The allure of potentially lucrative returns has made options trading a popular investment strategy, but it’s crucial to approach it with a well-informed and measured approach. One strategy that has gained traction among options traders is the broken butterfly spread, a complex vertical spread that offers both profit and loss potential. Understanding how much to risk on this strategy is essential for effective trading. This comprehensive guide will provide insights into the broken butterfly spread, risk management techniques, and strategies to help you determine an optimal risk level for your trades.

Image: datadrivenoptions.com

Understanding the Broken Butterfly Spread

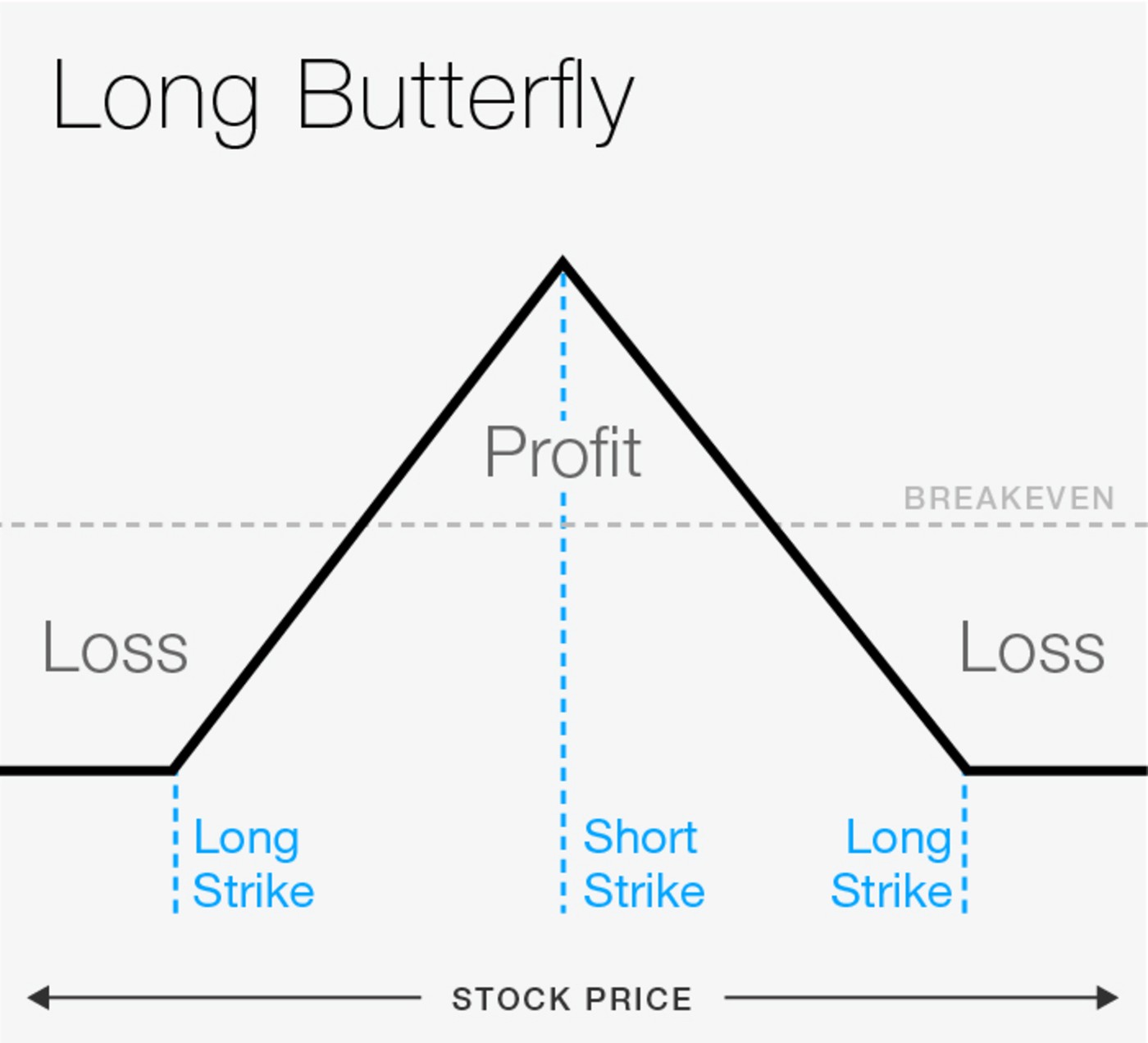

A broken butterfly spread is a neutral to bullish options trading strategy that involves buying two same-strike call options, selling one call option with a lower strike price, and selling one call option with a higher strike price. The trader expects the underlying asset’s price to move within a specific range. If the price remains within this range, the trader can potentially profit from the difference in premiums paid and received.

The broken butterfly spread has a defined risk profile. The maximum loss is limited to the net premium paid, which is the difference between the premiums received for selling the call options and the premiums paid for purchasing the call options. The maximum profit is also limited and is determined by the difference between the strike prices of the purchased and sold call options.

