In the dynamic world of investing, options trading offers a compelling opportunity to enhance your portfolio with strategic execution. Among the most popular options contracts, SPDR options stand out as a powerful tool for both experienced traders and those seeking to elevate their financial literacy. If you’re ready to venture into the realm of SPDR options trading, this comprehensive guide is here to equip you with the knowledge and strategies to succeed.

Image: www.cryptocurrencieschannel.com

Understanding SPDR Options: A Comprehensive Overview

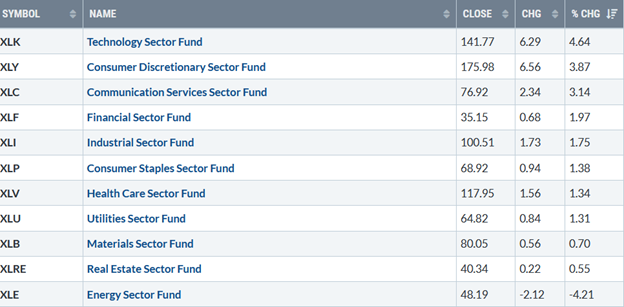

SPDR (Spider) options are exchange-traded funds that track an underlying index, providing investors with exposure to a wide range of assets without having to purchase each individual stock. SPDR options provide the leverage to magnify potential returns while also mitigating risk compared to buying and selling the underlying index directly.

By harnessing the power of options contracts, traders can speculate on the future direction of the underlying index within a specified time frame. These contracts come in two primary forms: call options, which give the buyer the right to purchase the underlying index, and put options, granting the right to sell. Additionally, options are characterized by their strike price, which determines the price at which the underlying index can be bought or sold, and expiration date, which dictates the timeframe within which the option can be exercised.

Traversing the Market: A Journey of Options Strategies

The realm of options trading offers a vast array of strategies, each tailored to distinct market conditions and risk tolerances. Covered call writing, for instance, involves selling a call option against an underlying stock that you already own, generating income from the premium received while limiting your potential profit on the underlying asset. Conversely, if you anticipate a market downturn, you might employ protective put options, granting yourself the right to sell the underlying index at a specified strike price, thereby safeguarding your portfolio against significant losses.

Iron condor strategies represent a more sophisticated approach, simultaneously selling call and put options at different strike prices to capitalize on market volatility. While these strategies can amplify potential profits, they also amplify risks, demanding a thorough understanding of options dynamics and careful management of positions.

Mastering the Art of Trading SPDR Options: Expert Insights

As you embark on your journey into SPDR options trading, gleaning insights from seasoned experts can significantly enhance your decision-making. One such expert, Tom Sosnoff, advocates for focusing on near-term options, where market behavior is more predictable. Another luminary, Amy Arnott, underscores the importance of disciplined risk management, emphasizing the need to limit your potential losses on each trade.

These expert insights provide a valuable roadmap, but it’s essential to bear in mind that options trading involves inherent risks. Educating yourself thoroughly, understanding your risk tolerance, and prudently managing your positions are paramount to achieving long-term trading success.

Image: www.sec.gov

Trading Spdr Options

Image: www.moneyshow.com

Conclusion: Unveiling the Path to Options Mastery

Trading SPDR options offers immense potential for profit and portfolio enhancement, but it also demands a deep understanding of options dynamics and disciplined risk management. This comprehensive guide has equipped you with the foundational knowledge, expert insights, and actionable tips to navigate the options market with confidence.

As you continue your trading journey, remember to prioritize learning, adapt to changing market conditions, and refine your strategies over time. The world of options trading is an ongoing pursuit of knowledge and mastery, and by embracing a continuous learning mindset, you can unlock the full potential of SPDR options and elevate your financial acumen to new heights.