Embark on the Journey of Currency Options Trading

As a novice in the realm of financial markets, I was intrigued by the allure of options trading but hesitant due to its perceived complexity. However, a pivotal moment arose when I stumbled upon the concept of currency options. The simplicity and clarity it offered ignited my enthusiasm, and I delved deeper into this fascinating arena.

Image: fsmsmartreviews.blogspot.com

Currency Options: A Gateway to Currency Markets

Currency options are financial contracts that grant the holder the right, but not the obligation, to buy or sell a specified amount of a currency at a predetermined price (the strike price) on or before a certain date (the expiration date). This flexibility offers traders the ability to speculate on currency movements and hedge against potential risks.

Striking a Balance: Calls vs. Puts

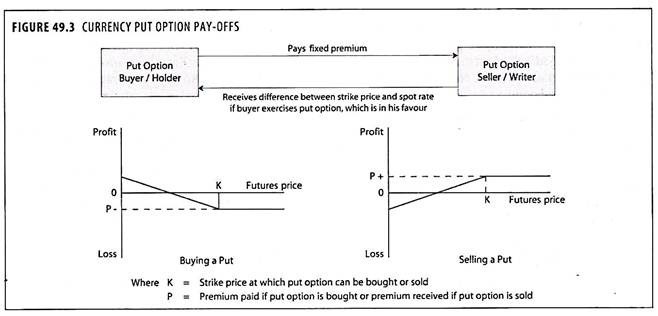

In the world of currency options, two main types emerge: call options and put options. Call options empower the holder to purchase the underlying currency at the strike price if it exceeds that level. Conversely, put options bestow the right to sell the currency at the strike price should it fall below it.

Navigating the Currency Options Market

Accessing the currency options market is a straightforward process. Through online brokers or financial institutions, traders can purchase options contracts that align with their desired strategy. Each contract represents the right to trade a standardized amount of the underlying currency.

Image: www.businessmanagementideas.com

A Glimpse into the Mechanics

To illustrate the mechanics of currency options trading, let’s consider the following example:

- The EUR/USD exchange rate is currently trading at 1.1200.

- A trader purchases a one-month call option with a strike price of 1.1300 for a premium of 0.01 (1 pip).

- This contract grants the trader the right to buy 100,000 EUR at 1.1300 on or before the expiration date.

Decoding the Profits and Losses

The profitability of an options trade hinges on the difference between the option’s premium and the change in the underlying currency’s price. In our example:

- If the EUR/USD rate rises above 1.1301 (strike price + premium), the trader can exercise the call option and reap a profit.

- However, if the rate remains below 1.1301, the option expires worthless, resulting in a loss of the premium paid.

Stay Informed and Adapt

Delving into the realm of currency options trading requires a commitment to staying abreast of market trends and developments. Regularly monitoring news sources, forums, and social media platforms can provide valuable insights and help traders make informed decisions.

Expert Tips for Enhancing Your Strategy

- Identify a Trading Strategy: Clearly define your trading objectives and develop a tailored strategy.

- Manage Risk Prudently: Limit your risk exposure by carefully evaluating each trade and implementing proper risk management measures.

- Patience is Paramount: Options trading often demands patience and discipline. Allow trades to unfold naturally, avoiding impulsive decisions.

Frequently Asked Questions

Q. What is the difference between a call option and a put option?

A. A call option grants the right to buy the underlying currency, while a put option bestows the right to sell it.

Q. How do I calculate the potential profit or loss in an options trade?

A. Subtract the option’s premium from the difference between the underlying currency’s price and the strike price.

Currency Options Trading Example

/close-up-of-computer-monitor-946388998-a64b758052274786b2c0a57891cf9fce.jpg)

Image: www.investopedia.com

Conclusion

Currency options trading offers a versatile approach to speculating on currency movements and hedging against risks. Embracing its simplicity and applying prudent risk management can lead to rewarding outcomes. Whether you are a seasoned trader or a newcomer to the financial markets, consider exploring the possibilities that currency options have to offer.

Are you intrigued by the world of currency options trading? Let us know if you would like to delve deeper into this fascinating subject.