When it comes to the complex and diverse world of financial markets, options trading stands as a sophisticated financial strategy that can yield considerable profits while also entailing substantial risks. At the heart of options trading lie two fundamental instruments: call options and put options, each carrying unique characteristics and offering distinct opportunities to astute investors.

Image: tradewithmarketmoves.com

Unveiling Options Trading: A Gateway to Market Speculation

In essence, options trading revolves around the buying and selling of contracts that grant the buyer the right—but not the obligation—to purchase or sell an underlying asset at a predefined price on or before a specific date. Unlike futures contracts, which bind the buyer to buy or sell, options provide the flexibility of either exercising the right or letting it expire, empowering the investor with greater control over their investment decisions.

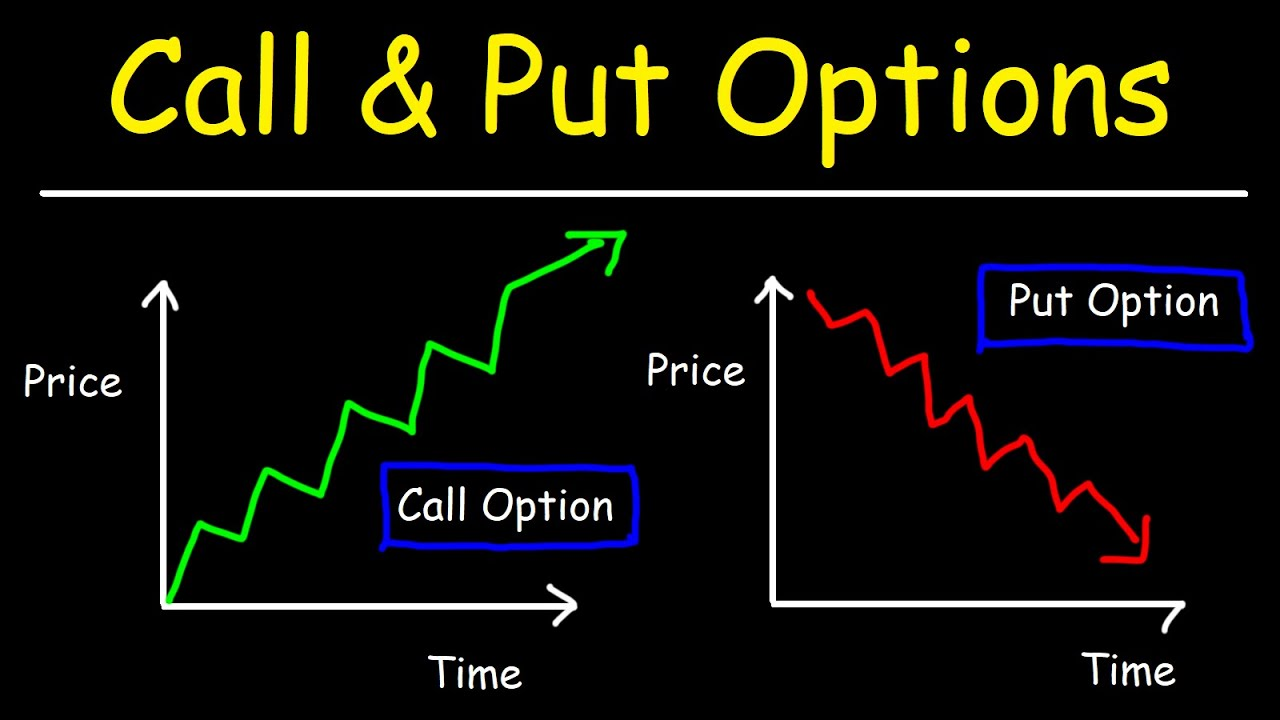

Delving into Call Options: Betting on a Bullish Surge

Call options emerge as a powerful tool for investors who anticipate a future price increase in the underlying asset, whether it be a stock, bond, or commodity. By purchasing a call option, the buyer secures the right to buy the asset at a predetermined “strike price” on or before the contract’s expiration date. Should the asset’s market price surpass the strike price, the call option holder can exercise their right to purchase at the lower strike price, profiting from the price difference.

Exploring Put Options: Hedging against Pessimistic Expectations

On the opposite side of the options trading spectrum, put options cater to investors who foresee a decline in the underlying asset’s price. By purchasing a put option, the buyer acquires the right to sell the asset at the strike price on or before the contract’s expiration. If the underlying asset’s market price falls below the strike price, the put option holder can exercise their right to sell at the higher strike price, again benefiting from the price difference.

Image: www.educba.com

A Deeper Dive into Options Trading: Strategies and Pitfalls

Mastering the art of options trading requires a thorough understanding of various strategies and risk management techniques. Buying and selling calls and puts involves a multitude of strategies, each tailored to specific market conditions and risk appetites. For instance, a covered call strategy involves selling a call option against an existing underlying asset, while a protective put strategy entails buying a put option to hedge against potential losses in the underlying asset.

Navigating the Risks of Options Trading: Caution and Informed Decision-Making

Equally important as grasping the opportunities presented by options trading is acknowledging the inherent risks involved. Unforeseen market fluctuations, unfavorable price movements, and a lack of proper risk management can lead to significant losses for unwary investors. It is imperative to approach options trading with caution, conducting thorough research, and employing appropriate hedging strategies to mitigate potential risks.

What Is Call And Put In Options Trading

Image: faqogumypoze.web.fc2.com

Conclusion: A Spear in the Financial Armor

For investors seeking to delve into the multifaceted world of options trading, call and put options serve as indispensable tools, empowering them to navigate market fluctuations with calculated bets and strategic maneuvers. Whether embracing a bullish outlook with a call option or hedging against market turbulence with a put option, mastery over these instruments can significantly enhance one’s financial literacy and empower them to seize market opportunities while mitigating risk. Remember, as with any financial endeavor, thorough research and prudent risk management remain sacrosanct for successful and rewarding options trading.