In the realm of financial markets, where the ebb and flow of asset values dance to the intricate melodies of supply and demand, options trading stands as a sophisticated symphony, potentially unlocking limitless opportunities for astute investors. This article embarks on a journey to unravel the intricacies of options trading, mapping the landscape of seminars worldwide and empowering you with the knowledge to navigate this multifaceted investment strategy.

Image: tradingview.com.vn

Delving into the Essence of Options Trading

Options, financial instruments with a rich history dating back centuries, empower traders to speculate on the future direction of underlying assets, ranging from stocks and indices to currencies and commodities. These versatile contracts grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility empowers investors to hedge existing positions, speculate on market movements, and generate income.

Navigating the Global Tapestry of Options Trading Seminars

A wealth of options trading seminars dot the international landscape, offering a gateway to unravel the complexities of this investment strategy. These seminars cater to diverse levels of experience, from budding enthusiasts seeking foundational knowledge to seasoned traders seeking advanced techniques.

In the vibrant metropolis of New York, the Academy of Options Trading hosts a comprehensive Bootcamp, delving into the mechanics of options, risk management, and trading strategies. Participants emerge equipped to confidently navigate the intricate world of options trading.

London, a global financial hub, plays host to the Options Workshop, a renowned seminar series led by industry experts. This immersive program combines theoretical insights with practical exercises, empowering attendees to develop a deep understanding of options strategies and their application in real-world markets.

Venturing into the heart of Asia, Tokyo’s Option Institute beckons with an array of seminars tailored to the unique dynamics of Japanese markets. Seasoned professionals guide participants through the intricacies of options pricing, volatility analysis, and the art of constructing optimal trading strategies.

Unveiling the Secrets of Options Trading: Expert Insights and Actionable Tips

The world of options trading, while alluring, demands a keen understanding of its inherent complexities. Seasoned experts offer valuable insights to help you navigate this intricate landscape:

“Options are not a get-rich-quick scheme. They require a methodical approach, a deep understanding of market dynamics, and disciplined risk management,” cautions John Carter, a renowned options trading strategist.

“Embrace the power of technical analysis,” advises Anna Coulling, a veteran options trader. “Chart patterns, moving averages, and technical indicators can provide invaluable insights into price trends and potential trading opportunities.”

These words of wisdom echo the importance of a comprehensive trading plan, rigorous risk management, and a thorough analysis of market conditions.

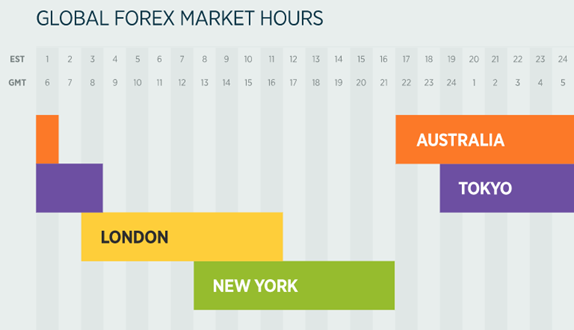

Image: www.sohomarkets.eu

Option Trading Seminars Worldwide

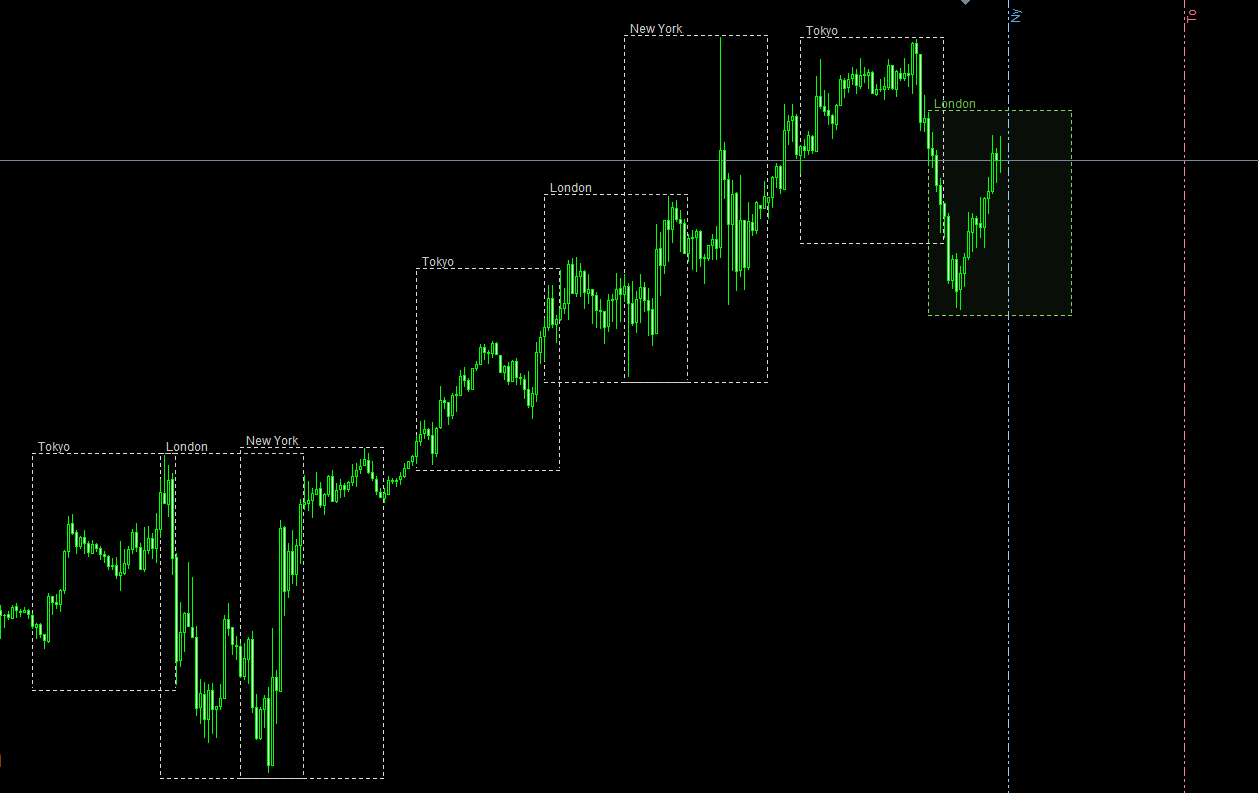

Image: dadforex.com

Empowering Investors: Harnessing the Knowledge for Success

Options trading, with its inherent complexities and potential rewards, is a discipline that requires a commitment to learning and continuous improvement. Embrace the opportunity to deepen your understanding through seminars and workshops, augment your knowledge with rigorous self-study, and seek guidance from experienced mentors.

Remember, the path to options trading mastery is not without its challenges. Exercise patience, stay disciplined, and manage your risks prudently. As you embark on this journey, you will unlock the potential to elevate your financial acumen and harness the power of this versatile investment strategy.