In the realm of financial markets, where opportunities and risks intertwine, understanding the art of option trading can empower investors to make calculated decisions that can yield substantial returns. Ford Motor Company, an industry titan, presents a plethora of options for savvy traders seeking to harness the potential of this dynamic investment landscape.

Image: seekingalpha.com

An option, in essence, grants you the right, not the obligation, to buy (in the case of “call” options) or sell (in the case of “put” options) an underlying asset at a predetermined price, within a designated timeframe. Ford option trading involves speculating on the future movements of Ford’s stock price, enabling investors to profit from both rising and falling markets.

Understanding the Mechanics of Ford Option Trading:

Before embarking on the journey of Ford option trading, it’s crucial to grasp the fundamental concepts. An option contract consists of three key components:

-

Call Option: Entitles the holder to buy 100 shares of Ford’s stock at a specific “strike price” on or before a certain “expiration date.”

-

Put Option: Offers the holder the right to sell 100 shares of Ford’s stock at the strike price on or before the expiration date.

-

Premiums: The price paid to acquire an option contract. When buying an option, you pay the premium, which represents the potential profit or loss on the trade.

Harnessing the Power of Ford Options:

Ford options offer a versatile toolset for investors with varying risk appetites. These instruments can be utilized for:

-

Bullish Strategies: Call options can be purchased when you anticipate an increase in Ford’s stock price. If the stock performs as expected, you can exercise your right to buy the shares at the predetermined strike price, locking in a profit.

-

Bearish Strategies: Put options provide an entry point to profit from falling stock prices. When the market turns bearish, you can sell your put options and collect the premium paid by the buyer.

-

Hedging Strategies: Options can be used to protect existing investments or reduce potential losses. For instance, holding a put option as insurance against a decline in Ford’s stock price can mitigate your exposure to downside risk.

Empowering Investors through Expert Insights:

Navigating the world of Ford option trading requires a blend of knowledge and guidance. Seeking advice from seasoned experts can significantly enhance your decision-making process. Renowned financial analysts and brokers possess a wealth of experience, providing invaluable insights into market trends and trading strategies.

-

Stay Informed: Regular monitoring of market news and company fundamentals can provide you with timely insights into the factors driving Ford’s stock price.

-

Risk Management: Understanding your risk tolerance is paramount in option trading. Carefully consider the potential losses associated with each trade and employ sound money management practices.

-

Continuous Education: The financial landscape is constantly evolving, necessitating ongoing education. Attend industry conferences, online webinars, or consult reputable trading resources to expand your knowledge.

Conclusion:

Ford option trading offers an avenue for ambitious individuals to capitalize on market movements and grow their wealth. By embracing the insights presented in this article, you can embark on a journey towards informed and empowering investment decisions. Remember, the path to financial success is paved with a combination of knowledge, strategy, and a relentless pursuit of excellence.

Image: tradingyourownway.com

Ford Option Trading

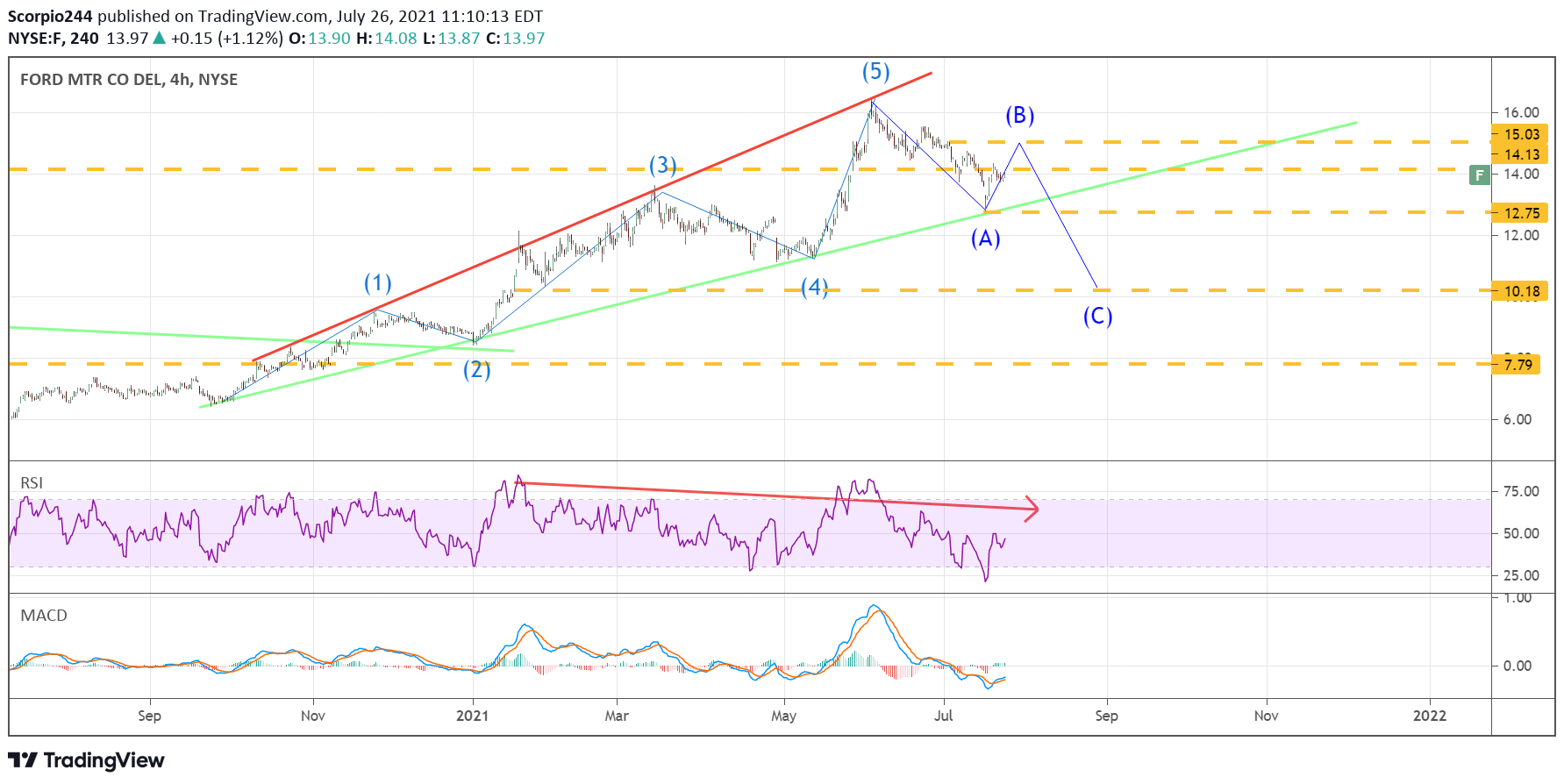

Image: www.tradingview.com