Stepping into the labyrinthine world of financial markets, I encountered a conundrum that piqued my curiosity: the ever-shifting price of options trading with Fidelity. Fidelity, renowned for its unparalleled brokerage services, offered an intriguing opportunity to explore the intricate machinations behind option pricing. Embarking on a journey of exploration, I delved into the annals of financial history, consulted with industry experts, and meticulously analyzed market data to unravel the secrets concealed within the price tag of Fidelity’s options trades.

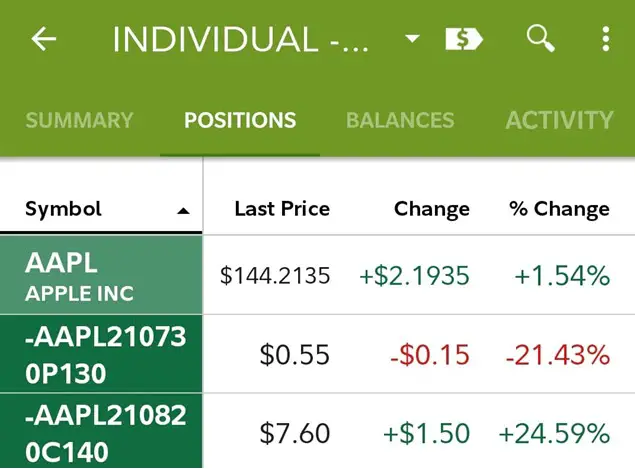

Image: usefidelity.com

Understanding Options Trading: A Tale of Risk and Reward

At the heart of options trading lies a concept as old as commerce itself: the right to buy or sell an underlying asset at a predetermined price on a specified date. These contracts, known as options, grant the buyer the privilege, not the obligation, to exercise this right. Options come in two flavors: calls, which confer the right to buy, and puts, which bestow the right to sell. The price of an option, often referred to as the “premium,” encapsulates the interplay of several variables that dance in the market’s enigmatic symphony.

Intrinsic Value: The Inherent Worth

Intrinsic value, the bedrock of option pricing, represents the difference between the current market price of the underlying asset and the strike price specified in the contract. For call options, intrinsic value arises when the underlying asset’s price exceeds the strike price. Conversely, put options possess intrinsic value when the underlying asset’s price falls below the strike price. Intrinsic value serves as the fundamental pillar upon which the option’s value rests.

Time Value: The Ticking Clock

Time, that relentless force, plays a pivotal role in option pricing through the concept of time value. Time value, also known as extrinsic value, reflects the remaining time until the option’s expiration date. As the clock ticks away, the time value of an option gradually diminishes, eventually eroding to zero upon expiration. The longer the time remaining until expiration, the greater the time value of the option, implying that time itself becomes a valuable asset.

