In the dynamic labyrinth of financial markets, options trading stands as a sophisticated strategy that empowers investors with the potential to amplify gains and manage risks. While shrouded in a veil of complexity for some, a thorough understanding of options trading can unlock a treasure trove of opportunities for savvy investors.

Image: www.youtube.com

So, what exactly are options? Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This distinct characteristic sets them apart from stocks or bonds and opens up a world of strategic possibilities for investors.

Types of Options

Options contracts exist in two primary flavors: calls and puts. Call options provide the buyer with the right to buy an underlying asset, while put options convey the right to sell an underlying asset. Additionally, options are classified as either American or European. American options can be exercised at any time up to their expiration date, whereas European options can only be exercised on their expiration date.

Mechanism of Options

To grasp the essence of options trading, let’s delve into the mechanics involved. When purchasing an option contract, the buyer pays a premium to the seller of the contract in exchange for the right, but not the obligation, to exercise the option. If the terms of the contract prove favorable to the buyer, they can exercise the option; otherwise, it expires worthless.

Advantages of Options Trading

The allure of options trading lies in its versatility and potential benefits for investors. Firstly, options offer leverage, providing the potential for amplified gains compared to investing directly in an underlying asset. Secondly, options can be employed as a hedging tool, allowing investors to mitigate potential losses by offsetting risks associated with other investments. Lastly, options offer flexibility, enabling investors to tailor strategies to their specific investment goals and risk tolerance.

Image: www.youtube.com

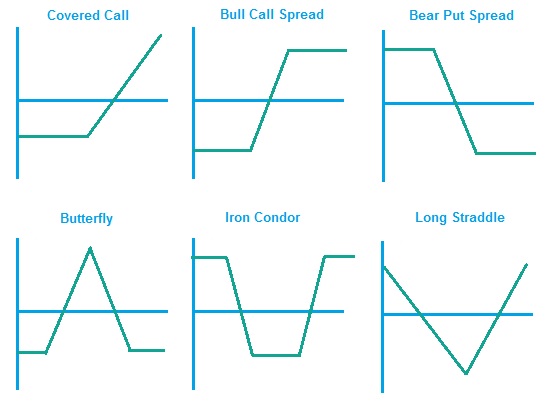

Strategies for Options Trading

The realm of options trading encompasses a wide array of strategies, each tailored to various market conditions and investment objectives. A few fundamental strategies include:

- Covered Call: Generating income by selling (writing) call options against an underlying asset that an investor already owns.

- Protective Put: A defensive strategy that involves purchasing a put option to protect an existing asset or portfolio.

- Bull Call Spread: A bullish strategy involving simultaneously buying a call option at a lower strike price and selling a call option at a higher strike price.

- Bear Put Spread: A bearish strategy that combines buying a put option at a lower strike price and selling a put option at a higher strike price.

Risks Associated with Options Trading

While options can provide significant opportunities, it’s imperative to acknowledge the inherent risks associated with this trading strategy. Options trading is not without its complexities, and losses can and do occur. Key risks include:

- Time Decay: The value of an option contract erodes over time due to factors such as the risk-free rate and time value.

- Volatility Risk: Options are heavily influenced by the volatility of the underlying asset. High volatility can lead to substantial gains or losses.

- Limited Return Potential: Unlike stock ownership, the maximum profit potential for an option buyer is limited to the net premium paid.

Explanation Options Trading

Image: learn.stocktrak.com

Conclusion

Options trading presents a powerful tool for investors seeking to navigate the complexities of financial markets. By understanding the nuances of this strategy, including the various types of options, mechanisms involved, potential advantages, available strategies, and associated risks, investors can harness the benefits of options trading while mitigating potential downsides. Whether a seasoned investor or a novice venturing into the world of options, a thorough comprehension of this subject matter is paramount for achieving financial success.