In the bustling realm of financial markets, where time is of the essence, understanding the intricate web of trading hours is imperative. For those venturing into the captivating world of US equity options, grasping the nuances of their trading schedule can empower them to seize market opportunities with precision and finesse.

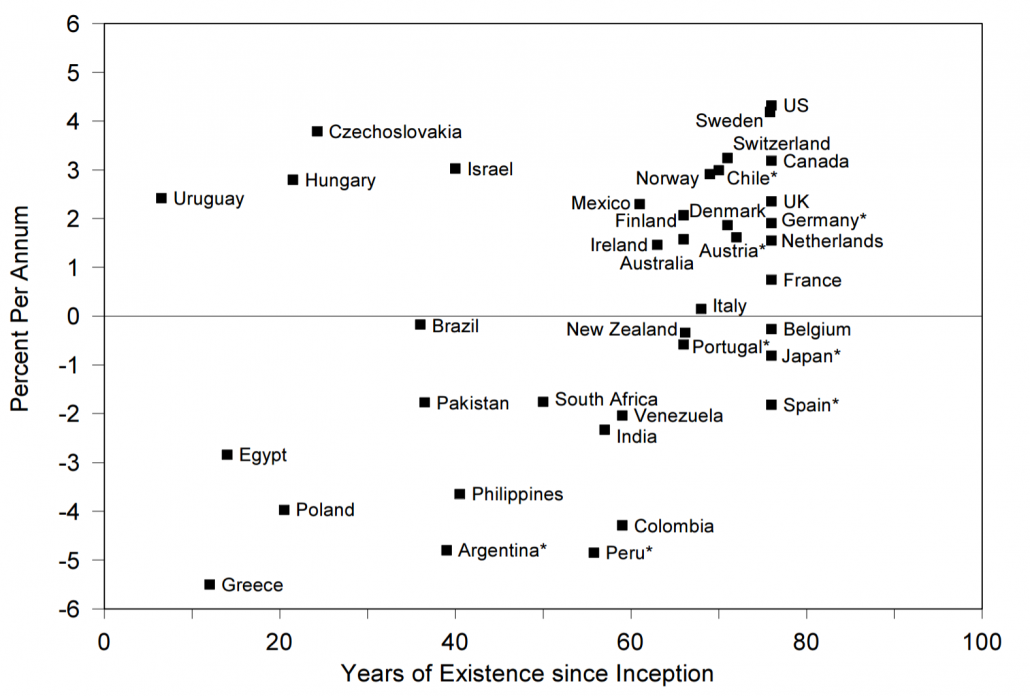

Image: alphaarchitect.com

Demystifying US Equity Options Trading Hours

The trading day for US equity options typically commences at 9:30 AM Eastern Time (ET) and draws to a close at 4:00 PM ET. However, market participants should be mindful of the existence of pre-market and post-market trading sessions that extend this timeframe. The pre-market session runs from 8:00 AM to 9:30 AM ET, while the post-market session operates from 4:00 PM to 8:00 PM ET. These extended sessions provide traders with additional opportunities to execute trades and manage their positions.

The Mechanics of Trading Hours

At the stroke of 9:30 AM ET, the opening bell rings, signaling the official start of regular trading hours. During this time, market participants can submit orders for buying and selling options contracts, and these orders are matched and executed based on price and quantity. The closing bell tolls at 4:00 PM ET, effectively concluding regular trading hours.

However, the market’s pulse continues to beat even after the closing bell. The post-market session allows traders to extend their trading activities beyond the traditional market hours. This session offers reduced liquidity but provides a unique avenue for those who wish to react to late-breaking news or adjust their positions.

Strategic Significance: Why Trading Hours Matter

Understanding the nuances of US equity options trading hours is not merely a matter of theoretical knowledge; it holds profound strategic implications. Traders who astutely align their trading activities with these established timeframes can gain a significant advantage.

Timely Execution: The regular trading hours provide the highest levels of liquidity and execution speed, ensuring that orders are filled with the greatest efficiency. Traders who execute trades during these hours can capitalize on optimal market conditions.

Price Discovery: The time of day can have an impact on option prices. As the market evolves throughout the trading day, supply and demand dynamics can lead to fluctuations in price. Understanding the price discovery process allows traders to make well-informed decisions.

Risk Management: Trading outside of regular hours introduces additional risks due to reduced liquidity. Post-market trading, in particular, can be volatile, and traders should exercise caution when placing orders during these sessions.

Conclusion

Delving into the intricacies of US equity options trading hours is an essential step for both novice and experienced traders seeking to navigate the market with confidence. By arming themselves with a thorough understanding of the trading timeframe, market participants can optimize their strategies, mitigate risks, and seize opportunities with greater precision. Remember, time is not simply a measure on the clock; in the financial markets, it is a precious currency that can empower traders to unlock market potential.

Image: www.pdffiller.com

Us Equity Options Trading Hours

Image: www.optiontradingtips.com