Introduction:

In the ever-evolving landscape of financial markets, currency options trading stands as a powerful tool for investors seeking to mitigate risk, capitalize on market volatility, and potentially generate substantial returns. A currency option is a contract that grants the buyer the right, but not the obligation, to buy or sell a specific currency at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility allows traders to tailor their strategies to suit their risk tolerance and market outlook. To delve into the intricacies of currency options trading, this comprehensive PDF guide provides a roadmap for success, equipping traders with the knowledge and insights needed to navigate the complexities of the foreign exchange market.

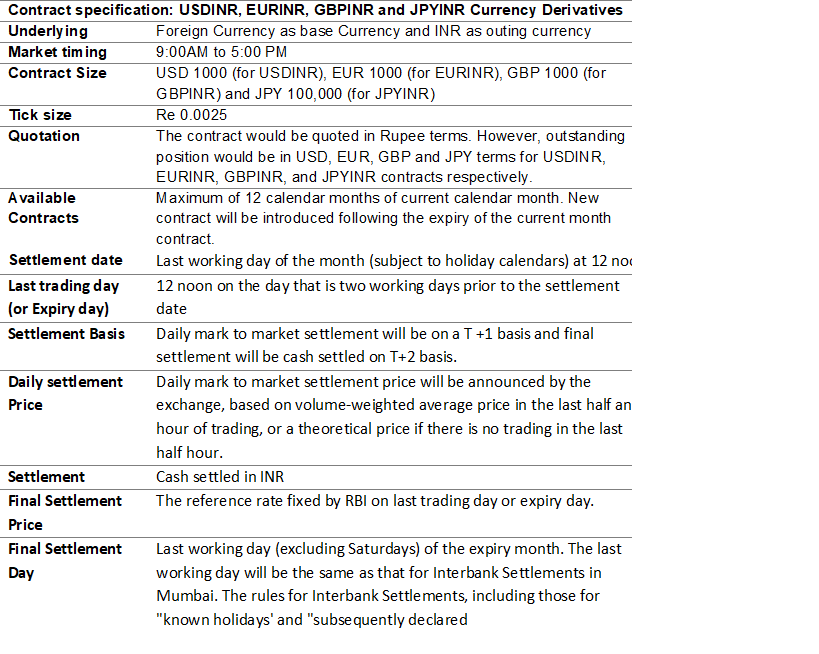

Image: www.5paisa.com

Delving into the Basics:

At its core, a currency option consists of two fundamental types: calls and puts. A call option grants the buyer the right to buy a currency at the strike price, while a put option grants the right to sell. The premium paid for an option represents the cost of purchasing this right, and it varies depending on factors such as the strike price, expiration date, and market volatility. Understanding the nuances of these options is paramount for successful trading.

Understanding the Currency Market:

The foreign exchange market, also known as forex or FX, facilitates the exchange of currencies worldwide, with transactions exceeding trillions of dollars daily. This vast market presents ample opportunities for currency options traders, but it also comes with its share of complexities. Factors such as geopolitical events, economic data, and central bank decisions can significantly impact currency values, making it essential for traders to stay abreast of market developments.

Navigating Strategies and Techniques:

Currency options trading offers a vast array of strategies and techniques to suit different market scenarios and risk appetites. From simple hedging strategies to complex multi-leg options trades, traders have the flexibility to customize their approach. Common strategies include using options for speculation, hedging, and income generation, each with its own set of advantages and drawbacks. By mastering these strategies and techniques, traders can enhance their chances of success in the currency options market.

Image: tradefinanceglobal.com

Analyzing Market Data and Trends:

A thorough understanding of market data and trends is indispensable for successful currency options trading. Technical analysis, involving the study of price charts and patterns, can help traders identify potential trading opportunities. Additionally, fundamental analysis, examining economic data and geopolitical events, provides insights into factors that can influence currency movements. Combining both technical and fundamental analysis empowers traders to make informed decisions and develop robust trading strategies.

Managing Risk and Maximizing Returns:

Risk management is paramount in currency options trading, as it helps traders preserve capital and enhance their chances of achieving long-term success. Techniques such as position sizing, stop-loss orders, and hedging can help mitigate potential losses and optimize returns. Moreover, understanding the concept of implied volatility and its impact on option premiums is crucial for effective risk management.

Seeking Education and Mentorship:

Continuous education and mentorship are essential for excelling in currency options trading. Enrolling in online courses, attending webinars, and reading reputable materials can expand knowledge and refine trading skills. Additionally, connecting with experienced traders through forums, communities, or mentorship programs can provide invaluable insights and support.

Currency Options Trading Pdf

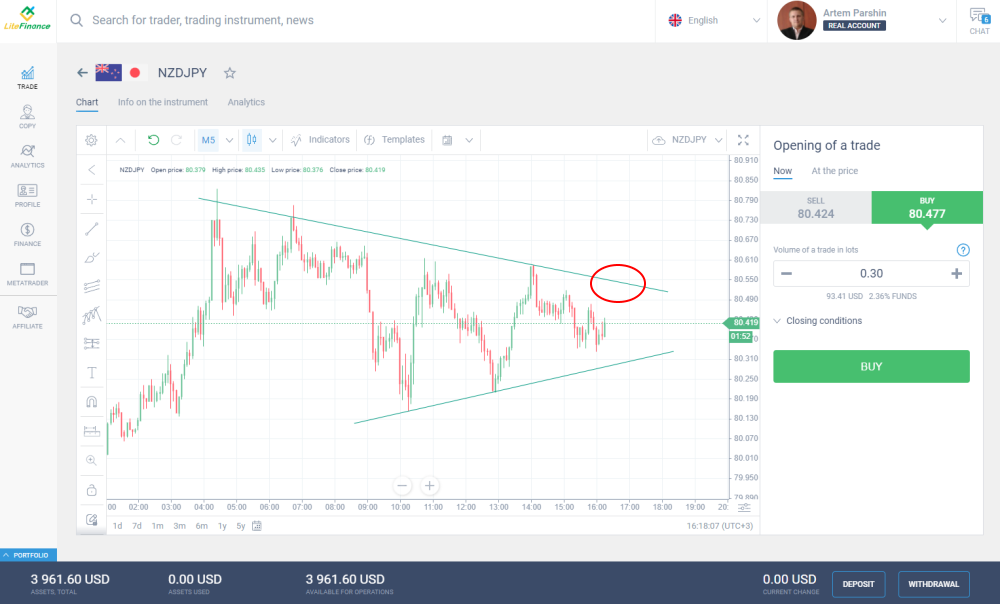

Image: www.litefinance.org

Conclusion:

Currency options trading offers a wealth of opportunities and challenges, and equipping oneself with the requisite knowledge and skills is paramount for success. This comprehensive PDF guide provides a solid foundation for understanding the currency options market, introducing essential concepts, strategies, and risk management techniques. By embracing continuous learning, seeking mentorship, and leveraging market analysis, traders can unlock the potential of currency options trading and navigate the ever-changing landscape of the foreign exchange market with confidence and expertise.