Introduction

As the turbulent stock market landscape continues to unfold, understanding the complexities of options trading becomes paramount. The Volatility Index, commonly referred to as the VIX, has emerged as a beacon of insight for discerning traders seeking to navigate this dynamic terrain.

Image: www.projectfinance.com

Imagine a rollercoaster ride where every twist and turn represents market volatility. The VIX is akin to the control panel, providing real-time readings of the market’s pulse, enabling traders to make informed decisions amidst the inevitable ups and downs.

Exploring the VIX

Definition

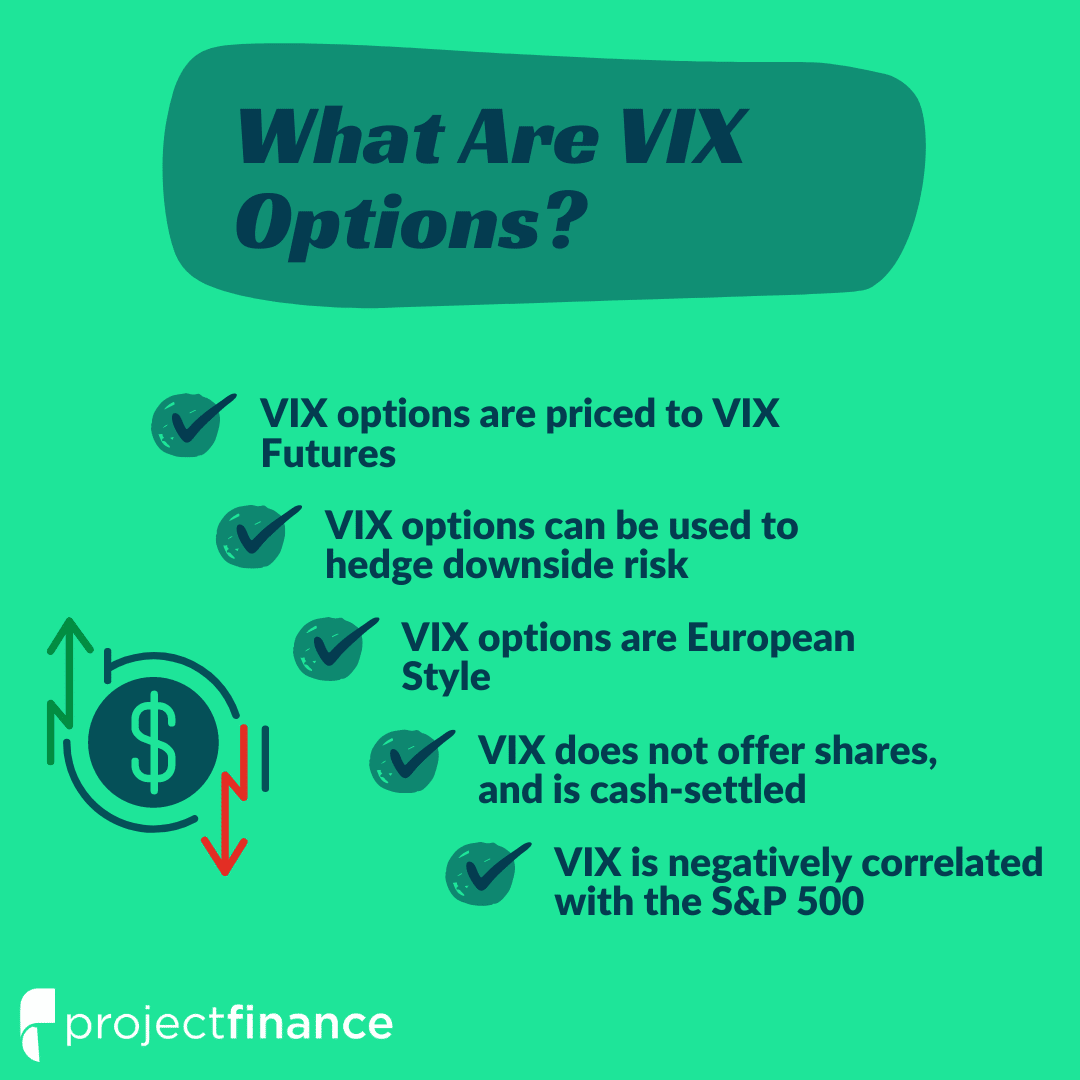

The VIX is a measure of implied volatility derived from the prices of S&P 500 index options. It quantifies the market’s perception of future price swings based on the premiums traders are willing to pay for these options.

