The Enigmatic World of Options Unveiled

Options trading, often shrouded in complexity, is a realm where traders seek to capitalize on the potential movements of underlying assets. Imagine yourself at a bustling market, where each booth offers a unique opportunity to bet on the price direction of stocks, bonds, or currencies. Options, like enigmatic oracles, provide a window into the future, enabling you to make educated guesses about these price movements. Let us embark on a journey to unravel the secrets of option trading, empowering you to venture into this captivating arena.

Image: www.paytmmoney.com

Diving into Options: A Layman’s Guide

An option contract, in essence, is an agreement that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific asset at a predetermined price known as the strike price. This agreement is valid until a set date, known as the expiration date. It’s like having an insurance policy on your investments, except in this case, you pay upfront for the right to make a decision later.

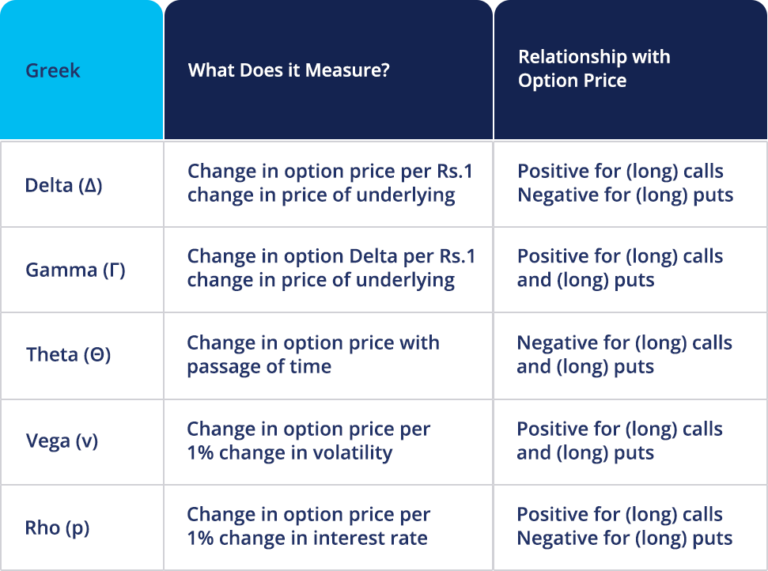

The value of an option contract is influenced by factors such as the underlying asset’s price, volatility, time until expiration, and interest rates. It’s a delicate dance between market dynamics and strategic calculations, where traders leverage their insights to maximize potential returns.

Unveiling Call and Put Options: A Tale of Two Strategies

Call options are for the optimists who believe the underlying asset’s price will rise above the strike price before the expiration date. If their prediction holds true, they exercise the right to buy the asset at the lower strike price, profiting from the price difference. Put options, on the other hand, are the domain of pessimists. These traders anticipate a decline in the asset’s price and purchase put options, giving them the right to sell the asset at the higher strike price, securing profits in a falling market.

Trading Options: A Calculated Risk Worth Taking

Venturing into option trading requires a keen eye for opportunity, meticulous risk management, and a solid understanding of the market. It’s not a get-rich-quick scheme but rather a strategic endeavor that rewards those who delve into its complexities. By carefully weighing potential rewards against potential risks, option traders strive to make calculated decisions that can yield substantial returns.

Image: cryptobuz.blogspot.com

Unlocking the Secrets of Successful Option Trading

Mastering option trading is a journey of continuous learning and adaptation. Immerse yourself in market analysis, study historical trends, and stay abreast of current events to make informed decisions. Risk management is paramount; determine your tolerance for losses and set stop-loss orders accordingly. Patience is a virtue in this realm, allowing you to ride out market fluctuations and maximize profit potential.

Option Trading Explained Simply

Image: tikloenglish.weebly.com

Conclusion: Empowering Yourself in the Arena of Options

Option trading presents a unique opportunity for savvy investors to enhance their returns and manage risks. Armed with a clear understanding of its concepts, strategies, and potential pitfalls, you can navigate this dynamic market with confidence. Remember, the pursuit of profit in the world of options is a marathon, not a sprint. By embracing knowledge and exercising prudent risk management, you empower yourself to explore this enigmatic realm and unlock its vast potential.