In the realm of investing, options trading stands out as a powerful tool that can amplify gains or hedge risks. Yet, for many, the concept remains shrouded in mystery and complexity. This comprehensive guide will demystify options trading, providing you with a clear understanding of how it works, its potential benefits, and the strategies involved.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

Image: www.investopedia.com

What is Options Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). This flexibility gives traders the ability to speculate on future price movements without committing to an actual purchase or sale.

Call and Put Options

There are two primary types of options: call and put options. Call options give the buyer the right to buy the underlying asset, while put options grant the right to sell the asset. Whether you choose a call or put option depends on your market outlook. If you believe the price will rise, you would purchase a call option. If you anticipate a price decline, you would opt for a put option.

How Options Trading Works

Options represent a contract between two parties: the buyer (who pays a premium) and the seller (who receives the premium). The premium is essentially the price of the option, which varies depending on factors such as the strike price, expiration date, and volatility of the underlying asset.

- Buying an Option: When you purchase an option, you pay the premium and gain the right to buy or sell the asset at the specified price. As the buyer, you hope that the future price movement of the asset will be favorable, allowing you to exercise your option at a profit.

- Selling an Option: As a seller of an option, you receive the premium but have the obligation to fulfill the contract if the buyer chooses to exercise it. You typically hope that the underlying asset price will not move in the direction that would require you to buy or sell the asset at an unfavorable price.

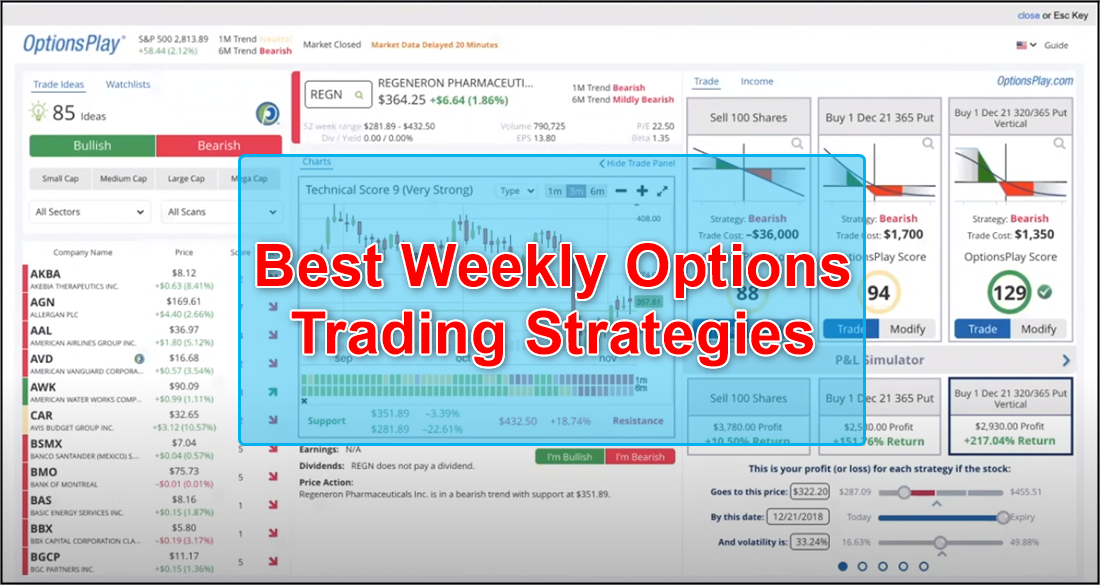

Image: stockscreenertips.com

Options Trading Strategies

Options trading offers a vast array of strategies that can be tailored to specific investment goals and risk appetites. These strategies range from simple speculative trades to complex hedging techniques. Here are some common options trading strategies:

- Long Call: Buying a call option with the expectation that the underlying asset will rise in value.

- Short Put: Selling a put option with the expectation that the asset price will not fall below the strike price.

- Bull Call Spread: Combining two call options with different strike prices and expiration dates to create a more defined risk-reward profile.

- Iron Condor: A non-directional strategy that includes buying a call and put option at one strike price and selling a call and put option at a higher strike price.

Benefits of Options Trading

Incorporating options trading into your investment portfolio offers numerous advantages, including:

- Leverage: Options provide leverage, allowing traders to magnify their gains with relatively less capital compared to purchasing the underlying asset outright.

- Risk Management: Options can be used to hedge against potential losses in other investments.

- Income Generation: Selling options can generate income, even if the underlying asset price does not move significantly.

- Flexibility: Options offer a wide range of strategies to adapt to different market conditions and investment goals.

Options Trading Works

Image: erainnovator.com

Conclusion

Options trading can be an effective way to enhance your investment returns and manage risk. However, it is a complex subject that requires a comprehensive understanding to navigate successfully. By thoroughly researching, practicing with simulated trades, and seeking guidance from experienced professionals, you can unlock the potential of options trading to achieve your financial objectives. Remember, responsible trading involves managing risk, understanding market dynamics, and being willing to learn and adapt. Embrace the power of options with caution and embark on a journey to elevate your investment strategies.