In the ever-evolving world of finance, option trading has emerged as a powerful tool for investors seeking to enhance their returns. Among the diverse range of option strategies, the butterfly option stands out as an effective technique for navigating market volatility and maximizing potential profits.

Image: optionalpha.com

Unveiling the Butterfly Option

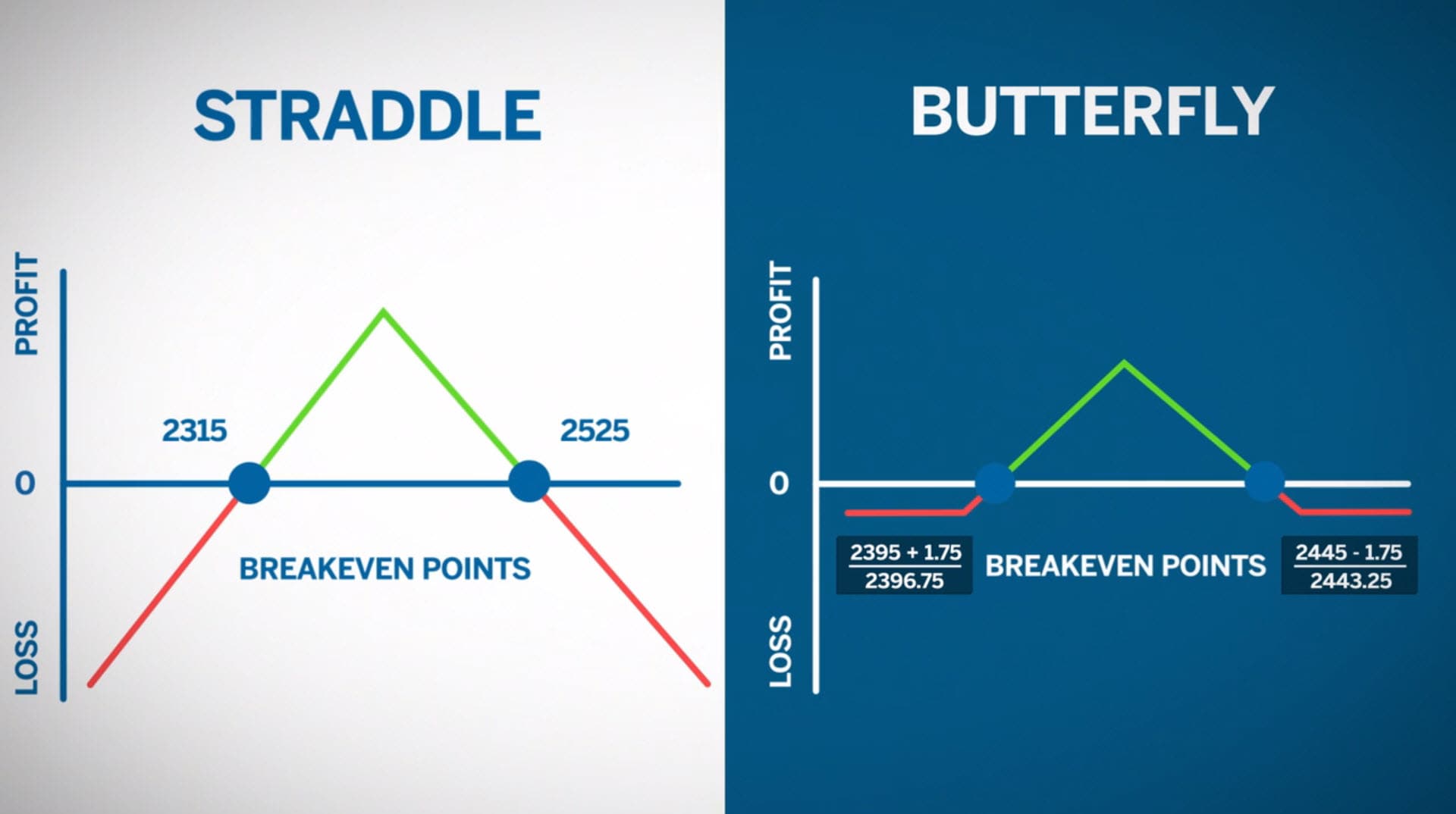

A butterfly option, also known as a butterfly spread, involves the simultaneous purchase and sale of three options with different strike prices. Typically, one option is purchased at a strike price below the current market price (the “put” option), while two options are sold at strike prices above the current market price (the “call” options). This combination creates a “butterfly” shape on the option chain.

The profit potential of a butterfly option resides in the difference between the premiums received from selling the call options and the premium paid for the put option. If the underlying asset’s price moves in the direction anticipated, the trader can potentially profit from the widening spread between the strike prices.

Navigating Market Volatility with Butterfly Options

The butterfly option excels in environments characterized by moderate market volatility. When the underlying asset’s price remains within a predictable range, the trader can capitalize on the time decay of the options premiums. Time decay erodes the value of options over time, and the butterfly option is strategically designed to benefit from this phenomenon.

Furthermore, since the butterfly option involves both buying and selling options, it offers a measure of protection against excessive market fluctuations. The call options sold at higher strike prices serve as a hedge against potential upward movement, while the put option purchased at a lower strike price provides protection against sharp declines.

Expert Insights and Actionable Tips

- Set Realistic Profit Targets: Avoid overestimating the potential profits from a butterfly option. Focus on achievable targets within the constraints of market volatility.

- Manage Risk Effectively: Employ a stop-loss order as a prudent risk management strategy to limit potential losses.

- Seek Professional Guidance: Consult with a financial advisor or a certified financial planner to tailor a butterfly option strategy to your specific investment goals and risk tolerance.

- Understand the Fees: Consider the transaction fees associated with butterfly options, as they can impact your overall profitability.

- Monitor Market Conditions: Stay vigilant in monitoring market conditions and make adjustments to the strategy as needed.

Conclusion: Harnessing the Power of Butterfly Options

By embracing the nuances of butterfly option trading, investors can unlock the power to harness market volatility and maximize potential returns. However, it is crucial to exercise caution, seek expert guidance, and meticulously manage risk. With a clear understanding of the strategy and its applications, butterfly options can serve as a valuable tool in the financial arsenal of any astute investor.

Image: www.cmegroup.com

Butterfly Option Trading

Image: futuresoptionsetc.com