Delta Sigma Theta: A Legacy of Financial Literacy

As a proud member of Delta Gamma Theta, I’ve witnessed firsthand the organization’s unwavering commitment to financial literacy. Our sisterhood empowers members to take control of their finances and secure a brighter future. One avenue we’ve embraced is the realm of options trading, a powerful investment strategy that requires a blend of knowledge and skill.

Image: www.projectfinance.com

Options trading involves the purchase of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. This provides investors with flexibility and leverage, allowing them to potentially magnify gains while mitigating risks.

Navigating the Options Landscape

Entering the world of options trading can seem daunting, but with the right guidance and knowledge, it can become a valuable tool for financial growth. Here are a few key concepts to consider:

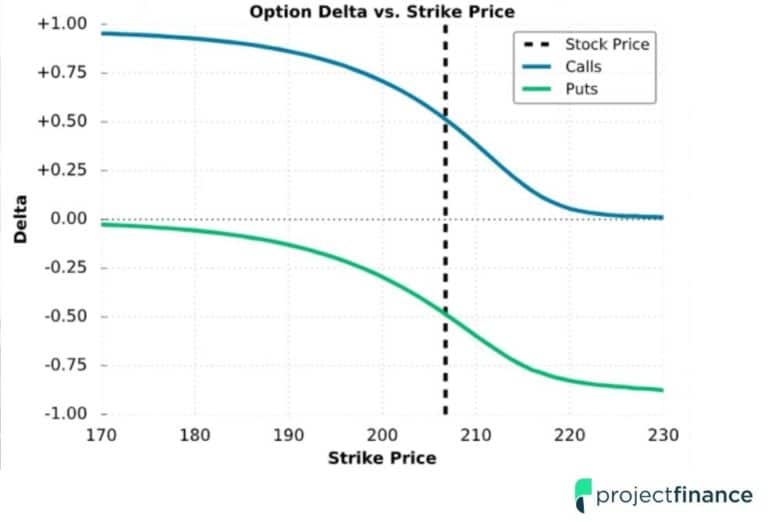

- Option types: There are two main types of options – calls and puts. Calls give the holder the right to buy the underlying asset, while puts give the holder the right to sell.

- Expiration dates: Options contracts have specific expiration dates. It’s crucial to understand the time frame and the consequences of holding an option until expiration.

- Strike prices: Options are traded at a designated strike price, which is the price at which the underlying asset can be bought or sold.

Trends and Developments in Options Trading

The options trading landscape is constantly evolving, and staying abreast of the latest trends and developments is essential. Online trading platforms have revolutionized the industry, making it more accessible and convenient. Mobile apps have further simplified trading, allowing investors to manage their portfolios on the go.

Another trend gaining traction is thematic investing. Rather than focusing on individual stocks, investors are creating option strategies around specific themes, such as sustainability or technology. This approach diversifies risk and amplifies returns in targeted sectors.

Tips for Successful Options Trading

Equipped with a solid understanding of the fundamentals, you can embark on options trading with a strategic approach. Here are some expert tips to enhance your trading experience:

- Start small: Begin with small positions to minimize risk and build confidence.

- Educate yourself: Continuously seek knowledge through books, online courses, and webinars.

- Manage risk: Use stop-loss orders and position sizing to limit potential losses.

- Monitor the market: Track market news and economic indicators to make informed decisions.

Image: www.tradingview.com

FAQs About Options Trading

- What is the difference between an option and a stock?

- An option grants the holder the right to buy or sell an underlying asset, while a stock represents ownership in a company.

- Are options risky?

- Yes, options trading involves risk. The value of an option depends on factors such as market volatility and the performance of the underlying asset.

- How do I get started with options trading?

- Open an account with a broker that offers options trading services. Educate yourself through credible resources and start with small positions.

Delta Gamma Theta Options Trading

Image: www.jatzam.com

Conclusion

Delta Gamma Theta’s commitment to financial literacy extends to the realm of options trading. By embracing this powerful investment strategy, members can unlock financial empowerment, diversify their portfolios, and contribute to the legacy of financial excellence within our organization. Embrace the learning curve, seek guidance from experts, and let options trading be a transformative tool in your financial journey.

Are you ready to delve into the fascinating world of Delta Gamma Theta options trading? Join the conversation and ask any lingering questions you may have.