Imagine stepping into the bustling world of financial markets, where intricate strategies unfold. Among the many gears turning, options trading stands out as a dynamic realm, offering both lucrative opportunities and potential pitfalls. Options, particularly call and put contracts, are powerful tools that enable investors to speculate on the future price movements of underlying assets. In this comprehensive guide, we will delve into the intricacies of options trading, empowering you with the knowledge to navigate this challenging yet rewarding arena.

Image: tme.net

Decoding Call and Put Options

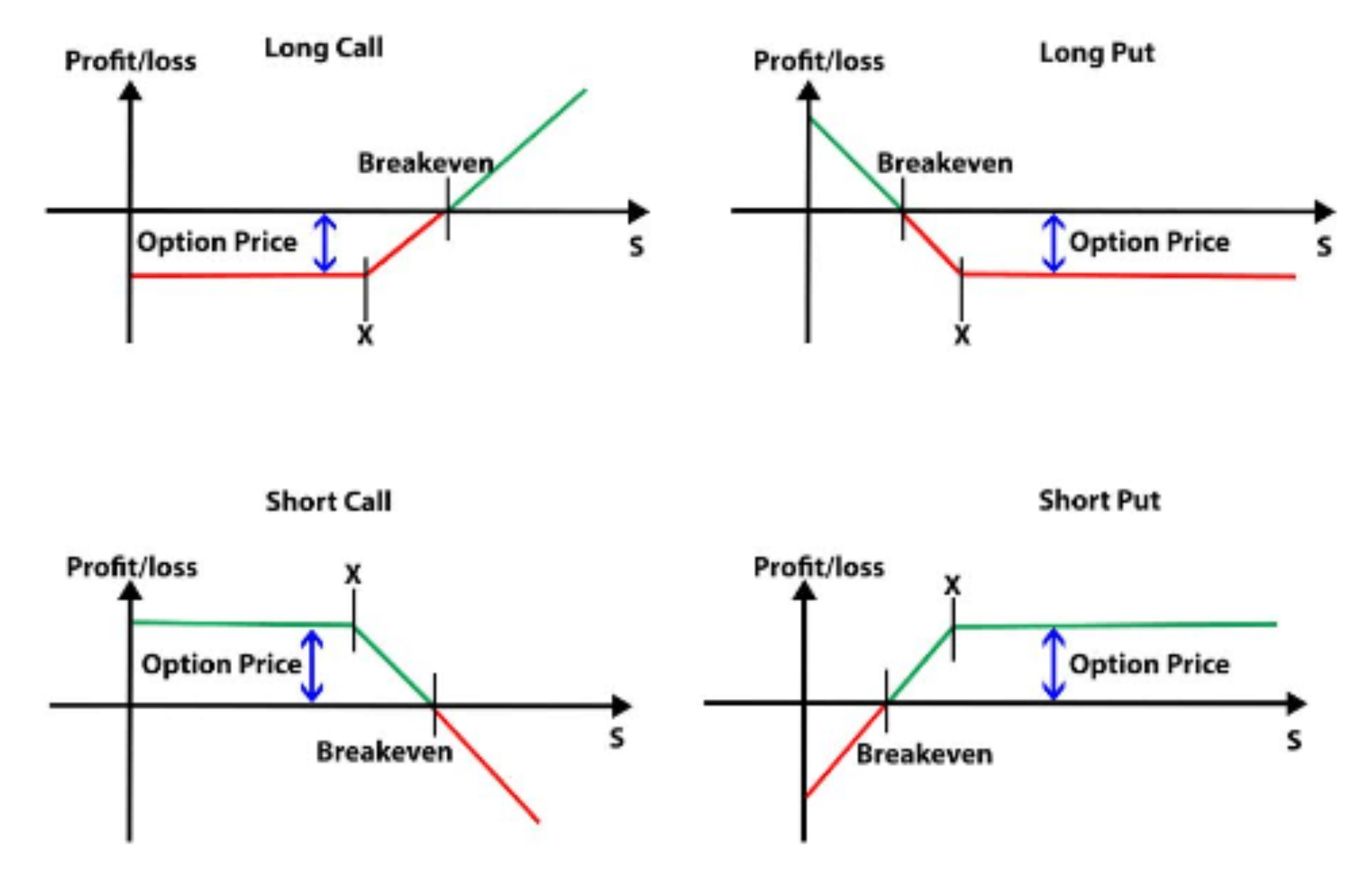

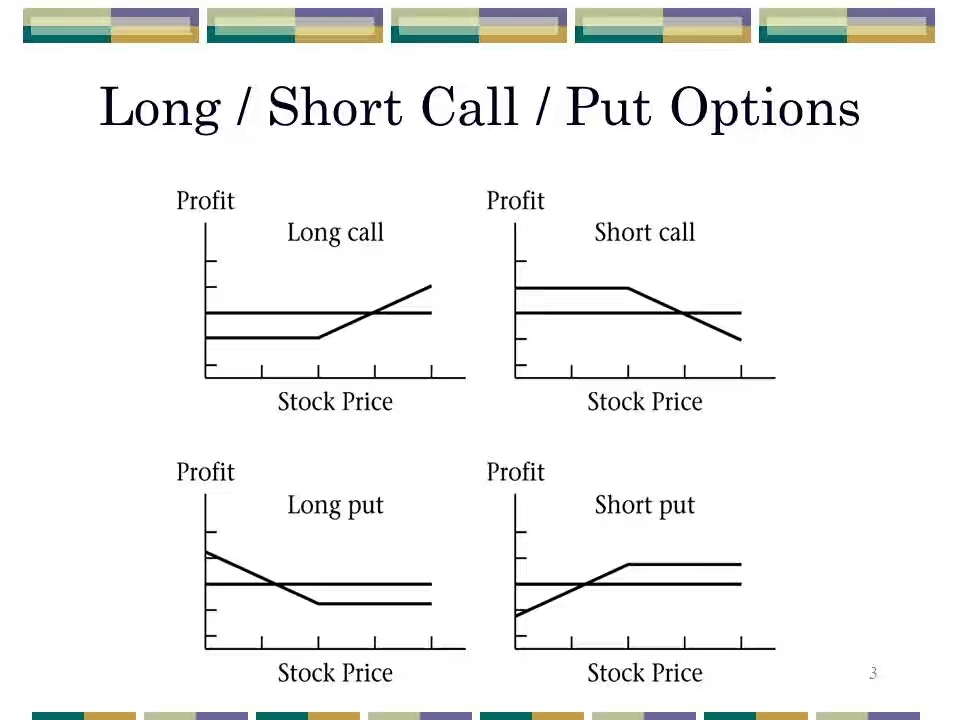

Options trading revolves around the exchange of contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price (strike price) on or before a specified date (expiration date). Call options, as the name suggests, bestow upon the buyer the right to purchase the underlying asset, while put options provide the holder with the right to sell the asset.

Understanding the interplay between these two options is crucial. If an investor anticipates a rise in the asset’s price, they may purchase a call option. Conversely, if they expect a decline, they may opt for a put option. This inherent flexibility is what makes options trading a versatile tool for both profit-seeking and hedging strategies.

Factors Influencing Option Pricing

The pricing of options is a complex tapestry woven from various strands: the underlying asset’s price, volatility, time to expiration, strike price, and interest rates. Volatility, a measure of the asset’s price fluctuations, plays a pivotal role in determining option premiums. Higher expected volatility translates to higher option prices.

Time also plays a critical part. As expiration approaches, the value of options decays due to the shrinking time window for potential profit. Additionally, the strike price relative to the underlying asset’s price exerts a significant influence. Options with strike prices near the current price tend to command higher premiums.

Strategies for Options Trading

Armed with an understanding of call and put options, traders can employ a range of strategies tailored to their investment objectives. A well-crafted strategy forms the bedrock of successful options trading. Some common approaches include:

- Short-term trading: Capitalizing on short-term price movements by holding options for a few days or weeks.

