Embark on a Journey of Informed Trading with Fidelity

When the allure of options trading beckons, it’s crucial to embark on a meticulous journey armed with the right tools and knowledge. Fidelity Investments, a trailblazer in the financial arena, offers a suite of brokerage accounts meticulously designed to cater to the spectrum of investment strategies, including the dynamic realm of options trading. This comprehensive guide will illuminate the intricacies of Fidelity’s brokerage offerings, empowering you to make informed decisions tailored to your unique aspirations.

Image: usefidelity.com

Welcome to Fidelity: A Vantage Point for Options Mastery

Since its inception in 1946, Fidelity has been an unwavering beacon in the financial landscape, amassing a loyal following of investors who value its customer-centric approach, unwavering commitment to innovation, and comprehensive suite of investment solutions. When it comes to options trading, Fidelity stands out as a formidable force, providing traders with an unparalleled array of account options, each meticulously crafted to empower them to navigate the complexities of this captivating asset class.

In the realm of options trading, Fidelity’s brokerage accounts serve as the launchpad for your financial endeavors. Whether you’re a seasoned veteran navigating the intricacies of complex options strategies or a novice eager to delve into this captivating arena, Fidelity provides a tailored solution to suit your aspirations.

The Fidelity Brokerage Account Landscape: Unveiling Your Options

Navigating the tapestry of Fidelity’s brokerage accounts is akin to unlocking a treasury of investment opportunities. Each account is endowed with a unique set of features and benefits, ensuring that investors can meticulously align their investment strategies with their personal objectives and risk tolerance.

A cornerstone of Fidelity’s brokerage offerings is the Cash Management Account (CMA), a versatile account that seamlessly integrates cash management capabilities with the dynamism of investing. The CMA empowers investors to transact effortlessly, offering check-writing privileges, online bill payment functionality, and the ability to set up automatic transfers, ensuring seamless financial management.

Venturing into the realm of margin trading unveils the merits of Fidelity’s Margin Trading Account. This account extends the power of leverage to experienced investors, enabling them to amplify their investment potential. However, it’s imperative to approach margin trading with judicious caution, as the potential for both substantial gains and losses is magnified.

Options Trading: Unraveling Fidelity’s Tailored Solutions

For investors seeking to harness the multifaceted potential of options trading, Fidelity’s Individual Brokerage Account (IRA) and Retirement Account (RA) emerge as compelling choices. These accounts provide a structured framework for long-term financial planning while enabling investors to explore the nuances of options trading. The tax advantages associated with these accounts further enhance their allure, providing a fertile ground for wealth accumulation over extended time horizons.

Image: thecollegeinvestor.com

Charting Your Course: Selecting the Fidelity Account that Resonates

Choosing the Fidelity brokerage account that aligns seamlessly with your investment aspirations is a pivotal step. Consider your investment objectives, risk tolerance, and trading style to make an informed decision.

For investors seeking a versatile and accessible starting point, the Cash Management Account stands as an excellent choice. Its user-friendly interface and robust cash management features empower investors to effortlessly manage their finances while exploring investment opportunities.

If the allure of leveraging lies at the heart of your investment strategy, the Margin Trading Account beckons. However, it’s imperative to exercise prudence and maintain a deep understanding of the inherent risks associated with margin trading.

For those navigating the complexities of long-term financial planning while seeking to harness the potential of options trading, the Individual Brokerage Account (IRA) and Retirement Account (RA) offer a compelling proposition. The tax advantages they bestow make them ideal vehicles for cultivating long-term wealth.

Empowering Investors: Fidelity’s Unwavering Commitment

Fidelity’s unwavering commitment to empowering investors shines through its comprehensive educational resources, designed to equip traders with the knowledge and skills to navigate the ever-evolving financial landscape with confidence. Explore webinars, online courses, and in-depth research reports to fortify your understanding of options trading strategies and market dynamics.

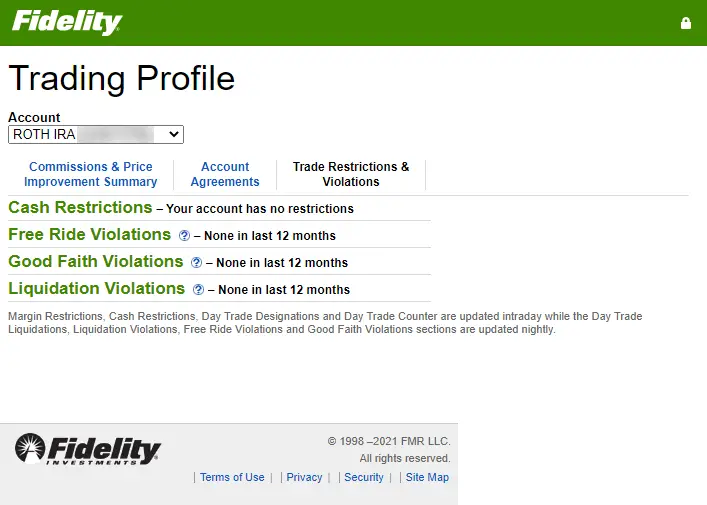

What Fidelity Account I Need For Options Trading

Image: www.merchantshares.com

Embark on a Transformative Trading Journey with Fidelity

Step into the realm of options trading with Fidelity as your steadfast partner. With a brokerage account meticulously aligned with your aspirations and an arsenal of educational resources at your disposal, you possess the power to unlock the transformative potential of this captivating asset class.

Embrace the journey of informed trading, where knowledge is your compass and Fidelity your trusted guide. Together, we will navigate the complexities of options trading, unlocking the doors to financial empowerment and the realization of your investment dreams.