Prologue: Tapping into Extended Trading Opportunities

Imagine if you could extend your trading horizons beyond the regular market hours, seizing opportunities to capitalize on late-breaking news or economic events. Enter the realm of E*Trade option after-market trading, an arena where savvy investors navigate extended trading sessions to maximize their market potential. In this comprehensive guide, we delve into the intricacies of this dynamic trading landscape, empowering you with the knowledge and strategies to unlock unprecedented trading opportunities.

Image: www.youtube.com

Comprehending the After-Market Arena

After-market trading, also known as extended-hours trading, grants investors access to trading sessions that extend beyond the traditional 9:30 AM to 4:00 PM EST market hours. These extended sessions, typically running from 4:00 PM to 8:00 PM EST, provide a unique platform for traders to respond to market-moving news and events that may occur after market close.

Benefits of Extended-Hours Option Trading

-

Capitalizing on News Flows: After-market trading allows investors to react to late-breaking news or economic data that may significantly impact stock prices. This agility can lead to timely trades that capture potential market shifts.

-

Extended Opportunities: Extended trading hours offer additional opportunities to adjust positions, close out trades, or enter new ones based on post-market information. This flexibility empowers traders to adapt their strategies as market conditions evolve.

-

Reduced Volatility: After-market trading sessions often experience lower volatility compared to regular trading hours. This reduced volatility can create more favorable trading conditions and minimize potential losses for strategic investors.

-

Hedging Strategies: After-market option trading facilitates hedging strategies that can help manage risk. Investors can utilize options to protect their portfolios against potential market downturns or price fluctuations during extended trading hours.

Mastering Option After-Market Trading

-

Understanding Options Basics: Grasping the basics of options trading, including concepts like call and put options, premiums, and expiry dates, is crucial for effective after-market trading.

-

Market Monitoring: Closely monitoring the market during extended trading hours is essential. Utilize news sources, economic data, and market analysis tools to stay informed about potential market-moving events.

-

Option Selection: Choose options that align with your investment goals and risk tolerance. Consider factors like strike price, expiration date, and implied volatility when selecting options for after-market trading.

-

Risk Management: Implement sound risk management practices, including stop-loss orders and position sizing strategies, to mitigate potential losses in volatile after-hours markets.

-

Expert Guidance: Consider consulting with a financial advisor or experienced options trader to gain insights and guidance on specific after-market trading strategies that suit your investment objectives.

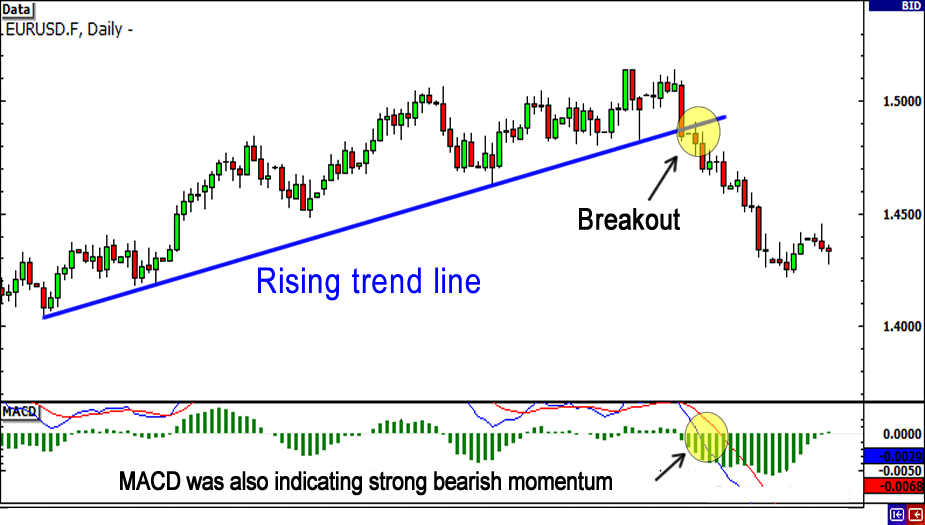

Image: www.blogforex.org

E*Trade: Your Gateway to Extended Options Trading

E*Trade stands as a renowned platform for options trading, offering a comprehensive suite of tools and resources to support your extended-hours trading endeavors. Their user-friendly platform, coupled with advanced charting capabilities and real-time market data, empowers you to navigate the after-market seamlessly.

-

Dedicated After-Hours Platform: E*Trade provides a dedicated after-hours trading platform optimized for extended trading sessions, ensuring seamless order execution and real-time market updates.

-

Advanced Market Analysis Tools: Access E*Trade’s advanced market analysis tools, including customizable charting, technical indicators, and news streams, to make informed trading decisions during after-market hours.

-

Expert Research and Education: Leverage E*Trade’s comprehensive research and educational resources, including expert insights, webinars, and trading guides, to enhance your understanding of options trading and develop effective extended-hours strategies.

E Trade Option After Market Trading

Image: www.protradingschool.com

Conclusion: Embracing the Power of After-Hours Option Trading

After-market options trading with E*Trade empowers you to extend your trading horizons and seize opportunities beyond regular market hours. By embracing this dynamic trading landscape, you gain the agility to respond to market-moving events, manage risk effectively, and potentially enhance your investment returns. Remember to approach extended-hours trading with a well-informed strategy, sound risk management practices, and a commitment to continuous learning. Embark on the journey of after-market options trading today and unlock the boundless possibilities it holds.