Introduction

Options trading has emerged as a lucrative avenue for investors seeking alternative income streams and portfolio diversification. As one of the leading online betting platforms, BetOnline recognizes the growing demand and has introduced options trading to its clientele. This article aims to provide a comprehensive overview of BetOnline’s options trading offerings, empowering readers with the knowledge to explore this exciting investment opportunity.

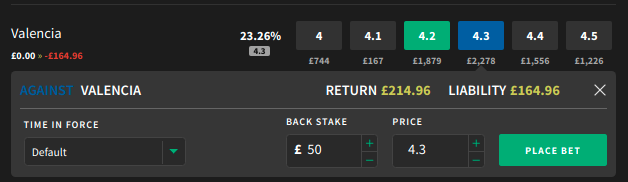

Image: help.smarkets.com

BetOnline’s foray into options trading offers a myriad of benefits to investors. Options provide a flexible and versatile tool to mitigate risk, enhance returns, and speculate on market movements. Whether you’re a seasoned trader or a novice investor, BetOnline’s user-friendly platform makes it accessible to everyone.

Understanding Options Trading

In options trading, traders speculate on the future price of an underlying asset, such as a stock or index. An option contract represents a right, not an obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price on or before a specific date. The buyer of an option pays a premium to the seller for this right.

The price of an option is determined by several factors, including the current market price of the underlying asset, the exercise price, the expiration date, and volatility. Volatility measures the rate at which the underlying asset’s price changes, influencing the value and risk associated with an option contract.

BetOnline’s Trading Platform

BetOnline’s options trading platform boasts an intuitive interface designed to simplify the trading process. Users can seamlessly navigate the platform, accessing real-time quotes, charting tools, and historical data. The platform also provides comprehensive educational resources and support, ensuring even novice traders have the necessary knowledge to make informed decisions.

BetOnline offers a wide range of underlying assets for options trading, including major stock indices, precious metals, energies, and cryptocurrencies. This diversity allows investors to diversify their portfolios and spread risk across different asset classes.

Types of Options Strategies

BetOnline supports a variety of options strategies, allowing traders to tailor their positions based on their risk tolerance and investment goals. Some popular strategies include:

- Covered Call: Selling a call option against an underlying asset that you own, generating income from the premium.

- Protective Put: Buying a put option to protect a long position in an underlying asset, limiting potential losses.

- Iron Condor: Selling a call option and put option at higher and lower strike prices, respectively, to capitalize on low volatility.

- Straddle: Buying both a call option and put option with the same strike price and expiration date, profiting from a significant price move in either direction.

Image: www.nairaland.com

Advantages of Options Trading

Options trading offers several advantages over traditional investing methods:

- Flexibility: Options provide flexibility in timing and direction, allowing traders to adjust their positions as market conditions change.

- Leverage: Options enable traders to control a larger position with less capital compared to purchasing the underlying asset outright.

- Risk Mitigation: Options can be used as a hedging tool to reduce portfolio risk or protect specific positions.

- Income Generation: Selling options premiums can generate income, potentially enhancing overall returns.

Considerations and Risks

While options trading offers potential opportunities, it’s essential to acknowledge the risks involved:

- Complexity: Options trading requires a deep understanding of market dynamics and involves potential complexities. It’s crucial for traders to educate themselves and thoroughly comprehend the underlying concepts.

- Potential Losses: Options trading can result in significant losses, particularly in highly volatile markets. Traders should establish a risk management plan to mitigate potential financial impact.

- Market Manipulation: Options prices can be influenced by market manipulation tactics, affecting the profitability of options trades.

- Time Decay: The value of options decays over time, especially as they approach expiration. Traders need to carefully monitor their options and adjust their positions accordingly.

Bet Online Offer Options Trading

Image: behindmlm.com

Conclusion

BetOnline’s options trading offerings provide a compelling opportunity for investors to diversify their portfolios, enhance returns, and manage risk. By understanding the basics of options trading, navigating the BetOnline platform, and employing sound trading strategies, investors can potentially reap the benefits this exciting market has to offer. However, it’s imperative to approach options trading with due diligence, recognizing the potential risks involved. By mitigating these risks and continually refining their knowledge and strategies, traders can harness the power of options to achieve their investment goals.