In the bustling arena of financial markets, where risk and reward dance a delicate tango, the allure of advanced option strategies captivates traders seeking to navigate the challenges and maximize their returns. Among these strategies, the broken wing butterfly stands out as a potent tool for risk-conscious investors who seek to amplify gains without sacrificing excessive capital.

Image: www.thetatrend.com

Understanding the Broken Wing Butterfly Strategy

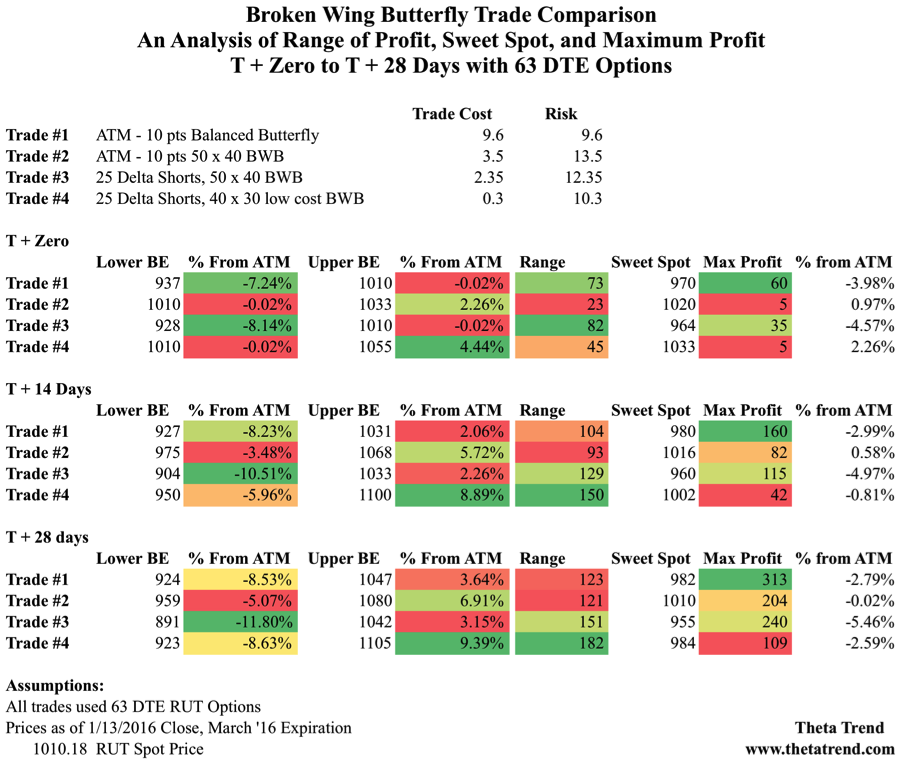

The broken wing butterfly strategy, a variant of the classic butterfly spread, comprises buying one call option at a lower strike price, selling two call options at a middle strike price, and buying one call option at a higher strike price. The buyer of this spread expects the underlying asset price to rise, but at a more moderate pace than anticipated by a traditional long butterfly spread.

This unique structure bestows upon the broken wing butterfly strategy the following characteristics:

- Limited Risk: Unlike naked call options, this strategy caps potential losses at the net premium paid.

- Moderate Return: It offers a balanced trade-off between potential profit and risk, making it suitable for cautious traders.

- Asymmetric Profile: Its profit potential exceeds its maximum loss, creating an asymmetric risk-reward profile.

Navigating the Nuances of the Broken Wing Butterfly Strategy

To harness the full power of this strategy, traders must meticulously consider several factors:

- Strike Price Selection: The judicious selection of strike prices is paramount. The lower and higher strike prices should be out-of-the-money, while the middle strike price can be either at-the-money or slightly in-the-money.

- Volatility Assessment: Understanding the implied volatility of the underlying asset is crucial. Higher volatility enhances the premium received from selling the call options, but it also elevates the risk.

- Time-to-Expiration: The timing of the strategy is essential. Sufficient time to expiration allows the underlying asset’s price to fluctuate and potentially reach the target profit zone.

Expert Tips and Insights

To augment the probability of successful broken wing butterfly trades, seasoned traders recommend:

- Monitoring Market Sentiment: Keeping abreast of market news and sentiment can provide valuable insights into potential price movements.

- Backtesting and Practice: Rigorous backtesting and simulated trading help traders refine their strategy and manage risk effectively.

- Adequate Capitalization: Maintaining sufficient capital to withstand potential losses is fundamental to prudent risk management.

Image: www.youtube.com

FAQs:

- What is the primary advantage of the broken wing butterfly strategy?

Answer: It offers a balanced blend of limited risk and moderate return potential.

- How does the broken wing butterfly differ from a standard butterfly spread?

Answer: It involves buying one call option at a lower strike price instead of two, resulting in a more cautious approach.

- What is the optimal time frame for executing a broken wing butterfly strategy?

Answer: This depends on the underlying asset and market conditions, but generally, 30 to 90 days to expiration offers a suitable balance of time decay and potential price movement.

Advanced Option Trading With Broken Wing Butterflies

Conclusion

The broken wing butterfly strategy presents a compelling option trading technique for traders seeking to mitigate risk while capturing upside potential. By embracing its nuances and seeking expert guidance, traders can harness its power to enhance their financial performance and navigate the ever-evolving market landscape with greater confidence. Are you intrigued by the intricate complexities of advanced option trading and eager to delve deeper into the broken wing butterfly strategy? Share your thoughts and experiences below and let’s explore this fascinating topic together.