on or before a specific date. Armed with this knowledge, let us delve into the intricacies of call put option trading.

Understanding Call and Put Options

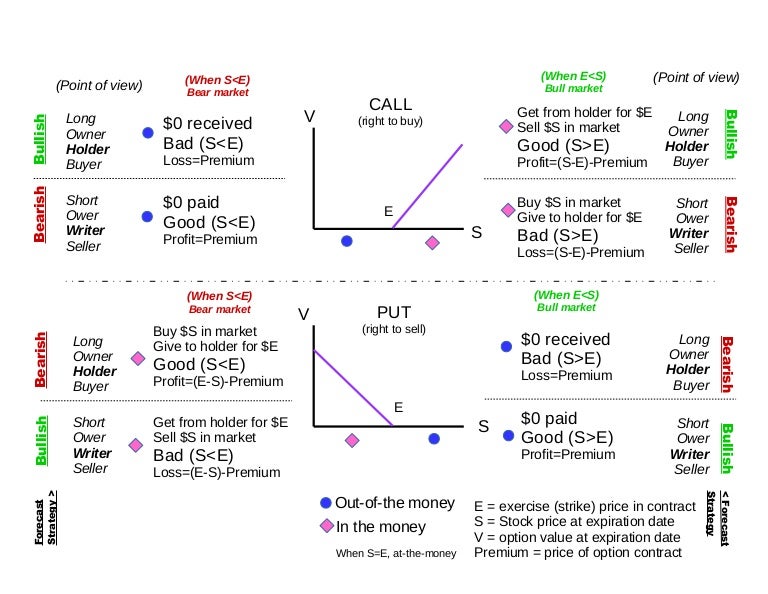

Call Options: These options grant the holder the right to purchase the underlying asset at a specified price, known as the strike price, on or before the expiration date. If the market price of the asset rises above the strike price, the call option becomes profitable, providing the holder with the potential to generate a return. However, if the price remains below the strike price, the option expires worthless, resulting in a loss for the trader.

Put Options: Conversely, put options confer the right to sell the underlying asset at the strike price on or before the expiration date. Should the market price of the asset fall below the strike price, the put option becomes valuable, allowing the holder to profit from the decline. Conversely, if the price increases, the option expires worthless, resulting in a loss for the holder.

The Mechanics of Call Put Option Trading

To trade call or put options, you must first establish a position with an options broker. Once your account is set up, you can begin assessing potential trading opportunities. Key factors to consider include:

- Underlying Asset: The asset being traded, such as a stock, commodity, or index.

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date on which the option expires.

- Option Price: The premium paid to acquire the option.

- Option Type: Call or put.

Once you have determined your desired position, you can place an order with your broker, specifying the number of contracts (each contract represents 100 shares of the underlying asset) and the type of option you wish to purchase or sell.

Trends and Developments in Call Put Option Trading

Rise of Exchange-Traded Options: In recent years, exchange-traded options have gained immense popularity. These options are standardized contracts traded on regulated exchanges, offering greater transparency and liquidity.

Technological Advancements: The advent of online trading platforms and mobile apps has revolutionized option trading, making it more accessible and convenient for retail investors.

Image: www.slideshare.net

Tips and Expert Advice

Manage Your Risk: Option trading can be a risky endeavor. It is crucial to establish a sound risk management strategy, including understanding the potential losses and setting appropriate stop-loss levels.

Understand the Underlying Asset: Thoroughly research the asset underlying your option trades. A clear understanding of its historical performance, market conditions, and potential price drivers will enhance your decision-making.

Frequently Asked Questions

-

Q: What is the difference between a call and a put option?

A: Call options give the holder the right to buy, while put options give the holder the right to sell the underlying asset.

-

Q: What is a strike price?

A: The price at which the option can be exercised.

-

Q: What is the expiration date?

A: The date on which the option expires and becomes worthless.

What Is Call Put Option Trading

Conclusion

Call put option trading offers a powerful set of tools for investors seeking diversification, hedging, or speculative opportunities. By comprehending the mechanics, strategies, and risks involved, you can harness the potential of options to navigate the financial markets with greater confidence. Remember, while this article provides a comprehensive overview, it is essential to conduct thorough research and consider professional advice before making any trading decisions.

Are you ready to embark on the journey of call put option trading? Share your thoughts and experiences in the comments below.