Presented as an annualized percentage, the VIX provides a snapshot of the consensus view on the degree of price fluctuations in the next 30 days. Higher values indicate expectations of higher volatility, while lower values suggest traders are anticipating a more tranquil market.

Interpreting the VIX

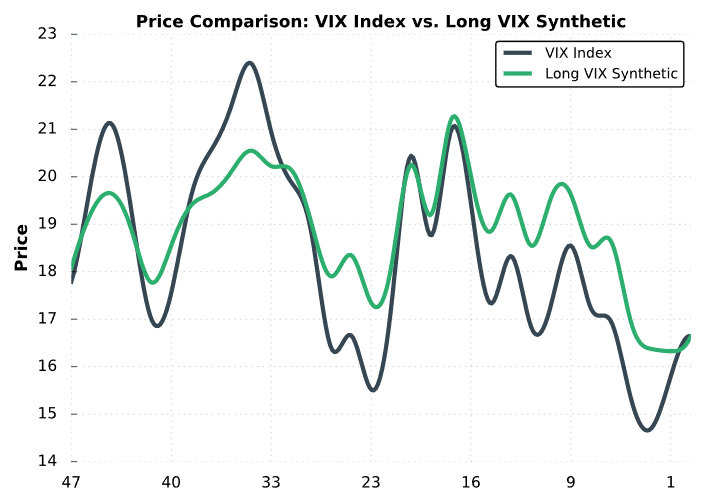

The VIX plays a pivotal role in options trading, as it gauges the market’s sentiments towards risk and uncertainty. When the VIX is high, it signals increased fear and caution among traders, who expect significant market swings. Conversely, a low VIX reflects complacency and a belief in stability.

Traders can harness the VIX to gain an edge in their options strategies. If the VIX is high, they may consider purchasing volatility-linked options, betting on continued market turbulence. Conversely, when the VIX is low, selling options with a volatility premium can yield potential gains.

Image: www.projectfinance.com

Expert Insights

Strategy and Profitability

Mastering the nuances of the VIX requires a deep understanding of options trading. Expert advice can prove invaluable in refining strategies and maximizing profitability.

One key aspect to consider is the relationship between the VIX and historical volatility. By comparing the VIX to the actual volatility realized over time, traders can identify potential trading opportunities. When the VIX is significantly higher than historical volatility, it may indicate an overestimation of market uncertainty, presenting an opportunity to sell volatility.

FAQ

- Q: What is the VIX based on?

- A: The VIX is calculated using the prices of S&P 500 index options.

- Q: How can the VIX help me in options trading?

- A: The VIX provides insight into the market’s perceived volatility, enabling traders to make informed decisions when buying or selling options.

- Q: What should I consider when trading using the VIX?

- A: Understanding the relationship between the VIX and historical volatility is essential for devising sound trading strategies.

How To Use The Vix For Trading Options

Image: www.youtube.com

Conclusion

The VIX stands as an indispensable tool for options traders seeking to decipher market volatility and navigate the ever-evolving financial landscape.

Whether you are seasoned in the world of options trading or just beginning to explore its depths, the VIX offers a window into the market’s collective consciousness. By understanding its nuances and leveraging expert advice, you can empower yourself with strategies that will carry you through both tumultuous and serene market conditions.

Are you ready to harness the power of the VIX in your options trading? Dive into the world of risk and reward, and discover the insights that will lead you to trading success with the VIX as your guiding light.