- Covered calls: Selling a call option against an underlying asset already owned, allowing potential upside while generating option premiums.

- Protective puts: Buying a put option to hedge an existing position in an underlying asset, providing downside protection.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Image: elearningensup.gifafrique.com

Expert Tips for Success

Navigating the options trading landscape requires both knowledge and a meticulous approach. Here are some expert tips to help you navigate the challenges and increase your chances of success:

- Know your options: Thoroughly research different options strategies before executing any trades.

- Manage risk: Limit your exposure to risk by diversifying your portfolio and using stop-loss orders.

- Stay informed: Monitor market news, economic data, and company updates to stay abreast of factors that may affect your options.

FAQ on Options Trading

- Q: Can I make money with options trading?

A: Yes, but it requires skill, strategy, and a clear understanding of options. - Q: Is options trading gambling?

A: Options trading involves risk but is not pure gambling, as it is based on calculated decisions and market analysis. - Q: How do I choose the right strike price?

A: The strike price should align with your predictions about the asset’s future price movements. - Q: What is the difference between a call and a put option?

A: A call option gives you the right to buy, while a put option gives you the right to sell. - Q: Can I lose more than I invest in options trading?

A: Yes, it is possible to lose the entire amount invested if the underlying asset’s price moves sharply against your position.

Options Trading Call Put

Image: 02brains.wordpress.com

Conclusion

Options trading is a complex yet highly rewarding realm within the financial markets. By understanding the mechanics of call and put options, leveraging expert advice, and implementing a well-defined strategy, you can harness the potential for profit while mitigating風險. As you embark on this journey, remember that knowledge is your sword and caution is your shield. Embrace the challenge, learn from your experiences, and may your options trades blossom into financial victories.

Are you eager to delve deeper into the world of options trading? Share your thoughts and questions in the comments below, and let’s continue exploring this fascinating topic together.