Introduction

In the vibrant world of finance, option trading stands tall as a potent financial instrument. Yet, the allure of this enticing realm conceals a sobering truth: a staggering 80% of option traders confront the bitter taste of loss. This astounding statistic begs the question—why do so many fall prey to the perils of option trading? Delve into this comprehensive guide as we embark on a quest to illuminate the underlying causes behind this widespread failure.

Image: www.youtube.com

Understanding Options: A Gateway to Risk and Potential

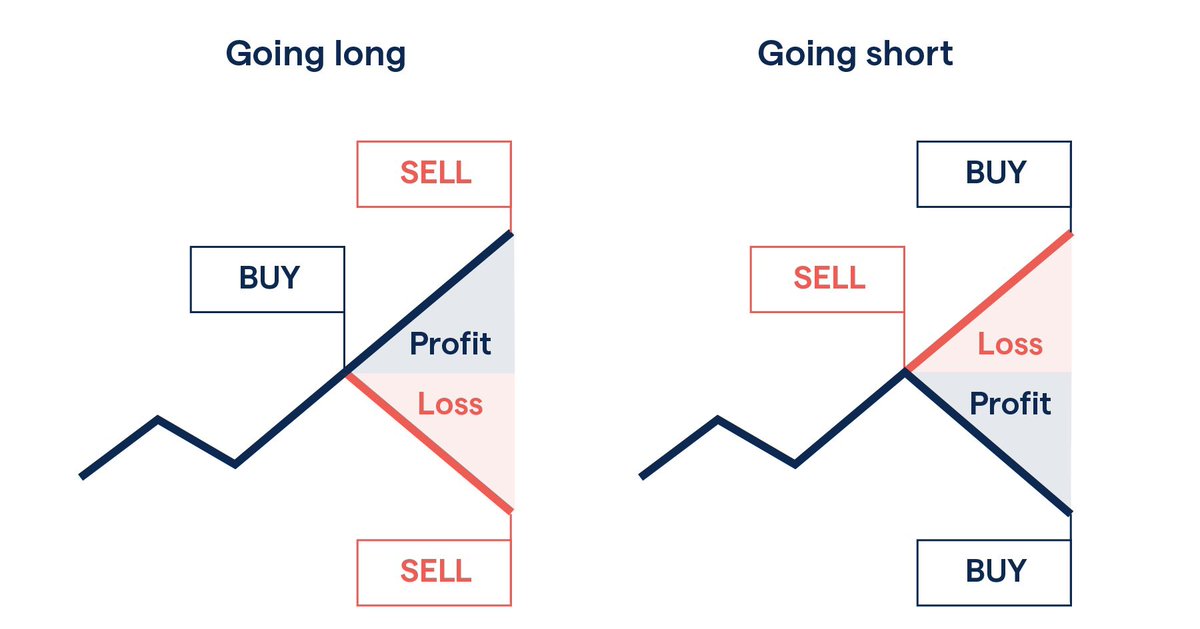

Options, in essence, are contracts that confer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) within a predetermined time frame (expiration date). Their inherent leverage and flexibility render them alluring to traders seeking to amplify gains or hedge against potential losses. However, this very leverage that beckons opportunity also magnifies risk, making options a treacherous terrain for the unwary.

Why 80% of Option Traders Lose Money: Unveiling the Perils

-

Lack of Understanding: Blindly venturing into option trading without a thorough grasp of the fundamental principles and strategies sets the stage for disaster. Misinterpreting market dynamics, failing to comprehend risk management techniques, and underestimating the time factor—all contribute to a shaky foundation that spells doom.

-

Inadequate Risk Management: Risk management is the cornerstone of prudent trading. Neglecting to define clear entry and exit points, failing to calculate potential losses, and succumbing to the lure of overleveraging—these reckless practices invite calamity. Without a robust risk management framework, traders surrender control, leaving fate at the mercy of relentless market forces.

-

Emotional Trading: The treacherous waters of option trading test even the steeliest of nerves. Anxiety, greed, and fear—the unwelcome trio—often cloud judgment, leading traders to abandon rational decision-making. Impulsive trades, ill-timed adjustments, and a persistent refusal to cut losses—these emotional traps ensnare the ill-disciplined, ultimately leading to financial ruin.

-

Lack of Market Discipline: Success in option trading demands unwavering discipline. Meticulously following a trading plan, adhering to predefined strategies, and resisting the temptations of impulsive trades—these virtues separate the successful from the vanquished. Yielding to the allure of quick profits and abandoning sound principles is a surefire path to trading oblivion.

-

Unrealistic Expectations: The allure of rapid wealth accumulation draws many to option trading. However, harboring unrealistic expectations of overnight riches is a recipe for disappointment. Consistent profits in option trading require a blend of skill, patience, and diligent effort—attributes that cannot be forged overnight.

-

Overconfidence: Hubris can be a trader’s downfall. Overestimating one’s abilities, disregarding risk, and trading recklessly—these traits pave the way for colossal losses. False confidence, like a treacherous quicksand, engulfs the overconfident, leaving them grappling for financial salvation.

-

Unreliable Trading Systems: Blindly following unproven or poorly designed trading systems is akin to navigating treacherous waters without a compass. Flawed systems yield false signals, mislead traders, and ultimately contribute to a trail of losses. Systematically testing and refining trading strategies, complemented by sound risk management practices, empowers traders to increase their chances of success.

-

Unforeseen Market Events: The financial markets abound with unforeseen events—geopolitical crises, economic upheavals, and natural disasters—that can wreak havoc on even the most carefully crafted trading strategies. Failing to factor in external events and their potential impact on the markets can lead to significant losses, underscoring the need for constant vigilance and adaptability.

Expert Insights: Navigating the Option Trading Landscape

“Option trading is not a get-rich-quick scheme but a complex endeavor that demands meticulous preparation, disciplined execution, and rigorous risk management,” cautions seasoned market veteran, John Carter.

His colleague, Steven Todd, echoes this sentiment: “Success in option trading hinges on a deep understanding of market dynamics, a robust trading plan, and the ability to control emotions. Unrealistic expectations and impulsive trading lead to financial ruin.”

Image: en.rattibha.com

Actionable Tips: Enhancing Your Option Trading Prowess

- Seek comprehensive education before embarking on option trading.

- Develop a robust trading plan and adhere to it diligently.

- Implement effective risk management techniques to minimize potential losses.

- Cultivate emotional discipline, resisting the siren call of greed and fear.

- Set realistic financial goals and avoid overleveraging.

- Conduct thorough due diligence and only trade options on underlying assets you understand.

- Embrace a mindset of continuous learning and improvement.

80 Of The People Lose In Option Trading

Conclusion: Triumph Over Loss in the Realm of Option Trading

The 80% failure rate in option trading is a stark reminder of the treacherous nature of this financial instrument. However, the path to success is illuminated by the lessons learned from those who have fallen prey to its pitfalls. By embracing knowledge, discipline, and a prudent approach, you can improve your chances of overcoming the perils that have plagued so many. Remember, the allure of option trading lies not in its promise of effortless wealth but in the potential for financial freedom that comes with mastering its intricacies. Approach this endeavor with a clear understanding of the risks involved, and let sound judgment guide your every trade.