Risk Management Techniques

Managing risk is paramount in options trading. Here are a few crucial techniques to consider when trading broken butterfly spreads:

- Margin Requirements: Determine the margin requirement for the trade and ensure you have sufficient funds available in your brokerage account.

- Position Sizing: Calculate the potential loss and adjust your position size accordingly to align with your risk tolerance.

- Technical Analysis: Use technical analysis tools to assess the underlying asset’s price movement and identify potential trading opportunities within a defined range.

- Stop-Loss Orders: Implement stop-loss orders to mitigate losses if the underlying asset’s price moves outside the anticipated range.

Strategies for Determining Risk Tolerance

Determining your risk tolerance is a personal decision that should be based on factors such as investment goals, financial situation, and trading experience. Here are some strategies to help you assess your risk tolerance:

- Self-Assessment: Reflect on how you react to market fluctuations and losses. Are you comfortable with potential drawdowns, or do you become overly anxious?

- Risk Tolerance Questionnaire: Consult with your financial advisor or use online risk tolerance calculators to determine your risk tolerance based on a series of questions.

- Stress Test: Simulate market conditions and observe how your trading decisions would perform under different scenarios to test your emotional response.

Once you have determined your risk tolerance, you can allocate a specific percentage of your trading capital to broken butterfly spreads. It’s advisable to start with small positions and gradually increase them as you gain experience and confidence.

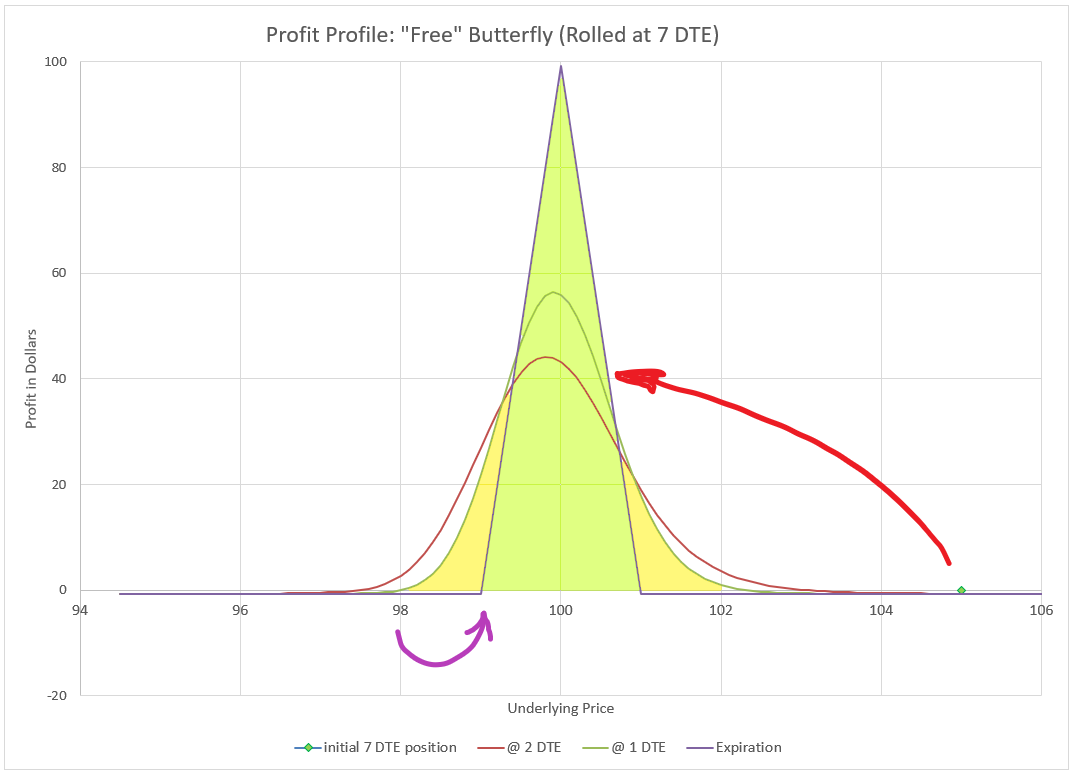

Image: insights.deribit.com

Additional Considerations

In addition to risk management techniques, here are a few other considerations when determining how much to risk on options trading broken butterfly:

- Market Volatility: High market volatility can increase the risk of the strategy. Consider adjusting your position size accordingly.

- Time Decay: Options have a limited lifespan, and time decay erodes their value. Account for this factor when determining your holding period.

- Margin Interest Expense: If you are trading on margin, monitor the interest expense, as it can add another cost to the trade.

How Much To Risk On Options Trading Broken Butterfly

Image: purrgramming.life

Conclusion

Trading broken butterfly spreads can be a potentially profitable strategy, but it’s essential to approach it with a well-defined risk management plan. Understanding how much to risk involves assessing your risk tolerance, employing risk management techniques, and considering market factors. Remember, there is no one-size-fits-all approach, and you should customize your risk level based on your individual circumstances and financial goals. By following the strategies outlined in this guide, you can enhance your chances of making informed decisions and mitigating potential losses in options trading broken butterfly.