In today’s dynamic financial landscape, it’s more crucial than ever to diversify your portfolio with sophisticated investment strategies. One such strategy that has gained immense popularity is credit options trading, a powerful tool that can unlock lucrative opportunities while mitigating risks. In this comprehensive guide, we will delve into the world of credit options trading, empowering you with the knowledge and confidence to make informed investment decisions.

Image: www.schwab.com

Understanding Credit Options Trading: A Foundation for Success

Credit options trading involves the buying and selling of options contracts, which are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. Unlike traditional stock options, credit options derive their value from the creditworthiness of the underlying asset, typically a corporate bond.

The beauty of credit options trading lies in its versatility. You can employ these options to speculate on market fluctuations, hedge against potential losses, or generate additional income through premium collection. However, it’s essential to remember that all trading carries inherent risks, and it’s crucial to exercise due diligence before venturing into the market.

The Mechanics of Credit Options: Unleashing the Potential

To fully grasp the mechanics of credit options, let’s consider a scenario. Suppose you believe that the credit rating of a particular corporation is poised to improve, leading to a potential rise in bond prices. You could purchase a call option, which gives you the right to buy a bond at a predetermined price within a certain time frame. If the bond price rises as anticipated, you can exercise your call option and realize a profit. Conversely, if the bond price falls, you can simply let the option expire without exercising it, limiting your losses to the premium paid upfront.

Now, let’s explore the other side of the coin. If you possess bonds that you anticipate may decline in value, you could sell a put option, giving someone else the right to sell those bonds to you at a fixed price within a specified timeframe. If the bond price falls below the strike price, the option holder may exercise their right to sell the bonds to you, and you will be obligated to buy them at the agreed-upon price. By selling a put option, you receive a premium upfront, which can offset potential losses if the bond price indeed declines.

Leveraging Credit Options in Your Investment Strategy: Keys to Success

Incorporating credit options trading into your investment strategy can amplify your returns while minimizing risks. Here are a few key tips to help you achieve optimal results:

-

Thoroughly research your underlying assets: Understanding the fundamentals of the companies whose bonds you are considering trading is crucial. This includes assessing their financial health, industry trends, and overall market sentiment.

-

Fine-tune your strike price selection: The strike price is the price at which you can exercise your option to buy or sell the bond. Choosing the right strike price is essential for maximizing your profits while managing risks.

-

Consider the option’s expiration date: Credit options have a finite lifespan, and it’s essential to select an expiration date that aligns with your investment goals. Options with shorter expiration dates typically carry higher premiums but also greater risk, while longer-term options offer more flexibility but potentially lower returns.

-

Manage your risk appetite: Credit options trading involves leverage, which can magnify both profits and losses. It’s crucial to define your risk tolerance and trade within your limits to avoid overexposure.

-

Seek professional guidance when needed: If you are a novice to the world of credit options trading, consulting with a reputable financial advisor or broker can provide invaluable guidance and help you build a tailored strategy.

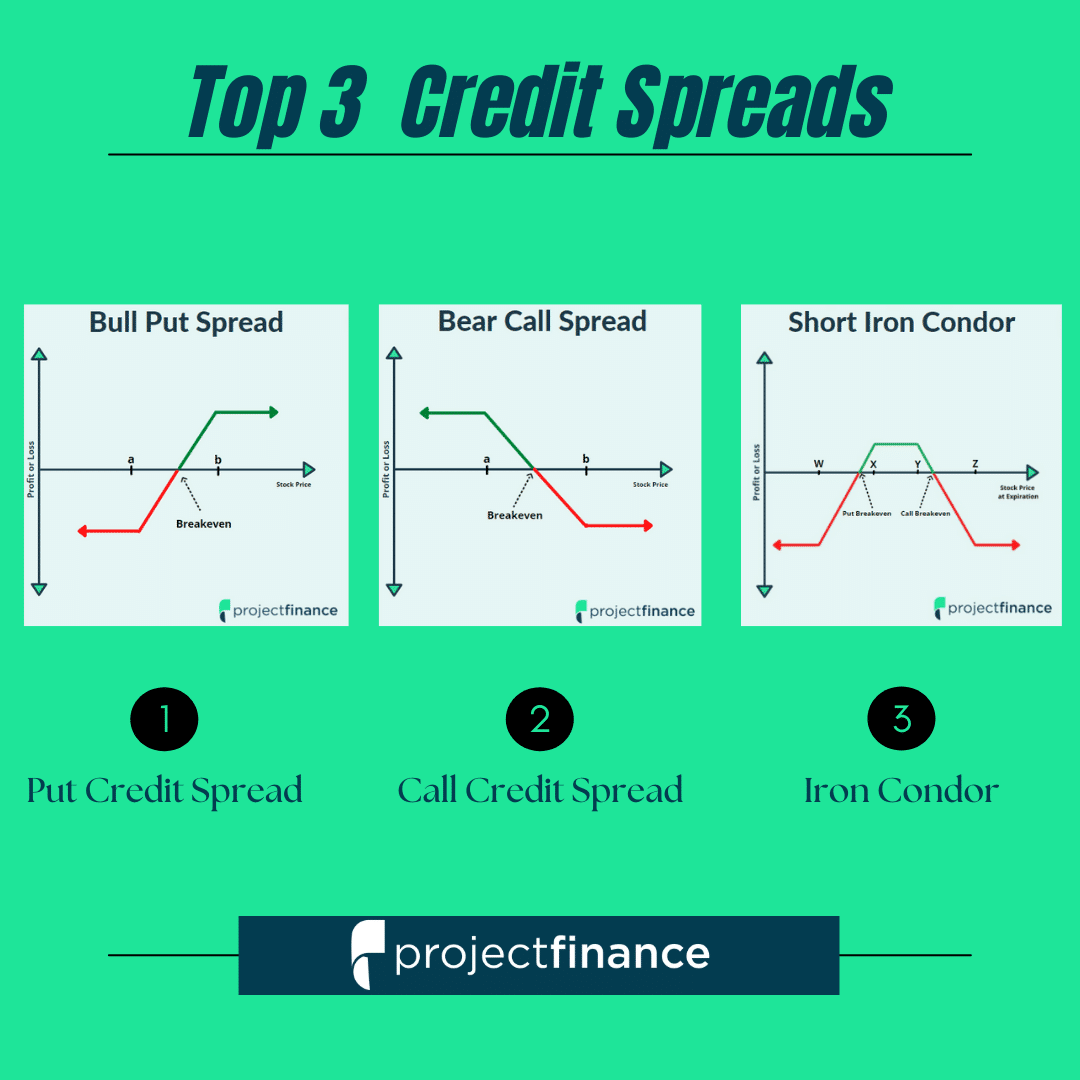

Image: www.projectfinance.com

Credit Options Trading

Image: www.optiongig.com

Conclusion: Empowering Yourself in the Financial Arena

Unlocking the power of credit options trading is a journey that requires knowledge, strategy, and a calculated mindset. By mastering the concepts outlined in this article, you can empower yourself to make informed investment decisions, diversify your portfolio, and navigate the financial markets with confidence. Remember, investing involves inherent risks, but by embracing a well-rounded approach and managing your risks appropriately, you can harness the opportunities that credit options trading offers. So, embark on this journey with enthusiasm, and may your investment endeavors reap rich rewards.