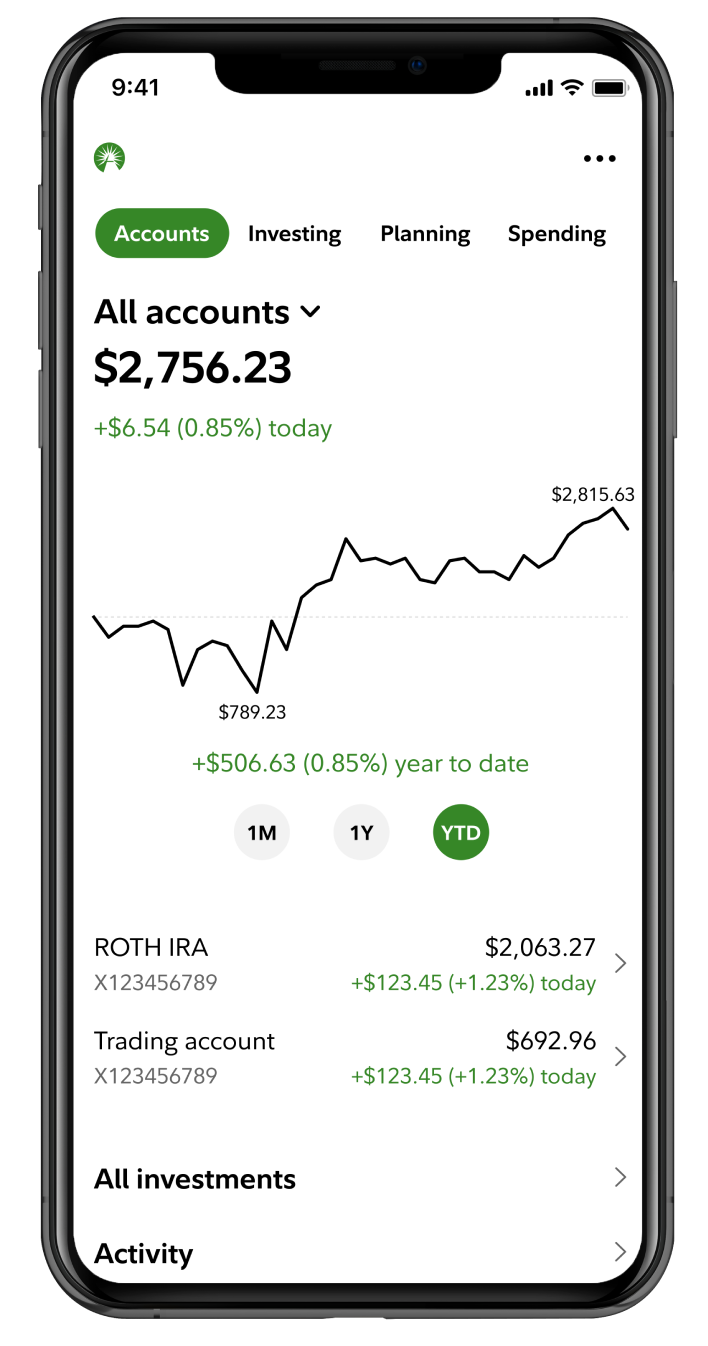

Image: www.fidelity.com

Volatility: The Unpredictable Pulse

The ever-changing heartbeat of the market, volatility, exerts a profound influence on option pricing. Volatility, a measure of the magnitude and frequency of price fluctuations in the underlying asset, directly impacts the premium of an option. When volatility surges, option prices tend to climb, as traders seek refuge in the ability to hedge against unpredictable market movements. Conversely, tranquil markets characterized by low volatility often lead to lower option premiums.

Fidelity’s Competitive Edge in Options Trading

Leveraging their extensive experience and formidable market presence, Fidelity has emerged as a formidable force in the options trading arena. Fidelity’s state-of-the-art trading platform empowers traders with a comprehensive suite of tools, real-time market data, and advanced analytics to navigate the complex world of options effortlessly.

Commission Structure: Striking a Balance

Fidelity’s commission structure for options trading strikes a delicate balance between cost-effectiveness and value-added services. Traders benefit from competitive per-contract pricing while having access to Fidelity’s exceptional educational resources, research reports, and dedicated support team. This holistic approach ensures that traders not only execute trades efficiently but also have the knowledge and support necessary to make informed decisions.

Margin Rates: Leveraging Flexibility

Fidelity’s flexible margin rates empower traders with the ability to leverage their capital more effectively. By leveraging margin, traders can amplify their buying power, potentially increasing their returns. However, it’s crucial to remember that margin trading also amplifies risk, and traders should exercise caution when employing this strategy.

Enhancing Your Options Trading Strategy

The path to options trading success is paved with a combination of knowledge, experience, and calculated risk-taking. Here are some tips and expert advice to help you navigate this dynamic landscape:

Master the Art of Volatility

Embrace volatility as an ally rather than an adversary. Study historical volatility patterns and monitor real-time market conditions to astutely predict future volatility. This foresight enables you to identify potential trading opportunities and make informed decisions about the appropriate option strategies to employ.

Diversify Your Trading Strategy

Don’t put all your eggs in one basket. Diversify your options trading strategy by spreading your capital across different underlying assets, option types, and expiration dates. Diversification mitigates risk and enhances the overall stability of your portfolio.

Frequently Asked Questions: Unraveling the Mysteries

To further illuminate the intricacies of Fidelity options trading price, here are answers to some frequently asked questions:

- Q: What factors influence Fidelity’s options trading prices?

- A: Fidelity’s options trading prices are influenced by a multitude of factors, including intrinsic value, time value, volatility, supply and demand, and market sentiment.

- Q: How do I determine the best Fidelity options trading price?

- A: To determine the best Fidelity options trading price, consider the underlying asset’s price, the strike price, the time to expiration, the volatility of the underlying asset, and your overall trading strategy.

- Q: What are the advantages of using Fidelity for options trading?

- A: Fidelity offers a competitive commission structure, flexible margin rates, an extensive suite of trading tools, real-time market data, and dedicated customer support.

Fidelity Options Trading Price

Image: cuartoymita.net

Conclusion: A Journey of Empowerment

Navigating the world of Fidelity options trading price unveils a tapestry of interconnected variables, both tangible and intangible. By understanding the complexities of intrinsic value, time value, and volatility, traders can harness the power of options to mitigate risk, enhance returns, and achieve their financial goals. The tips, expert advice, and frequently asked questions provided in this article serve as valuable tools in your options trading journey, helping you make informed decisions and unlock the boundless possibilities that this dynamic market holds.

Are you ready to embark on your own options trading adventure? Let the knowledge and insights gained through this article empower you to confidently explore the intricacies of Fidelity options trading and forge your path to financial success.